UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

| |

Filed by the Registrant ☒ | Filed by a Party other than the Registrant o |

Check the appropriate box: | |

|

| |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

|

FULL HOUSE RESORTS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

| | |

☒ | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| | |

| (2) | Aggregate number of securities to which the transaction applies: |

| | |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of the transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

Dear Fellow Shareholders:

It has now been just over two years since our new management team arrived at Full House Resorts. In 2016, we built on the progress that we made in our first year and prepared the Company for future growth in 2017 and beyond. Last year in May, we also completed the purchase of the Bronco Billy’s casino in Cripple Creek, Colorado, which performed well in the balance of the year.

Most notably, we have developed strategies to improve each property and structured the balance sheet to fund such improvements. Those improvements are now underway and are scheduled to be completed in stages over the next 18 months.

Our efforts have already improved the Company's financial strength and shareholder value -- but it’s just a start. While our company is small, we have good assets, a motivated management team and a dedicated group of employees. We see growth opportunities that we believe will result in further improved financial strength and enhanced shareholder value for many years ahead.

Silver Slipper Casino & Hotel

The Silver Slipper is still our largest earnings contributor, although it now contributes less than half of our Adjusted Property EBITDA(1) following the Bronco Billy’s acquisition.

The Silver Slipper performed well in a difficult market. The Mississippi Gulf Coast is a mature market, having offered casino gaming since 1992 and initially offering the only casinos in the region. Casinos opened shortly thereafter in adjoining Louisiana, followed by tribal casinos in Alabama and Florida. By the time Hurricane Katrina destroyed many of the Gulf Coast casinos in 2005, the economics caused several operators to choose not to rebuild, pocketing the insurance proceeds or using it to build casinos elsewhere.

A decade later, a new casino opened on the Mississippi Gulf Coast in December 2015. Including the opening of this new $300 million casino, gaming revenues for the region only rose 4%, or an average of $3.8 million per month in 2016. Casino revenues along the Mississippi Gulf Coast were likely to have been below 2015 levels, exclusive of the new casino.

Against this backdrop, the Silver Slipper did quite well in 2016. Its casino revenues increased 5% for the year and Adjusted Property EBITDA was flat. The Silver Slipper is the westernmost of the casinos along the Mississippi Gulf Coast, so the new casino opening in Biloxi, an hour to the east, had less impact. Our hotel, which opened in stages during mid-2015, was also open for the full year. We also may have benefitted from a smoking ban imposed on the casinos in New Orleans in April 2015. Offsetting this, torrential storms dropped between one and two feet of rain on a broad stretch of Louisiana over a four-day period in August 2016, unfortunately flooding the neighborhoods of many of our customers. This affected our business for several weeks in the third quarter.

We are now making physical improvements at the Silver Slipper that we expect will be significant in their impact relative to their modest cost. We believe these should help achieve higher Adjusted Property EBITDA in the years ahead.

While smaller compared to many of its competitors, the Silver Slipper is one of the nicest casinos in the region. It offers great food and beverage experiences and a new hotel with several VIP luxury suites. We have little, however, in the way of other amenities. We sit at the foot of a beautiful eight-mile-long, white sand beach -- the closest beach to the cities of New Orleans and Baton Rouge. So we are adding a “beach club,” which is essentially a bar and pool area along the beach. We think it will help fill our hotel in the summer, particularly mid-week, and allow us to better accommodate our best customers at the hottest times of the year. The beach club is now under construction and should be open by Memorial Day 2017.

__________

(1) Please see the endnote to this letter for a discussion of non-GAAP measures such as Adjusted Property EBITDA.

We have also operated the same food and beverage outlets -- a great buffet, a coffee shop, and an attractive fine-dining venue -- since the casino opened in 2007. From the fine-dining venue, one can watch commercial fishing and oyster boats going to and from an adjoining harbor. We’ve decided to add an oyster bar to our casino, which should freshen the experience and bring additional customers to our property. We hope to have this completed in the third quarter of 2017.

Bronco Billy’s Casino & Hotel

On an annualized basis, Bronco Billy’s is now our second-largest earnings contributor.

Bronco Billy’s is in Cripple Creek, Colorado, a historic mining town that had a population of more than 10,000 in 1890 and only about 500 in 1990. The town is on the west side of Pike’s Peak at almost 10,000 feet above sea level, an hour west of Colorado Springs. Colorado legalized gaming in 1991 in this small town, as well as two similar small historic towns an hour west of Denver, to keep these towns from becoming ghost towns by creating a new tourism base. It worked; the population of Cripple Creek has more than doubled and many of our employees commute from nearby communities such as Woodland Park.

Colorado Springs, with a metropolitan population of approximately 700,000, is the second-largest city in Colorado. Like Denver, an hour to the north, it has been showing rapid population growth.

This is a stable gaming market, with the opportunity for growth. The gaming per capita in the region is less than that of similar metropolitan areas with similarly located casinos. There are no Native American reservations or state borders nearby, and past proposals to expand casino gambling within Colorado have failed by large margins.

Many of Cripple Creek’s visitors drive an hour or more each way, principally visiting from Colorado Springs. There are only approximately 500 guest rooms in Cripple Creek and most visitors do not stay the night.

Prior to 2009, the maximum bet in Colorado was $5 per hand and the casinos were required to close between 2 a.m. and 8 a.m. Now, casinos operate 24 hours a day, the betting limit is $100 per hand, and roulette and craps have been added as permitted games.

This significantly changed the economics. Wealthier customers are more likely to be attracted to casinos with higher betting limits. The 24-hour operation reduces late-night traffic surges, improves the efficiency of employee scheduling, and makes it more interesting to stay the night. Roulette and craps brought some diversity to the casino floor. The earlier betting limits meant that much of the hotel and gaming product addressed a low-end casino customer. Furthermore, it was difficult for a casino to justify offering customers a complimentary higher-quality hotel room if it could only accept low-limit bets. Few customers would sit long enough at a $5 table to justify a $100 hotel “comp.”

Today, there are six casino operators in Cripple Creek. Three of these are clustered along the same block of Bennett Avenue, the main street in town, and are believed to account for a substantial majority of the town’s revenues. We occupy approximately two-thirds of the north side of the block, whereas casinos owned by Triple Crown (a private company) and Century Casinos occupy the other side of the block. Additionally, we own or lease (with options to purchase) significant land behind and around our casino.

We currently have 14 guestrooms on the roof of our casino and an additional 10 guestrooms in a historical structure a block away. We are currently designing a new four-star hotel to be built adjoining our casino that would have more than 100 guest rooms. We intend for this to offer the best hotel product in Cripple Creek. In similar markets, we’ve found that the addition of quality hotel rooms attracts a higher-quality clientele and extends the operations of the casino substantially later into the evening. Ultimately, the ability to add hotel rooms without having to acquire land, add casino space or build new restaurants should result in a high return on investment.

Today, Bronco Billy’s is doing well -- on pace for the approximately $5 million per year of Adjusted Property EBITDA that we cited when we announced its purchase. It continually wins awards for the friendliest casino, the best food product, and simply the best casino in Cripple Creek. However, we think this is only a preview of what Bronco Billy’s can do moving forward.

Even as we design this future hotel, we are bringing more creativity to the property.

We’re rebranding a small but prominent bar as “The Crippled Cow,” adding pizza, espresso and ice cream to the outlet’s offerings. According to local folklore, the city’s name came from the accidental discharge of a cowboy’s rifle that caused a calf to jump the creek, breaking a leg and becoming forever crippled. So, we’re mounting a fiberglass cow over the bar and celebrating the colorful local history.

We’re also working with the city to introduce a European-style Christmas market outside, on the street, during the 2017 holiday period. That’s a slow time of year in Cripple Creek, and we believe that an additional attraction celebrating the holiday season may bring additional visitors to Cripple Creek, as it has to Rising Sun.

Rising Star Casino Resort

Our Rising Star Casino Resort is in Rising Sun, Indiana, near Cincinnati, Ohio and not far from Louisville, Kentucky and Indianapolis, Indiana.

This was the first casino in the region, opening in 1996, and it initially produced revenues and income that exceed those of our entire company. Over the years, however, competition opened that was newer, located closer to the major metropolitan areas, and was often land-based, rather than on a non-cruising riverboat. Adjusted Property EBITDA at this property fell from over $50 million per year to near zero, as its casino revenues went from $160 million per year to only $50 million.

