EXHIBIT 10.2

(EXHIBIT G

to Indenture)

FORM OF

SECURITY AGREEMENT

Made by

EACH OF THE GRANTORS PARTY HERETO

and

Wilmington Trust, National Association,

as Collateral Agent

February 2, 2018

TABLE OF CONTENTS

|

| | |

| | Page |

ARTICLE I DEFINITIONS | 6 |

| | |

Section 1.01 | Definitions. | 6 |

| | |

ARTICLE II SECURITY INTEREST | 12 |

| | |

Section 2.01 | Grant of Security Interest | 12 |

Section 2.02 | Certain Limited Exclusions | 14 |

| | |

ARTICLE III REPRESENTATIONS AND WARRANTIES | 14 |

| | |

Section 3.01 | Ownership of Collateral; Absence of Encumbrances and Restrictions | 14 |

Section 3.02 | No Required Consent | 15 |

Section 3.03 | Security Interest | 15 |

Section 3.04 | No Filings By Third Parties | 15 |

Section 3.05 | Name; No Name Changes | 15 |

Section 3.06 | Location of the Grantors and Collateral; Intellectual Property | 15 |

Section 3.07 | Intellectual Property | 16 |

Section 3.08 | Accounts, Instruments, Equity Interests, Claims and Letter of Credit Rights | 17 |

Section 3.09 | Collateral | 17 |

Section 3.10 | Taxpayer and Organizational Identification Number | 17 |

Section 3.11 | Pledged Equity Interests | 17 |

Section 3.12 | Actions, Filings, Etc. | 18 |

Section 3.13 | Accuracy of Information | 18 |

| | |

ARTICLE IV COVENANTS AND AGREEMENTS | 18 |

| | |

Section 4.01 | Change in Location of Grantor | 18 |

Section 4.02 | Change in Grantor’s Name or Corporate Structure | 18 |

Section 4.03 | Collateral in Possession of Third Parties | 18 |

Section 4.04 | Delivery of Collateral | 19 |

Section 4.05 | Maintenance of Security Interest | 19 |

Section 4.06 | Records and Inspection Rights | 19 |

Section 4.07 | Reimbursement of Expenses | 20 |

Section 4.08 | Further Assurances | 20 |

Section 4.09 | Maintenance of Collateral | 21 |

Section 4.10 | Use, Possession and Control of Collateral | 21 |

Section 4.11 | Collateral Attached to Other Property | 21 |

Section 4.12 | Intellectual Property | 22 |

Section 4.13 | Deposit Accounts, Securities Accounts and Commodity Accounts | 23 |

Section 4.14 | Pledged Equity Interests, Investment Related Property | 24 |

Section 4.15 | Accounts Receivable | 25 |

Section 4.16 | Limitations on Disposition | 25 |

|

| | |

Section 4.17 | Notices | 26 |

Section 4.18 | Further Covenants | 26 |

| | |

ARTICLE V RIGHTS, DUTIES AND POWERS OF COLLATERAL AGENT | 26 |

| | |

Section 5.01 | Discharge Encumbrances | 26 |

Section 5.02 | Licenses and Rights to Use Collateral | 26 |

Section 5.03 | Cumulative and Other Rights | 26 |

Section 5.04 | Disclaimer of Certain Duties | 27 |

Section 5.05 | Modification of Secured Obligations; Other Security | 27 |

Section 5.06 | Investment Related Property | 27 |

| | |

ARTICLE VI EVENTS OF DEFAULT | 28 |

| | |

Section 6.01 | Events of Default | 28 |

Section 6.02 | Remedies | 28 |

Section 6.03 | Attorney-in-Fact | 31 |

Section 6.04 | Account Debtors | 32 |

Section 6.05 | Liability for Deficiency | 32 |

Section 6.06 | Reasonable Notice | 32 |

Section 6.07 | Non-judicial Enforcement | 32 |

Section 6.08 | Gaming Licenses | 32 |

| | |

ARTICLE VII MISCELLANEOUS PROVISIONS | 33 |

| | |

Section 7.01 | Notices | 33 |

Section 7.02 | Amendments and Waivers | 33 |

Section 7.03 | Absolute and Unconditional Secured Obligations; Waivers | 33 |

Section 7.04 | Possession of Collateral | 36 |

Section 7.05 | Redelivery of Collateral | 36 |

Section 7.06 | Governing Law; Jurisdiction; Venue; Waiver of Jury Trial | 36 |

Section 7.07 | Gaming Laws and Regulations | 37 |

Section 7.08 | Conflicts | 38 |

Section 7.09 | Continuing Security Agreement | 38 |

Section 7.10 | Termination | 38 |

Section 7.11 | Counterparts; Effectiveness | 39 |

Section 7.12 | Additional Grantors | 39 |

Section 7.13 | Acknowledgments and Agreements by Grantors and each issuer of Pledged Equity Interests | 39 |