Given the legalization of other casinos in the region, Rising Star will likely never earn what it earned in its early, heady days. But we think it has significant potential from its current and recent historical levels.

No new casinos are expected to open under current laws in Indiana and Ohio. Casino gaming in Kentucky seems to have stalled at a low installed base of historical horse racing machines, principally at race tracks distant from Rising Star. The two race tracks in Indiana near Indianapolis will be able to offer table games beginning in 2021. Today, they offer tables imbedded with video blackjack machines and an employee standing at the table.

Second, the regional gaming taxes have a progressive tax schedule. We have the lowest annual gaming revenues of any casino in Indiana or Ohio. As a result, we are also taxed at the lowest gaming tax rate, providing a competitive advantage. As we find ways to increase revenues, a healthy portion of the increase goes to the bottom line.

Third, we have a large footprint, largely from the days when revenues were significantly higher, justifying a large investment and providing the former owners a return on that investment. Today, we have the benefits of that footprint; it is valued within our stock price at much less than its replacement cost. Indeed, the theoretical replacement cost of Rising Star probably rivals the value of our entire company.

We made some significant marketing changes in 2015, including the introduction of the “Christmas Casino.” The Christmas Casino worked. It was the principal factor in the significant Adjusted Property EBITDA improvement in 2015.

We repeated the Christmas Casino in 2016, adding a retail component, some additional decorations and a rented ice rink, so the attraction could be “bigger and better” in its second year. This helped increase casino revenues in the Christmas Casino’s second year. The skating rink cost us about $150,000 and modestly hurt earnings, but we think we now know how to offer skating in future years at a more manageable cost.

The property also did well otherwise in the year, driven by other targeted marketing initiatives. Overall for 2016, net revenues rose 4%. -- it was the first time in ten years that the property showed an increase in annual gaming revenues. Adjusted Property EBITDA of $2.9 million compares to $4.0 million in 2015, though the 2015 period benefited from a $1.4 million property tax refund.

Meanwhile, we are starting to make physical improvements at Rising Star that should result in increased gaming revenues and higher returns.

We have a large parking lot that is no longer necessary for our current casino volumes, but which is conveniently located within our property. It has mature landscaping around it and is convenient to the front desk of the smaller of our two hotels. We’ve started construction on a 56-space RV park, which is expected to cost approximately $1.5 million and be completed by Memorial Day 2017.

According to the Recreational Vehicle Industry Association, about 9% of all U.S. households now own recreational vehicles. The average cost of a new RV is approximately $40,000 and some $16 billion of them were sold last year. Over 60% are manufactured in Indiana, principally in the northern part of the state.

RV parks are common at casinos in many U.S. markets. We have a small one at the Silver Slipper. Just in Las Vegas, there are RV parks at Circus Circus, Sam's Town and Arizona Charlie’s. Many tribal casinos have them. Yet, none of the casinos in Indiana, Ohio or West Virginia offer RV parks.

Our RV park will have all the usual higher-end amenities -- full utility hook-ups with water, sewer and 50-amp power lines; full bathrooms with showers; a laundromat; and recreational amenities like shuffleboard, a fire pit, and bocce ball. It even will have a dog run. Equally important, it is a short walk from our casino and our golf course. RV customers will have access to our indoor swimming pool and small workout room. It also is located within walking distance of the neighborhood grocery store, the restaurant and historical district in downtown Rising Sun, and the Rising Sun boat ramp.

Many RV owners drag along a car so that they can have some mobility from the RV park without having to “unhook” the RV itself. In our case, that’s not necessary; there are plenty of services and amenities within easy walking distance.

From a casino operator’s point of view, RV owners are great customers. They can afford a fairly expensive recreational “toy.” They come to spend the night and essentially bring their own hotel room. And we believe they gamble at least as much as the population at large.

One of Rising Star’s competitive issues is its location on the west side of the Ohio River, across the river from a significant population. The nearest bridges, however, are each approximately 20 miles north and south of our property, respectively, and each bridge has a competing casino on its Indiana side. Today, many of our customers, particularly those from Cincinnati or Northern Kentucky, must pass a competing casino many miles before arriving at Rising Star.

To address this, the company has recently contracted with a shipyard for construction of a ferry boat. Our ferry will cost approximately $700,000, plus the cost of the roads and landings. All in, we expect the project to cost approximately $1.7 million, including the cost of the land acquired in Kentucky for the ferry landing.

Boone County, Kentucky, which is located across the river from Rising Star, is growing rapidly and has 128,000 people, with the second-highest per capita income in the state. Rising Star’s location in Ohio County, Indiana, by comparison, has only 6,000 people and a per capita income that is only 73% of that of Boone County.

We are working through our submission to the Army Corps of Engineers, whose approval is necessary to build the roads and ramps leading into the river. We will also need U.S. Coast Guard approval of the ferryboat itself and have designed it so that it meets the Coast Guard requirements.

We believe the ferry will provide a sound, cost-effective means of transporting guests from Kentucky to our casino. If all goes well, we hope to have the ferry boat in operation in the second half of this year.

We are also making physical improvements within the property itself.

Approximately 120 of the 190 guestrooms in our larger, older hotel were refurbished in 2012 and 2013. As a result, only 119 of the 190 rooms were renovated. We are now investing approximately $0.5 million to bring the additional rooms up to date. In a similar vein, we are ordering new carpeting and wallpaper for the guestroom corridors and new furniture for the hotel lobby.

More excitingly, we are preparing to make significant improvements to the “Pavilion.” This was once a large waiting area where customers could buy tickets and wait to board the then-cruising casino riverboat. That boat hasn’t cruised in approximately 15 years and the Pavilion is now an empty, cavernous space that guests cross to get to our casino or visit our restaurants. We are enhancing the indoor streetscape of the pavilion, adding artificial trees, improving the floors from its current stamped concrete, and enhancing the lighting. It will be a significant improvement from the customer arrival experience of today. We intend to have this completed within the next few months.

Meanwhile, we are designing improvements to the casino boat itself. These are a little more complicated, as it is a boat, with metal walls and flotation and balance considerations.

Today, customers arrive on our boat from a short gangway. They arrive in a small space, squeezed at the top of some escalators, between an emergency stairwell and two elevators. It was designed to disembark and embark customers quickly, as the then-cruising casino riverboat changed from one customer group to the next, so it could cast off and resume gaming.

The boat could also accommodate a large number of customers. It wasn’t important to be the nicest casino in the region; it was the only casino in the region.

It’s much different today. The boat doesn’t cruise. It’s larger than is needed. It has many newer competitors, some of which offer lavish high-roller areas. It is now more important to be nice rather than merely big. Gaming revenues at this point are determined by the number of customers, not by the number of slot machines.

Fortunately, the gangway is fixed in its location, but the boat is not. We are going to move the boat back a few feet, so that customers enter a more spacious location,where we can create a real sense of arrival. We will also create a warm, exciting high-roller area near that sense of arrival. As part of this, we are also creating a new casino bar and will refurbish the nearby casino restrooms.

We expect this casino VIP area to be completed in early 2018.

We have also planned to convert part of the casino space to a new restaurant, which would be within the casino itself. Part of the reason for this is that we pay a “head tax” of $3 each time a person enters the casino. Today, if someone leaves the casino to get something to eat, then returns to gamble, we pay that head tax twice. We have a specific restaurant concept in mind and have expended some effort designing it.

As I write this, however, the Indiana legislature is considering a bill that would convert the head tax into a percentage gaming tax. The percentage tax would be based on the percentage that the head tax was to the gaming revenues in the recent past. If that bill becomes law, we actually have less incentive to put a restaurant on the casino boat itself and the money might be better spent improving the restaurants that we already have, which are more convenient from a back-of-the-house standpoint.

That same proposed bill in the Indiana legislature would eliminate, over time, a strange quirk in Indiana tax law. In Indiana, gaming taxes are not deductible in determining taxable income for state income taxes. Gaming taxes are one of our largest expenses and this can result in an inordinately high state income tax rate. For the larger casino operators in the state, this is a heavy burden. It could even result in an unprofitable casino having to pay significant state income taxes.

In our case, our revenues in Indiana in recent years have been so low that the double taxation issue has had little impact on us. However, it might become an issue as our growth projects ramp up and the property’s results continue to improve. Correcting this anomaly in the law could be significantly important to us in future years.

Proposal in Terre Haute, Indiana

We don’t have a casino in Terre Haute. In fact, there’s no casino in Terre Haute, a community that, when combined with neighboring communities in Illinois, has approximately 171,000 people.

In the years since Indiana legalized casinos in 1993, Illinois expanded casino gaming with slot machines in pubs and taverns. Then Ohio legalized casinos, while Kentucky has allowed historical racing machines at horse tracks.

Indiana has a fixed number of allowable “gambling games” at each of its casinos, based on the number of games that were operated historically. However, times have changed. Because of the expansion of gaming in neighboring states, much of the Indiana gaming capacity is in the wrong locations to maximize the economic development, jobs and tax revenues for the State.

Take our Rising Star casino. We are permitted to operate up to 1,489 “gambling games.” Under the unique definition used by the State, one slot machine is a “gambling game,” as is one craps table, even if 10 people are simultaneously playing craps.

Our gaming revenues at Rising Star in 2016 were $51.3 million. The State’s total gaming revenues were $2.2 billion and the total permitted “gambling games” are 26,610. The average revenues per permitted gambling game was $83,277. If we had the average revenues per gambling game, we would only need 616 gambling games to satisfy our customers. As noted, we are permitted to have 1,489 gambling games.

As a benefit to the State and an opportunity for our company, we have offered to relocate our excess gaming capacity to another location, where we would invest in a new gaming facility, employ more people and generate more gaming taxes. We believe we could do so without having any negative impact on Rising Star or its community.

In 2015, we responded to a Request for Proposals (“RFP”) put out by the Indianapolis Airport Authority, seeking proposals for development of a large tract of surplus land owned by the airport and located on the west side of the city. We proposed a large, multi-use complex anchored by a casino, with that casino utilizing the surplus gaming capacity of Rising Star. It would have provided significant investment, jobs and tax revenues for the Indianapolis region, as well as healthy rent for the airport authority. It might also have increased traffic through the airport, as it would have been convenient for people to fly into Indianapolis to visit a quality casino adjoining the airport. We believe we offered the best proposal received by the airport authority, but the authority decided to retract its RFP rather than become embroiled in an attempt by us to develop a potential casino in the Indianapolis metropolitan area.

One in three Hoosiers live in Indianapolis, but the city has no casino. There are two race tracks with casinos, however, both owned by the same company, that are each approximately 30 miles to the northeast and southeast of Indianapolis. Those casinos opposed any efforts to allow more gaming in the area.

We returned in 2016 with a proposal to build a small casino in Terre Haute, an hour west of Indianapolis along the Indiana/Illinois border. This location is far from any existing Indiana casino, would benefit an economically depressed community, and would draw revenues from areas in Illinois that do not currently offer a casino.

This time, we had the strong support of the local community. The casino legislation was sponsored by local State Senator Ford. When the bill was heard by the public policy committee, it came to a 5-5 tie vote on the bill; unfortunately, it required a majority vote to proceed to the Senate floor.

We plan to be back to the legislature next year. The state’s tax revenues from gaming will continue to be under pressure. As noted, much of its permitted gaming capacity is in the wrong place. We think that the legislature will realize that this should be corrected. It’s our hope that this will create an opportunity for us, while also being a substantial “win” for the state.

Stockman’s Casino

Our Stockman’s Casino is in Fallon, Nevada, approximately an hour east of Reno and home to a large Naval Air Station and the famed Top Gun flying school. Our principal customers are the ranchers and retirees that live in this area, with the Naval Air Station being an important second source of business.

The large Tesla battery factory is being built about half an hour to our west and is eventually expected to employ approximately 10,000 people. This may create regional growth and opportunity. We expect most of that growth to fall to the west of that factory, toward Reno. Fallon, however, is a small community and even a small portion of the Tesla benefit would cause significant growth for the community.

Stockman’s is the clear leader of the several small casinos in this town and it had been neglected for many years. We replaced the carpet in the casino last year and recently changed the carpet in the coffee shop to a much more sanitary and durable vinyl product, which also looks better. We also removed some slot machines, making the casino more spacious.

We are making much bigger changes to its exterior. We demolished an administrative building that blocked the view of our casino and replaced it with a parking lot. Previously, our principal parking was essentially at the back of the casino, behind our kitchens, and customers had to walk around the building to gain entrance. We are adding a new porte cochère, which should be completed this quarter along with new landscaping and lighting. We recently revamped the property’s main sign, adding a larger, higher-resolution reader board. We are also reconditioning an old, historic sign and relocating it to the front of the property.

This has been a stable market; Churchill County’s casino revenues are consistently about $20 million per year. No new significant casino has opened in many years and none have closed. As recently as 2009, Stockman’s had a 35% share of this market. Through neglect, this had fallen to 26% in 2015. We think the physical improvements now underway will allow us to regain some market share, resulting in a high return on our investment. The total cost of these improvements is estimated to be approximately $1.5 million.

Results for the year showed improvement, despite construction disruption late in the year. Net revenues rose 7% and Adjusted Property EBITDA rose 31%. The improvements are being completed in stages just now through the next few months and the full benefit will probably be seen in 2018.

Grand Lodge Casino at Hyatt Tahoe

We operate the Grand Lodge Casino within the unique Hyatt Regency Lake Tahoe, along the beautiful North Shore of Lake Tahoe. The casino is leased from Hyatt and the lease was scheduled to expire in September 2018. In late 2015, we reached an agreement with Hyatt where the lease was extended for five years, to September 2023, and the casino is to be refurbished. Hyatt is investing $3.5 million into the refurbishment and we are investing $1.5 million, principally into things like new chairs, gaming tables and slot machines. After the refurbishment is completed, our rent will increase from $1.5 million per year to $2.0 million per year. We believe that the benefits of the refurbishment will exceed the increase in our rent.

That refurbishment is now underway. We have been operating since January with only part of our casino, as the other portion is torn apart and being rebuilt. Soon, we will reopen the one part and close the other, so that the entire casino should be refurbished prior to the important summer season.

The refurbishment is exciting. The casino will have an entirely new look, with new carpet, wallpaper, light fixtures and new gaming tables, gaming chairs and slot chairs. The “look” is warm, inviting and appropriate to the luxury of the Hyatt and its beautiful mountain environment.

Previously, the casino had two bars. One, at the front of the casino, was effectively called “The Lonely Moose Bar,” as its decor largely consisted of a single moose head and few people ever sat there. The other bar was at the back of the casino, distant from the hotel lobby. We’ve consolidated the two bars into one attractive and well-designed venue, located toward the back of the casino, near the entrance from the casino parking. That makes it convenient for our local customers, while drawing hotel customers deeper into the casino than they might have otherwise ventured. Meanwhile, we are replacing The Lonely Moose Bar with a new slot machine area, which we think will be amongst the most productive on the entire casino floor.

We also have closed our small poker room, which was not profitable. We plan to use the space for other more profitable, casino games.

The Rights Offering

All of these little projects add up -- to about $10 million of capital spending.

Our company has significant leverage, with our second-lien debt bearing a high coupon of 13.5%. We didn’t want to further increase our debt load to finance these smaller projects, even though we expect the returns on these projects to be significantly higher than our cost of debt.

We generate significant positive cash flow, even after taking into consideration maintenance capital spending estimated at $3 million per year. We probably could have built these projects over time using cash generated from operations, but we wanted to move more quickly, so we could improve earnings more quickly, reduce our leverage and the cost of our debt capital, and prepare our company for further growth, including perhaps a hotel in Cripple Creek.

We calculated that we could fund about half of this $10 million from internally generated cash flows. For the other half, we opted to issue equity.

In the U.S., equity is commonly issued through an underwritten public offering. That’s expensive and time-consuming. It wouldn’t be cost effective for a $5 million offering. We opted to do a rights offering, which is a common way to raise equity in many foreign countries, but it is uncommon here. Essentially, it’s a reverse dividend, or similar to a capital call in a private partnership.

To motivate our shareholders to make this additional investment, we offered the new stock at a discount to where the stock was trading. If everyone exercised their rights and purchased the new stock, then everyone would have contributed equally to the $5 million capital raise. However, if someone didn’t exercise all of his or her rights, then they would be slightly diluted, as others were being allowed to purchase stock at below the market price.

Rights offerings are often “backstopped” by an individual or an institution, effectively providing assurance that the company will receive the intended proceeds. The “backstop party” commits to exercising any rights not exercised by others, often in return for a fee, in addition to purchasing shares at below market.