Section 7.14 | No Release | 40 |

Section 7.15 | Indenture | 40 |

| | |

EXHIBITS | | |

A | General Information | |

B | Intellectual Property | |

|

| | |

C | Material Contracts | |

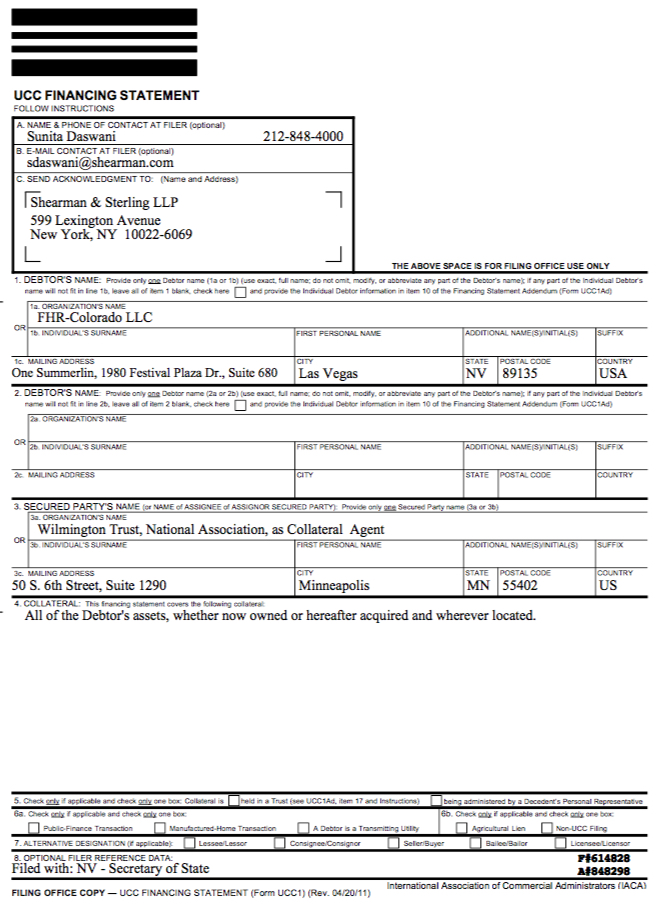

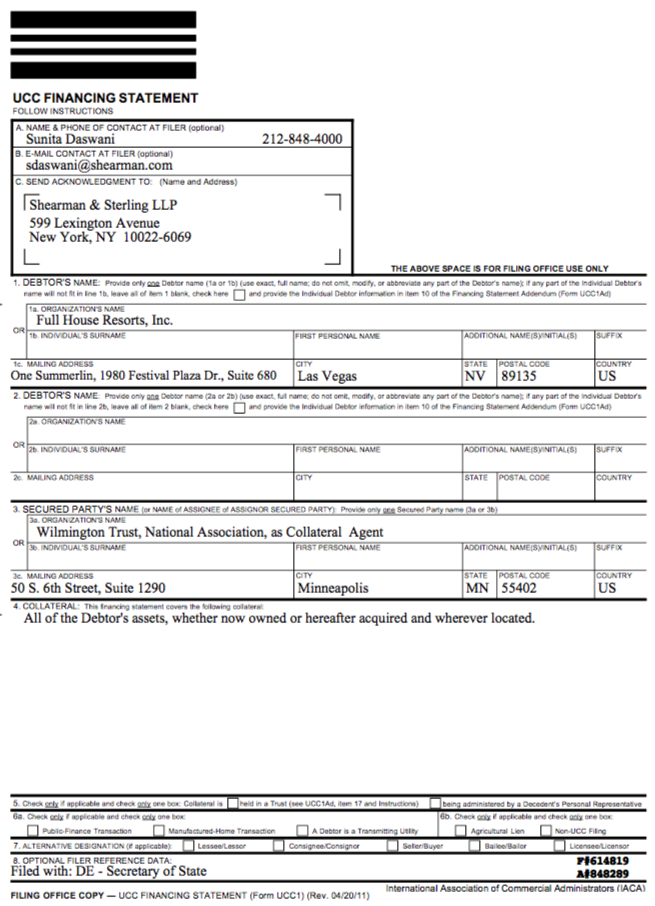