In our case, I agreed to be the backstop party and did so without a fee. My fee, effectively, was the ability to purchase shares at the exercise price and I agreed to hold those shares for a period of time after their purchase. Furthermore, since I am the Company’s CEO, the shares are restricted shares, with encumbrances as to their eventual sale.

As it turned out, most shareholders exercised their rights and many shareholders opted to participate in the “over-allotment pool.” To raise $5 million at the exercise price of $1.30 per share, the company offered 3,846,154 rights. Of these, shareholders exercised 2.7 million rights. That left 1.1 million unexercised rights. Under my backstop agreement, I purchased 1.0 million of these. The remaining 0.1 million unexercised rights were substantially oversubscribed and were distributed on a pro rata basis.

In the end, the company raised the full $5 million on a cost-efficient basis. I’d like to thank our shareholders for their support. Besides the backstop agreement, certain family trusts and I also exercised the rights that pertained to the shares that we previously owned. I also have substantial stock options, but the company opted to not provide rights to option holders. All told, my family and I invested an additional $1.4 million into the company. It is generally a good thing to have the company’s CEO invest in the company and I was happy to do so, to help the company raise the $5 million, as a good investment for me and my family, and in light of the bright future I see for our company.

Other directors exercised their rights under the offering as well. Together, our board and executive officers currently own approximately 17% of our company, including vested options, with most of it purchased in the open market or through the rights offering.

Our Debt

The Company reached an agreement to purchase Bronco Billy’s in September 2015, making a $2.5 million non-refundable deposit. At the time, the debt markets were good and we anticipated refinancing our debt on favorable terms, including the money needed to close on the purchase.

In the gaming industry, however, it takes several months to be licensed in a new jurisdiction, even for companies licensed in other jurisdictions. By the time we were licensed in Colorado and approved to close the transaction, the debt markets had changed. Interest rates had spiked and liquidity had disappeared, largely a result of a plunge in energy prices.

For a while, it looked as if we might not be able to close the deal and we risked losing our deposit, as well as the opportunity to diversify our company and potentially expand Bronco Billy’s. Ultimately, however, our existing lenders stepped up, albeit at an expensive price. Our first-lien lenders extended the maturity of our existing bank debt by 25 months to May 2019, in return for receiving a first lien on the acquired property. Our second-lien lenders also extended their maturities and provided us the capital to close on the transaction.

We got it done, but it was expensive. Our second-lien debt is currently at an interest rate of 13.5%, although the shock of this is somewhat offset by the favorable 4.75% variable interest rate on our first-lien debt. We also had to provide the second-lien lender with warrants for 5% of our company at the then-trading price. We accepted these expensive terms, as the acquisition was important to our company. It was at an attractive price, it provided us with important diversification of income, and it provided us with a significant growth opportunity. We believed that the expensive debt would not be outstanding for long, while Bronco Billy’s could be an important part of our company for many years to come.

In the year since the purchase, our company has become stronger and debt markets have improved. The rights offering also helped, as it boosted our equity and demonstrated the support of our shareholders and our board.

We are again looking at refinancing our debt at more attractive interest rates. We have no immediate need to do so -- we still have a couple of years to go on our existing maturities. Often, it is best to refinance a company’s debt when the markets are favorable and the maturity of the existing debt is not imminent. If all goes well, we hope to do this refinancing before the end of the second quarter, as the call premium on our second-lien debt drops from 103 to 102 in mid-May. We also intend to design into the financing the ability to fund at least part of a new hotel at Bronco Billy’s. Until that refinancing is completed, of course, there is no certainty that we will be able to do so.

We are proud of the progress we’ve made in the approximately two years that our management team has overseen our company. When we arrived at Full House, virtually every property was trending down in revenues and earnings. We reversed that trend at every property in 2015. Our Adjusted EBITDA rose 30.5% from 2014 to the 2015 results. With the partial year of Bronco Billy’s in the 2016 numbers, our Adjusted EBITDA is 51.2% higher than 2014 levels.

Our stock has approximately doubled since the new management team arrived, yet is still valued below that of many of its peers. We think we have a long way to go. It is easier for a small company to grow faster and for a longer period of time than a large company. Ultimately, stock price appreciation is a function of the growth rate of a company, not of its size. In this industry, larger companies tend to trade at higher multiples, presumably reflecting the diversity and stability of their operations. We believe that if we are careful, maintain diversity and stability, and grow our company to a larger size in smart and rational ways, then perhaps we will also trade at those higher multiples.

We thank our shareholders for your support. We will continue to work hard and effectively on your behalf.

/s/ Daniel R. Lee

Daniel R. Lee

President and Chief Executive Officer

Note: This letter supplants the glossy annual reports that are still prepared by some companies; such a report would not be economical for our small company. For a full description of our financial results, please see our annual report on Form 10-K that was filed with the Securities and Exchange Commission and that is available on our website, at www.fullhouseresorts.com.

This letter contains statements that are "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Some forward-looking statements in this letter include, but are not limited to, the statements regarding Full House’s proposed capital improvements and investments at its properties, completion of its debt refinancing, and our operating trends and expected results of operations. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the control of Full House. Information concerning potential risk factors that could affect Full House’s financial condition and results of operations is included in the reports Full House files with the Securities and Exchange Commission, including, but not limited to, its Form 10-K for the most recently ended fiscal year and the Company’s other periodic reports filed with the Securities and Exchange Commission. The Company is under no obligation to (and expressly disclaims any such obligation to) update or revise its forward-looking statements as a result of new information, future events or otherwise. Actual results may differ materially from those indicated in the forward-looking statements.

This letter also contains supplemental financial information and should only be viewed in conjunction with our audited financial results reported using U.S. generally accepted accounting principles (GAAP) and as filed with the Securities and Exchange Commission. A reconciliation between non-GAAP measures such as Adjusted EBITDA and Adjusted Property EBITDA and GAAP measures is attached as Annex 1 to this proxy statement and can also be found in the Company’s Form 10-K for the fiscal year ended December 31, 2016.

FULL HOUSE RESORTS, INC.

4670 South Fort Apache Road, Suite 190

Las Vegas, Nevada 89147

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on the 22nd day of May, 2017

Dear Stockholder:

As I write this letter, it has been just over two years since the board was reconstituted and new management was recruited to lead the company. Since that effort began, our share price has more than doubled from $1.19 on October 8, 2014 to $2.50 on April 9, 2017.

I view the function of the board as follows: develop a strategy, hire and work with a management team to implement that strategy, allocate capital, measure the results, reward the team or hold them accountable, and plan for the future. My role as chairman is to keep the board focused on these tasks.

To help us with these efforts, we have a wide range of experience in the board room today: legal, human resources, accounting, governance, finance, and a healthy dose of hospitality and gaming.

The board has been fortunate to recruit and work with Dan Lee as the CEO. Hopefully you have met him in person or via teleconference. From day one, Dan has reinvigorated the existing team and he has recruited excellent talent where necessary to improve the company.

The board has worked with management to develop and support a strategy of growing organically where we can and pursuing acquisitions if the price is right. In both instances, we try to generate good returns on our capital.

We have also supported a strategy to strengthen our balance sheet. The rights offering in the fall of 2016 served this purpose and will also help finance some modest capital projects at each of our properties. These projects should help us both grow and obtain a more favorable cost of capital. Shareholders should see the fruits of these efforts as each of the projects are completed and hopefully the debt market will reward our efforts with reduced interest expense. We see the relationship between growth and lower interest expense as a virtuous circle and we are working diligently to complete this arc. That said, our to-do list is always longer than our day.

The board is presenting to shareholders a proposal to increase the equity incentive plan. We are very cognizant of the potential dilution to shareholders, but we believe that options vesting over years is one way to align management with long-term value at a small company like ours.

We are also working on a management incentive plan to reward management for success on achieving strategic goals. Our plan will focus on cash flow growth, return on invested capital, free cash flow per share, and other discretionary metrics. Rewards will be payable by the board in either cash, stock or options. No plan is perfect, but our aim is to keep management clearly and firmly aligned with shareholders and enthusiastic to build our company.

Management and the board own a significant number of shares and we have a substantial amount of our own money at stake. Collectively, we currently own approximately 17% of the company, including vested options. I believe that this investment we have made, and recently increased during the rights offering, fortifies an owner-oriented culture we hope to promote.

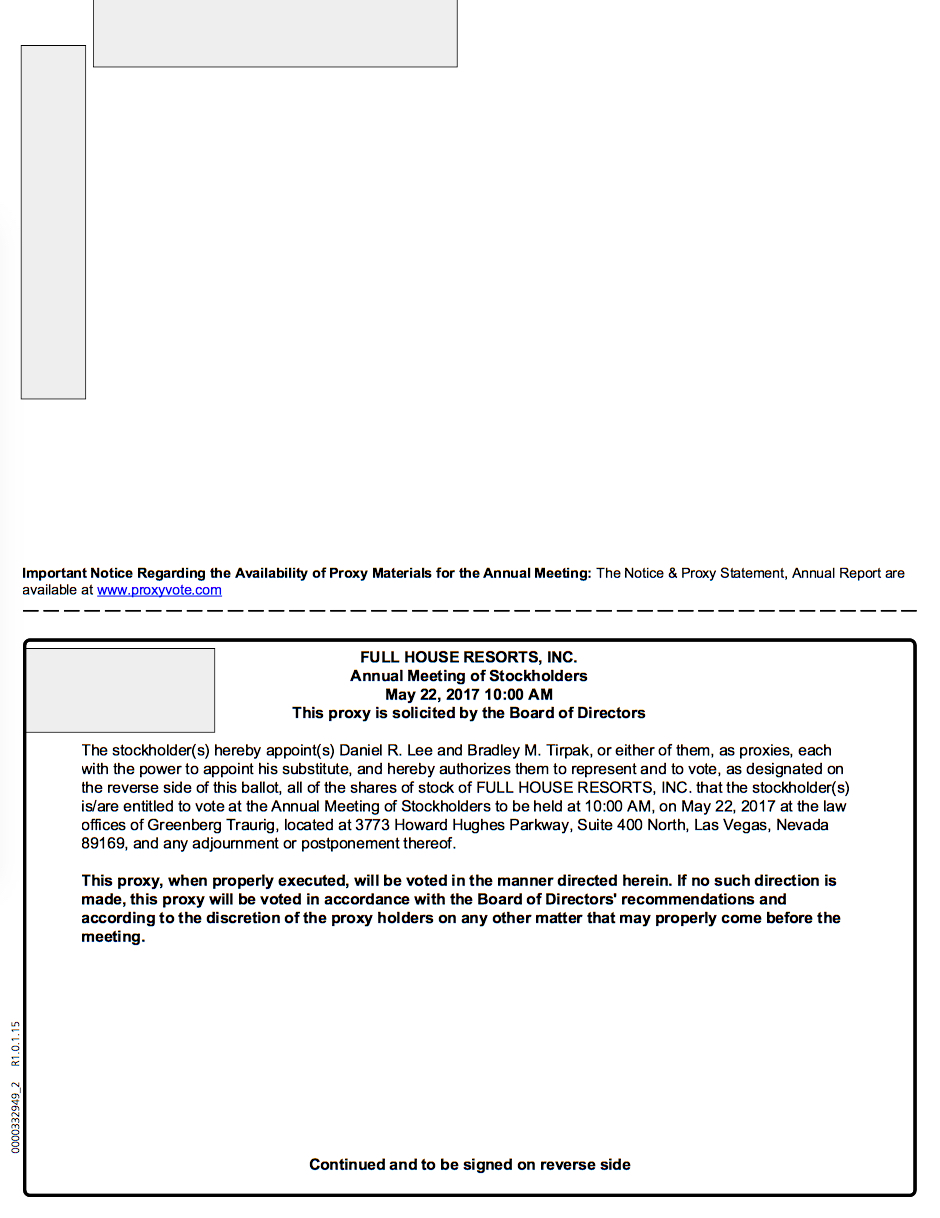

Finally, you are invited to attend our Annual Meeting of Stockholders, which will be held at 10:00 a.m., local time, on the 22nd day of May, 2017, at the law offices of Greenberg Traurig, located at 3773 Howard Hughes Parkway, Suite 400 North, Las Vegas, Nevada 89169.

The following items will be on the agenda:

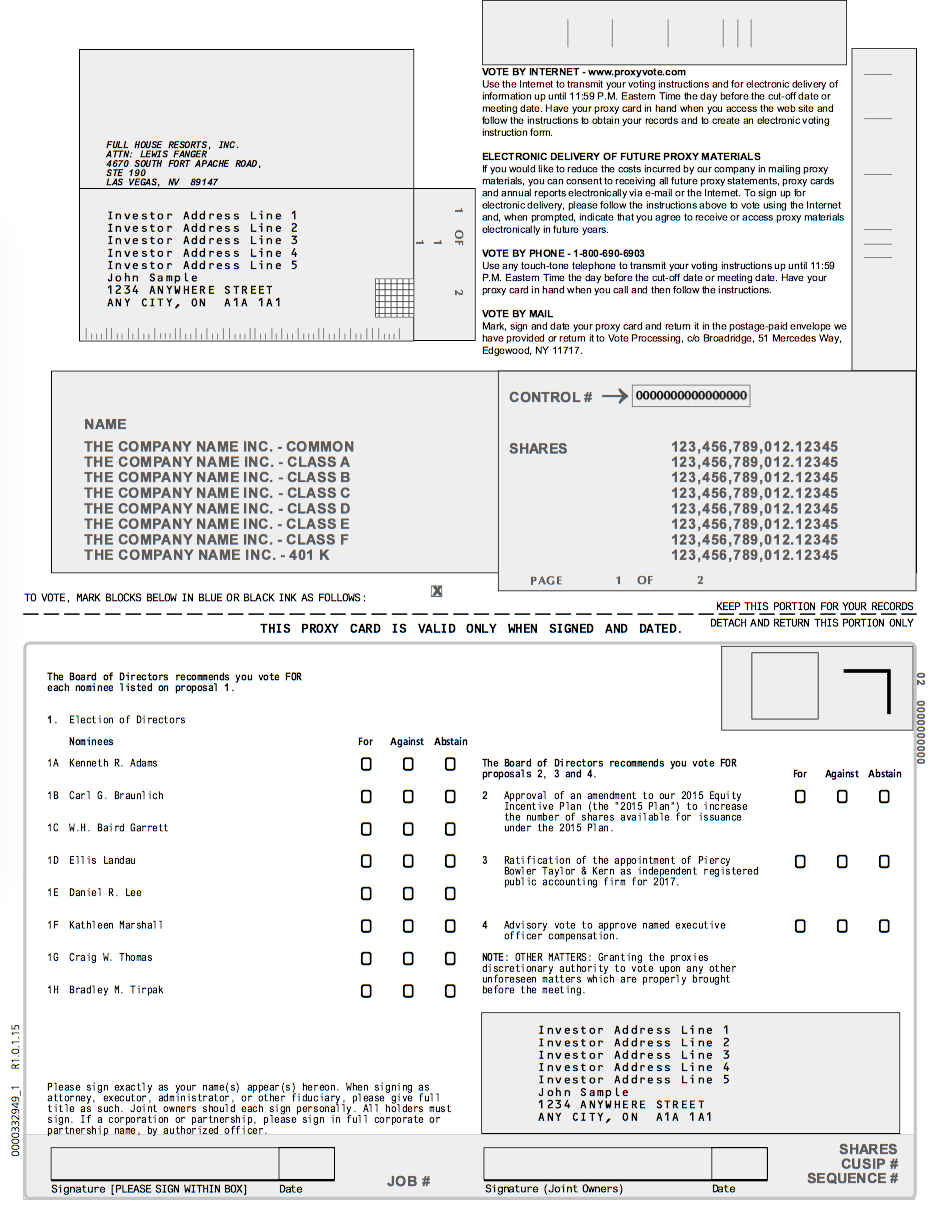

| |

1. | Election of eight members to our board of directors to serve until our next annual meeting of stockholders or until their successors are duly elected and qualified; |

| |

2. | Approval of an amendment to our 2015 Equity Incentive Plan (the "2015 Plan") to increase the number of shares available for issuance under the 2015 Plan; |

| |

3. | Ratification of the appointment of Piercy Bowler Taylor & Kern, Certified Public Accountants (“Piercy Bowler Taylor & Kern”), as our independent registered public accounting firm for 2017; |

| |

4. | An advisory vote to approve named executive officer compensation; and |

| |

5. | Transaction of such other business as may properly come before the annual meeting, including any adjournments or postponements thereof. |

Our board of directors has fixed the close of business on April 4, 2017 as the record date for determining those stockholders entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements thereof.