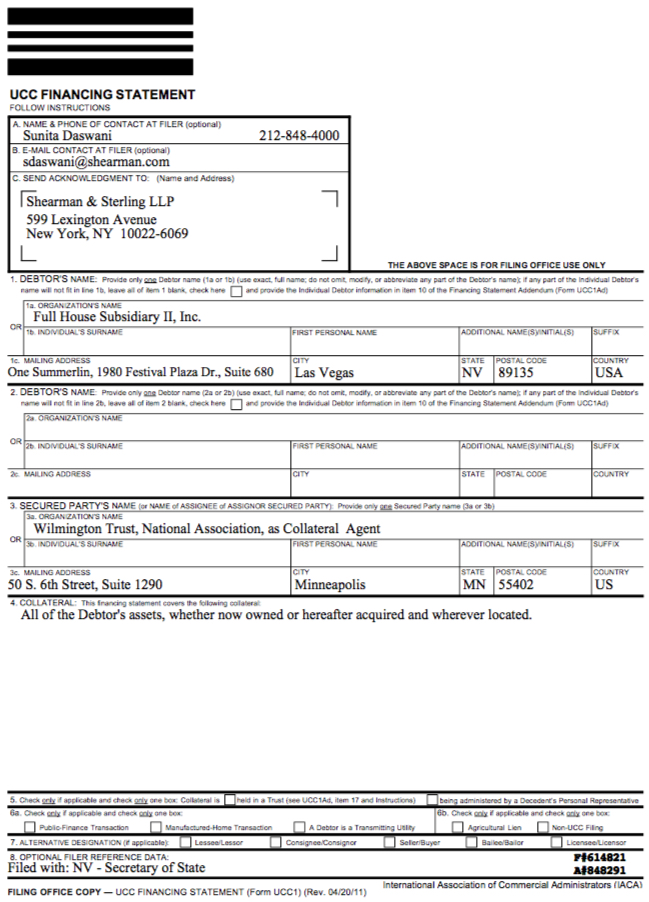

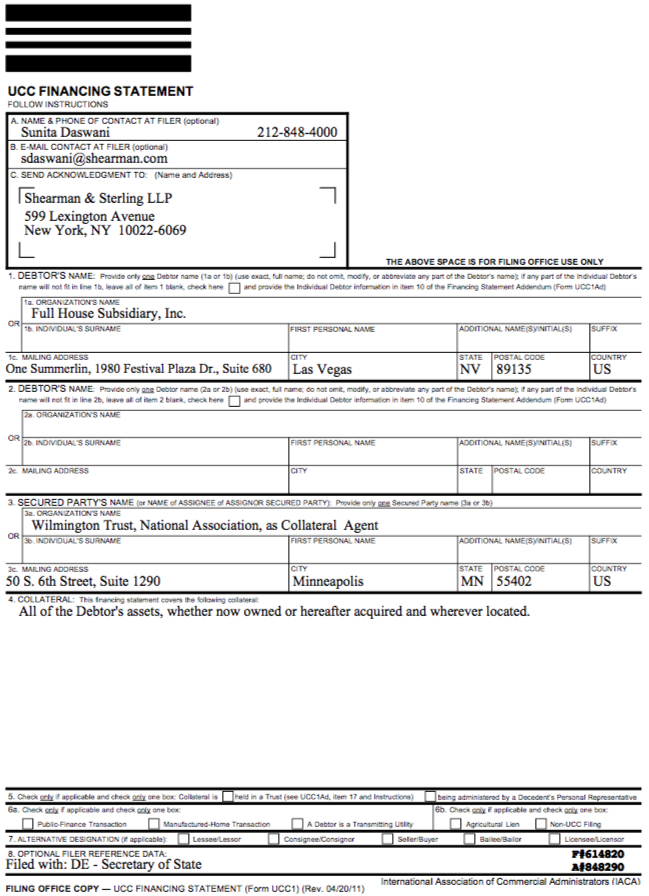

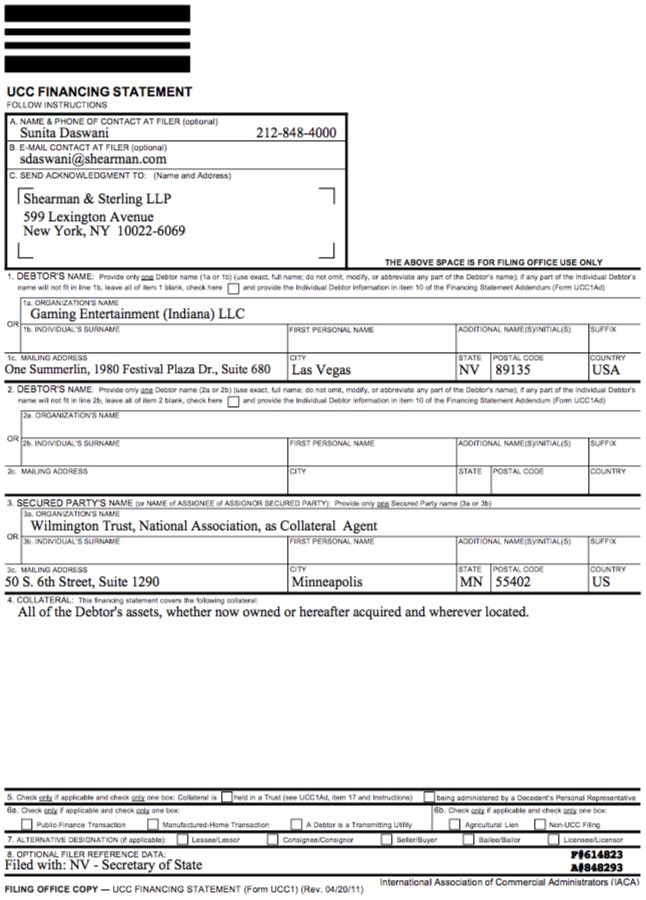

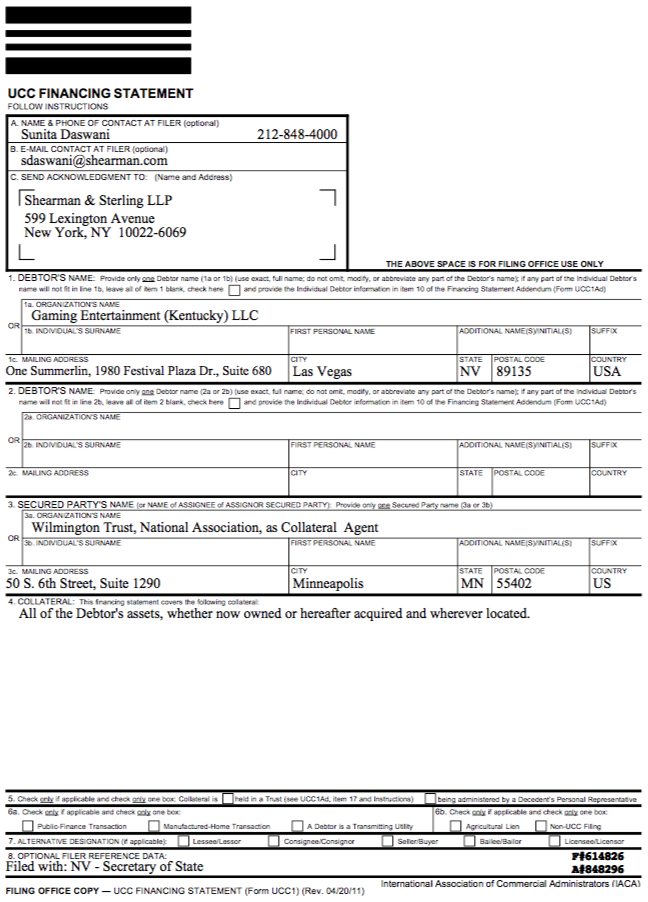