Whether or not you expect to be present, please sign, date and return the enclosed proxy card in the enclosed pre-addressed envelope as promptly as possible. No postage is required if mailed in the United States.

I look forward to seeing you at the meeting. If you are unable to attend, I would still welcome your feedback. I am always available.

Sincerely,

/s/ Bradley M. Tirpak

Bradley M. Tirpak

Chairman

Las Vegas, Nevada

April 14, 2017

YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. EVEN IF YOU EXECUTE A PROXY CARD, YOU MAY NEVERTHELESS ATTEND THE MEETING, REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE, AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

This proxy statement, the enclosed form of proxy, and the letter from our President and Chief Executive Officer are first being mailed to stockholders on or about April 14, 2017. Our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 is being mailed with this proxy statement, but is not part of the proxy soliciting materials.

TABLE OF CONTENTS

|

| | |

PROXY STATEMENT | 1 |

|

| |

ABOUT THE MEETING | 1 |

| |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 4 |

|

| |

PROPOSAL ONE: | |

ELECTION OF DIRECTORS | 6 |

|

| |

CORPORATE GOVERNANCE | 8 |

|

| |

INFORMATION CONCERNING EXECUTIVE OFFICERS | 12 |

|

| |

EXECUTIVE COMPENSATION | 13 |

|

| |

PROPOSAL TWO: | |

APPROVAL OF AN AMENDMENT TO THE 2015 EQUITY INCENTIVE PLAN | 18 |

|

| |

PROPOSAL THREE: | |

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 25 |

|

| |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM MATTERS | 25 |

|

| |

PROPOSAL FOUR: | |

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | 27 |

|

| |

GENERAL INFORMATION | 28 |

|

| |

ANNEX 1: GAAP TO NON-GAAP RECONCILIATIONS | 29 |

|

| |

ANNEX 2: FULL HOUSE RESORTS, INC. 2015 EQUITY INCENTIVE PLAN | 31 |

|

2017 ANNUAL MEETING OF STOCKHOLDERS

OF

FULL HOUSE RESORTS, INC.

PROXY STATEMENT

This proxy statement contains information relating to the 2017 Annual Meeting of Stockholders of Full House Resorts, Inc. (referred to herein as “we”, “us”, “our” and the “Company”), to be held at10:00 a.m., local time, on the 22nd day of May, 2017, at the law offices of Greenberg Traurig, located at 3773 Howard Hughes Parkway, Suite 400 North, Las Vegas, Nevada 89169, and to any adjournments or postponements.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON MAY 22, 2017

This proxy statement, form of proxy and our annual report on Form 10-K are also available on our website at www.fullhouseresorts.com or at www.proxyvote.com.

ABOUT THE MEETING

What is the purpose of the annual meeting?

At the annual meeting, stockholders will act upon the matters outlined in the accompanying notice of meeting, including:

| |

• | the election of eight directors; |

| |

• | the approval of an amendment to our 2015 Plan to increase the number of shares available for issuance under the 2015 Plan; |

| |

• | the ratification of Piercy Bowler Taylor & Kern as our independent registered public accounting firm; and |

| |

• | an advisory vote to approve named executive officer compensation. |

The stockholders also will transact any other business that properly comes before the meeting.

Who is entitled to vote?

Only stockholders of record at the close of business on the record date, April 4, 2017, are entitled to receive notice of the annual meeting and to vote the shares of our common stock that they held on that date at the meeting, or any postponement or adjournment of the meeting. Each outstanding share of common stock entitles its holder to cast one vote on each matter to be voted upon.

What is the difference between a stockholder of record and a beneficial owner?

If your shares are registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the “stockholder of record” with respect to those shares. If your shares are held by a brokerage firm, bank, trustee or other agent (“nominee”), you are considered the “beneficial owner” of shares held in “street name”. As the beneficial owner, you have the right to direct your nominee on how to vote your shares by following their instructions for voting included in the enclosed proxy materials.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend. Please note that if you are the beneficial owner of shares held in street name, you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date. You will also need a photo ID to gain admission.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of 40% of the total number of shares of our common stock and preferred stock outstanding on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, 22,864,963 shares of our common stock were outstanding and held by approximately 90 stockholders of record.

As of the record date, no shares of our preferred stock were outstanding. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum.

If less than 40% of outstanding shares entitled to vote are represented at the meeting, a majority of the shares present at the meeting may adjourn the meeting to another date, time or place, and notice need not be given of the new date, time or place if the new date, time or place is announced at the meeting before an adjournment is taken.

How do I vote?

If you are a stockholder of record, you may vote:

| |

• | in person at the meeting. |

If you are a beneficial owner of shares held in street name, you must follow the voting procedures of your nominee included in your proxy materials. Beneficial owners who wish to vote in person at the meeting will need to obtain a proxy from their nominee.

May I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with our Secretary either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

What are the Board’s recommendations?

The enclosed proxy is solicited on behalf of the Board of Directors of the Company (the “Board”). Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of our Board. The recommendation of the Board is set forth with the description of each item in this proxy statement. In summary, the Board recommends a vote:

| |

• | FOR the election of the nominated slate of directors (see pages 6 through 8). |

| |

• | FOR the approval of an amendment to our 2015 Plan to increase the number of shares available for issuance under the 2015 Plan (see pages 18 through 24). |

| |

• | FOR the ratification of Piercy Bowler Taylor & Kern as our independent auditors (see page 25). |

| |

• | FOR the proposal regarding an advisory vote to approve named executive officer compensation (see page 27). |

The Board does not know of any other matters that may be brought before the meeting nor does it foresee or have reason to believe that the proxy holders will have to vote for substitute or alternate board nominees. In the event that any other matter should properly come before the meeting or any nominee is not available for election, the proxy holders will vote as recommended by the Board, or if no recommendation is given, in accordance with their best judgment.

What vote is required to approve each item?

| |

• | Election of Directors. An affirmative vote of a majority of the votes cast at the meeting is required for election of each director. |

| |

• | Approval of an amendment to our 2015 Plan to increase the number of shares available for issuance under the 2015 Plan. An affirmative vote of a majority of the votes cast at the meeting is required for approval of this amendment. |

| |

• | Ratification of Piercy Bowler Taylor & Kern. An affirmative vote of a majority of the votes cast at the meeting is required for the ratification of our independent registered public accounting firm. |

| |

• | Advisory vote to approve named executive officer compensation. An affirmative vote of a majority of the votes cast at the meeting is required for the approval of this advisory proposal. |

| |

• | Other Items. For any other item that may properly come before the meeting, the affirmative vote of a majority of the votes cast at the meeting, either in person or by proxy, will be required for approval, unless otherwise required by law. |

How are abstentions treated?

Abstentions will not be counted as votes cast in the final tally of votes with regard to any proposal. Therefore, abstentions will have no effect on the outcome of any proposal. As stated above, abstentions will be counted for the purpose of determining whether a quorum is present.

What are “broker non-votes” and how are they treated?

If your shares are held by a broker on your behalf (that is, in “street name”), and you do not instruct the broker as to how to vote these shares on Proposal 1, Proposal 2 or Proposal 4, the broker may not exercise discretion to vote for or against those proposals. This would be a “broker non-vote” and these shares will not be counted as having been voted on the applicable proposal. With respect to Proposal 3, the broker may exercise its discretion to vote for or against that proposal in the absence of your instruction. Please instruct your bank or broker so your vote can be counted.

What is the effect of the advisory vote on Proposal 4?

Although the advisory vote on Proposal 4 is non-binding, our Board and its compensation committee will annually review the results of the vote and take them into account in making determinations concerning executive compensation.

Who pays for the preparation of the proxy statement?

We will pay the cost of preparing, assembling and mailing the proxy statement, notice of meeting and enclosed proxy card. In addition to the use of mail, our employees or authorized agents may solicit proxies personally and by telephone. Our employees will receive no compensation for soliciting proxies other than their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies and we may reimburse those persons for their expenses incurred in connection with these activities. We will compensate only independent third-party agents that are not affiliated with us to solicit proxies. At this time, we do not anticipate that we will be retaining a third-party solicitation firm, but should we determine in the future that it is in our best interests to do so, we will retain a solicitation firm and pay for all costs and expenses associated with retaining this solicitation firm.

Do I have dissenter’s or appraisal rights?

You have no dissenter’s or appraisal rights in connection with any of the proposals described herein.

Where can I find voting results of the annual meeting?

We will announce the results for the proposals voted upon at the annual meeting and publish final detailed voting results in a Form 8-K filed within four business days after the annual meeting.

Who should I call with other questions?

If you have additional questions about this proxy statement or the meeting or would like additional copies of this proxy statement or our annual report, please contact: Full House Resorts, Inc., 4670 South Fort Apache Road, Suite 190, Las Vegas, Nevada 89147, Telephone: (702) 221-7800.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of the record date concerning the beneficial ownership of our common stock by:

| |

• | each person known by us to be the beneficial owner of more than 5% of our outstanding common stock; |

| |

• | each of our directors and named executive officers; and |

| |

• | all of our directors and executive officers as a group. |

The address for each of our executive officers and directors is c/o Full House Resorts, Inc., 4670 South Fort Apache Road, Suite 190, Las Vegas, Nevada 89147.

|

| | | | | | |

Name of Beneficial Owner | | Number of Shares of Common Stock Beneficially Owned (1) | | Percentage of Class Outstanding (1) |

Named Executive Officers and Directors: | | | | |

Kenneth R. Adams (2) | | 88,888 |

| | * |

|

Carl G. Braunlich (2) | | 50,892 |

| | * |

|

W.H. Baird Garrett (2) | | 61,318 |

| | * |

|

Ellis Landau (2) | | 89,549 |

| | * |

|

Daniel R. Lee (3) | | 1,906,957 |

| | 8.1 | % |

Kathleen Marshall (2) | | 48,892 |

| | * |

|

Craig W. Thomas (2) | | 755,303 |

| | 3.3 | % |

Bradley M. Tirpak (2) | | 671,924 |

| | 2.9 | % |

Lewis A. Fanger (4) | | 210,590 |

| | * |

|

Elaine L. Guidroz (5) | | 62,274 |

| | * |

|

All Executive Officers and Directors as a Group (10 Persons) | | 3,946,587 |

| | 16.6 | % |

| | | | |

Holding More than 5%: | | | | |

RMB Capital Holdings, LLC (6) | | 2,269,299 |

| | 9.9 | % |

Franklin Resources, Inc. (7) | | 1,923,520 |

| | 8.4 | % |

| |

* | Less than 1% of the outstanding shares of common stock. |

| |

(1) | Shares are considered beneficially owned, for purposes of this table only, if held by the person indicated as beneficial owner, or if such person, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise, has or shares the power to vote, to direct the voting of and/or dispose of or to direct the disposition of, such security, or if the person has a right to acquire beneficial ownership within 60 days, unless otherwise indicated in these footnotes. Any securities outstanding that are subject to options or warrants exercisable within 60 days are deemed to be outstanding for the purpose of computing the percentage of outstanding securities of the class owned by such person, but are not deemed to be outstanding for the purpose of computing the percentage of the class owned by any other person. The percentages shown are based on 22,864,963 shares of common stock issued and outstanding as of April 4, 2017. |

| |

(2) | Includes 10,588 shares which are subject to options that are exercisable within 60 days of April 4, 2017. |

| |

(3) | Includes (a) 1,000,122 shares owned by Mr. Lee as of April 4, 2017, (b) 550,570 shares which are subject to options that are currently exercisable, (c) 72,659 shares which are subject to options that are exercisable within 60 days of April 4, 2017, (d) 127,945 shares beneficially owned by a subtrust for the benefit of Mr. Lee's children, (e) 139,735 shares beneficially owned by a family trust for the benefit of Mr. Lee's children, and (f) 15,926 shares beneficially owned by an account for the benefit of Mr. Lee's daughter previously established pursuant to the Massachusetts Uniform Transfer to Minors Act. Mr. Lee has sole voting and dispositive power over these shares. |

| |

(4) | Includes (a) 18,923 shares owned by Mr. Fanger as of April 4, 2017, (b) 162,500 shares which are subject to options that are currently exercisable, and (c) 29,167 shares which are subject to options that are exercisable within 60 days of April 4, 2017. |

| |

(5) | Includes (a) 15,000 shares directly owned by Ms. Guidroz as of April 4, 2017, (b) 608 shares beneficially owned that are held indirectly by Ms. Guidroz's spouse, (c) 16,666 shares which are subject to options that are currently exercisable, and (d) 30,000 shares which are subject to options that are exercisable within 60 days of April 4, 2017. |

| |

(6) | Based on information disclosed in Schedule 13G/A, as filed with the SEC on February 13, 2017 pursuant to a joint filing agreement by and among RMB Capital Holdings, LLC, RMB Capital Management, LLC and Iron Road Capital Partners, LLC. RMB Capital Holdings, LLC, RMB Capital Management, LLC, and Iron Road Capital Partners, LLC reported shared voting and dispositive power over 2,269,299 shares. The principal business address of RMB Capital Holdings, LLC, RMB Capital Management, LLC and Iron Road Capital Partners, LLC is 115 S. LaSalle Street, 34th Floor, Chicago, IL 60603. |

| |

(7) | Based on information disclosed in Schedule 13G/A, as filed with the SEC on February 8, 2017. Franklin Resources, Inc. (“FRI”), its subsidiary Franklin Advisory Services, LLC, and Charles B. Johnson and Rupert H. Johnson, Jr. (holders of more than 10% of the common stock of FRI), reported holdings of our common stock beneficially owned by one or more open or closed-end investment companies or other managed accounts that are investment management clients of subsidiaries of FRI. FRI reported that Franklin Advisory Services, LLC has sole voting and dispositive power for all such shares. The principal business address of FRI, Charles B. Johnson and Rupert H. Johnson, Jr. is One Franklin Parkway, San Mateo, CA 94403-1906. The principal business address for Franklin Advisory Services, LLC is 55 Challenger Road, Suite 501, Ridgefield Park, NJ 07660. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) requires our directors and executive officers and persons who own more than ten percent of our outstanding common stock, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock. These persons are required by SEC regulation to furnish us with copies of all such reports they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, Section 16 filings show no late filings. We believe that all Section 16(a) reports were timely filed by our officers, directors and greater than ten percent beneficial owners.

PROPOSAL ONE:

ELECTION OF DIRECTORS

Our Amended and Restated By-laws (the “By-laws”) provide that the number of directors constituting our Board shall be fixed from time to time by the Board. Our Board currently consists of eight directors. The nominees to be voted on by stockholders at this meeting are Kenneth R. Adams, Carl G. Braunlich, W.H. Baird Garrett, Ellis Landau, Daniel R. Lee, Kathleen Marshall, Craig W. Thomas and Bradley M. Tirpak. Directors are elected by a majority of the votes cast, assuming a quorum is present. The term of office of each director ends at the next annual meeting of stockholders or when his or her successor is elected and qualified.

All nominees have consented to be named and have indicated their intent to serve if elected. We have no reason to believe that any of these nominees are unavailable for election. However, if any of the nominees become unavailable for any reason, the persons named as proxies may vote for the election of such person or persons for such office as our Board may recommend in the place of such nominee or nominees. It is intended that proxies, unless marked to the contrary, will be voted in favor of the election of each of the nominees.

Director Nominees

We believe that each of our nominees possesses the experience, skills and qualities to fully perform his or her duties as a director and to contribute to our success. In addition, each of our nominees is being nominated because they each possess high standards of personal integrity, are accomplished in their field, have an understanding of the interests and issues that are important to our stockholders and are able to dedicate sufficient time to fulfilling their obligations as a director.

Each nominee’s biography containing information regarding the individual’s service as a director, business experience, director positions held currently or within the last five years and other pertinent information about the particular experience, qualifications, attributes and skills that led the Board to conclude that such person should serve as a director appears on the following pages.

Kenneth R. Adams, 74, joined our Board in January 2007. Mr. Adams is a principal in the gaming consulting firm, Ken Adams Ltd., which he founded in 1990. He is also an editor of the Adams’ Report monthly newsletter, the Adams’ Daily Report electronic newsletter and the Adams Analysis, each of which focus on the gaming industry. Since 2012, Mr. Adams has been a partner in the Colorado Grande in Cripple Creek, Colorado, a limited-stakes casino with a restaurant and bar. Since August 1997, Mr. Adams has been a partner in Johnny Nolon’s Casino in Cripple Creek, Colorado, a limited stakes casino with a restaurant and bar. From 2001 until 2008, he served on the board of directors of Vision Gaming & Technology, Inc., a privately held gaming machine company, and he formerly served on the board of directors of the Downtown Improvement Agency in Reno, Nevada. The Board believes Mr. Adams is qualified to serve as a Director due to his 40 years of gaming industry experience, including specific experience as a casino operator, his knowledge of the casino industry, and his continuing analysis and review of the industry.

Dr. Carl G. Braunlich, 64, has been one of our directors since May 2005, and is the current Vice Chairman. Since August 2006, he has been an Associate Professor at the University of Nevada, Las Vegas. Dr. Braunlich holds a Doctor of Business Administration in International Business from United States International University, San Diego, CA. Prior to joining the faculty of University of Nevada, Las Vegas, Dr. Braunlich was a Professor of Hotel Management at Purdue University since 1990. Previously he was on the faculty at United States International University. Dr. Braunlich has held executive positions at the Golden Nugget Hotel and Casino in Atlantic City, New Jersey and at Paradise Island Hotel and Casino, Nassau, Bahamas. He has been a consultant to Wynn Las Vegas, Harrah’s Entertainment, Inc., Showboat Hotel and Casino, Bellagio Resort and Casino, International Game Technology, Inc., Atlantic Lottery Corporation, Nova Scotia Gaming Corporation and the Nevada Council on Problem Gambling. Dr. Braunlich was on the board of directors of the National Council on Problem Gambling, and he has served on several problem gambling committees, including those of the Nevada Resort Association and the American Gaming Association. The Board believes that Dr. Braunlich is qualified to serve as a Director due to his knowledge of and experience gained over 15 years in the casino industry and his position as an educator and consultant to the casino industry.

W.H. Baird Garrett, 55, joined our Board in November 2014. Since July 2015, Mr. Garrett has served as Senior Vice President of Legal at Elasticsearch, Inc., a leading software company in the enterprise search and data analytics space. From October 2008 through September 2015, Mr. Garrett served as an attorney at VLP Law Group, including as the chair of its Technology Transactions practice group. Mr. Garrett has extensive experience in corporate law, having represented clients as diverse as The Walt Disney Company and the venture capital firm of Kleiner, Perkins, Caufield and Byers. He specializes in the negotiation of complex commercial transactions, particularly those involving new technology and intellectual property, such as the purchase and licensing of gaming devices and on-line gaming software. Mr. Garrett also previously practiced law at the law firm of Wilson, Sonsini, Goodrich and Rosati in Palo Alto, CA and Seattle, WA. Prior to entering private practice, he clerked for the Delaware Court of Chancery. Mr. Garrett earned a B.A. degree from Pennsylvania State University, an M.A. degree from the University of Chicago

and a J.D. degree from the University of Virginia School Of Law. The Board believes that Mr. Garrett is qualified to serve as a Director due to his expertise in complex legal transactions involving technology and gaming devices.

Ellis Landau, 73, joined our Board in November 2014. Mr. Landau is a private investor who serves on various for-profit and non-profit boards. In 2006, Mr. Landau retired as Executive Vice President and Chief Financial Officer of Boyd Gaming Corporation, a position he held since he joined the company in 1990. Mr. Landau previously worked for Ramada Inc., later known as Aztar Corporation, where he served as Vice President and Treasurer, as well as U-Haul International and the Securities and Exchange Commission. Mr. Landau was President, Treasurer and Director of ALST Casino Holdco, LLC, the holding company of Aliante Gaming, LLC, which owned and operated Aliante Casino + Hotel in North Las Vegas, Nevada until 2016 when it was sold to Boyd Gaming Corporation. From 2007 to 2011, Mr. Landau was a member of the board of directors of Pinnacle Entertainment, Inc., a leading gaming company, where he served as chair of the audit committee and as a member of its nominating and governance committee and its compliance committee. Mr. Landau served as a director of Spectrum Group International from 2012 until March 2014. Mr. Landau has served as a director of A-Mark Precious Metals (formerly a part of Spectrum Group International) since March 2014 and is chairman of the audit committee and a member of the compensation committee. Mr. Landau currently holds a gaming license in Indiana and Colorado and he has previously been licensed in Nevada and Mississippi, which are collectively all four of the jurisdictions where the Company operates. Mr. Landau earned his B.A. in economics from Brandeis University and his M.B.A. in finance from Columbia University Business School. The Board believes that Mr. Landau is qualified to serve as a Director due to knowledge of and experience in the casino and hospitality industries and his experience as a director for gaming companies, as well as his service on various committees of those boards.

Daniel R. Lee, 60, joined our Board, and was appointed as our President and Chief Executive Officer, in November 2014. Mr. Lee was the Managing Partner of Creative Casinos, LLC, a developer of casino resorts, from September 2010 through December 2014. He was previously Chairman and Chief Executive Officer of Pinnacle Entertainment, Inc., a casino operator and developer, from 2002 to 2009. In the 1990s, he was Chief Financial Officer, Treasurer and Sr. Vice President of Finance and Development at Mirage Resorts, reporting to Mirage CEO Steve Wynn. During the 1980s, Mr. Lee was a securities analyst for Drexel Burnham Lambert and CS First Boston, specializing in the lodging and gaming industries. He serves as an independent director of Associated Capital since November 2015, where is a member of the governance committee. He also serves as a director of Myers Industries, Inc. since April 2016, where he is a member of the audit committee and the corporate governance and nominating committee. Mr. Lee previously served as an independent director of LICT Corporation and of ICTC Group, Inc. While working as a securities analyst, he was a Chartered Financial Analyst. Mr. Lee earned his M.B.A. in finance and a B.S. degree in Hotel Administration, both from Cornell University. The Board believes that Mr. Lee is qualified to serve as a Director due to his extensive experience in the financial services industry, his experience and knowledge in the gaming, lodging and securities industries and his executive management experience as Chief Executive Officer of a large public corporation.

Kathleen Marshall, 61, joined our Board in January 2007. Ms. Marshall has also been appointed the Chairperson of our Audit Committee. Ms. Marshall is a Certified Public Accountant who, since June 2016, has served as Controller for the Casino Reinvestment Development Authority (CRDA) in Atlantic City, NJ. She provided consulting services to CRDA from January 2016 to June 2016. From October 2008 through January 2016, Ms. Marshall served as Director of Business Development of Global Connect, LLC a web-based voice messaging company. Prior to that, from July 2003 through August 2008, Ms. Marshall served as Vice President of Finance for Atlantic City Coin & Slot Service Co. Inc., which designs, manufactures and distributes gaming equipment. Between January and June 2003, Ms. Marshall worked as a consultant. From April 1999 to December 2002, she served as Vice President of Finance for the Atlantic City Convention and Visitors Authority, a government agency responsible for enhancing the economy of the region with coordination of the operations of the Atlantic City Convention Center. Prior to that, Ms. Marshall held various finance positions with several Atlantic City Casinos, including Vice President of Finance at Atlantic City Showboat, Inc. and various internal audit and financial positions at Caesars Atlantic City, Inc. In addition, Ms. Marshall has worked as a public accountant in the audit division of Price Waterhouse. The Board believes that Ms. Marshall is qualified to serve as a Director due to her knowledge of and experience in the casino industry and her background as a financial officer for casino and casino-related companies.

Craig W. Thomas, 42, joined our Board in November 2014. Mr. Thomas is a professional investor with more than 15 years of investing experience who has been a portfolio manager at CR Intrinsic Investors and S.A.C. Capital Advisors and an analyst at Goff Moore Strategic Partners and Rainwater, Inc. He is currently the co-founder of Shareholder Advocates for Value Enhancement (S.A.V.E.) and manages various other investment partnerships. Prior to becoming a professional investor, Mr. Thomas was a consultant at The Boston Consulting Group. Mr. Thomas is a former director of Laureate Education, Inc. (LAUR) and Direct Insite Corporation, currently Paybox Corp., from May 2011 to June 2014. In addition, Mr. Thomas currently serves as a director of United States Antimony Corporation (UAMY) since May 2016. Mr. Thomas earned an A.B. from Stanford University and an M.B.A. from the Graduate School of Business at Stanford University. The Board believes that Mr. Thomas is qualified to serve as a Director due to his knowledge and experience in portfolio management, investment analysis and stockholder advocacy.