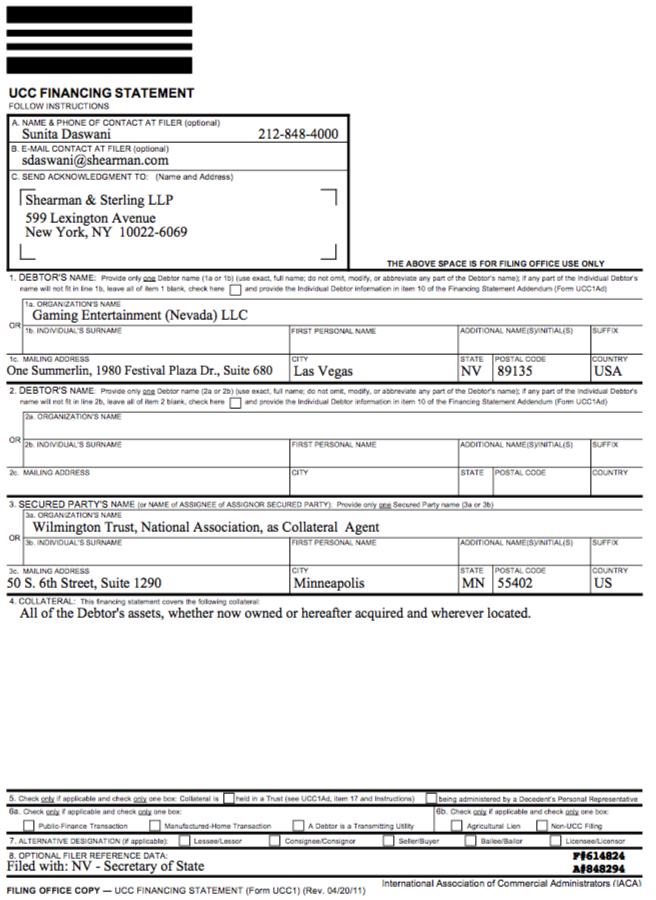

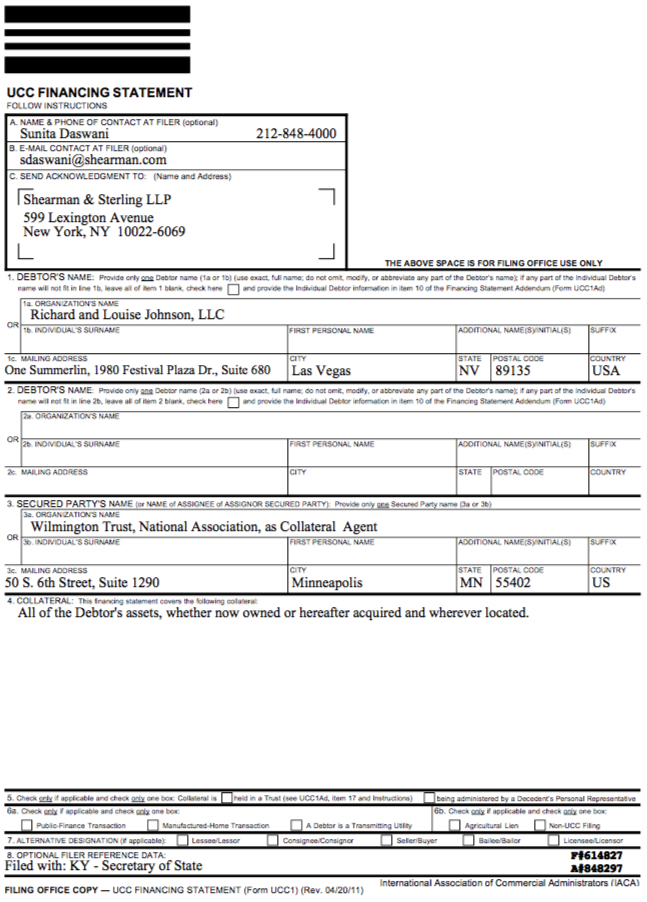

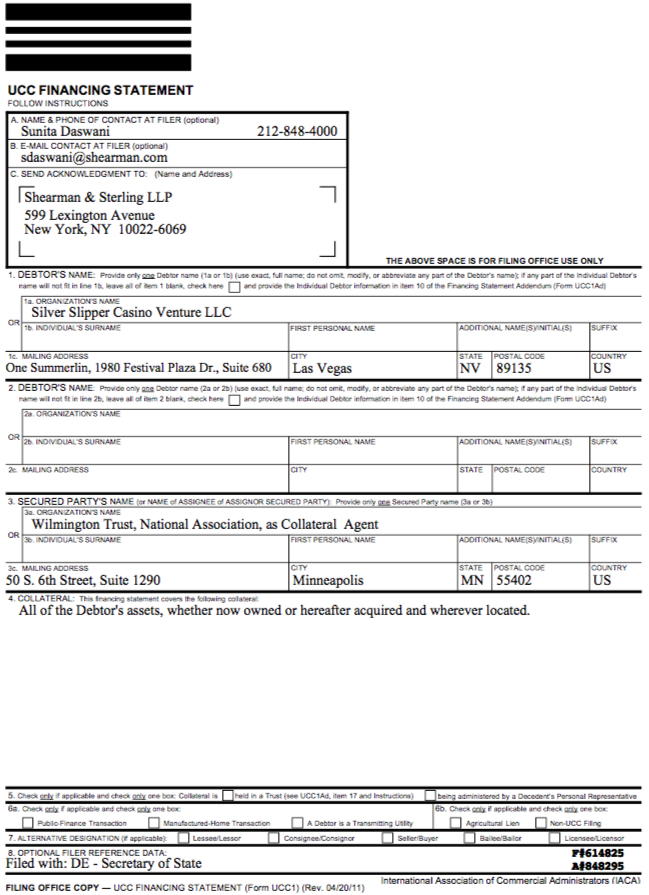

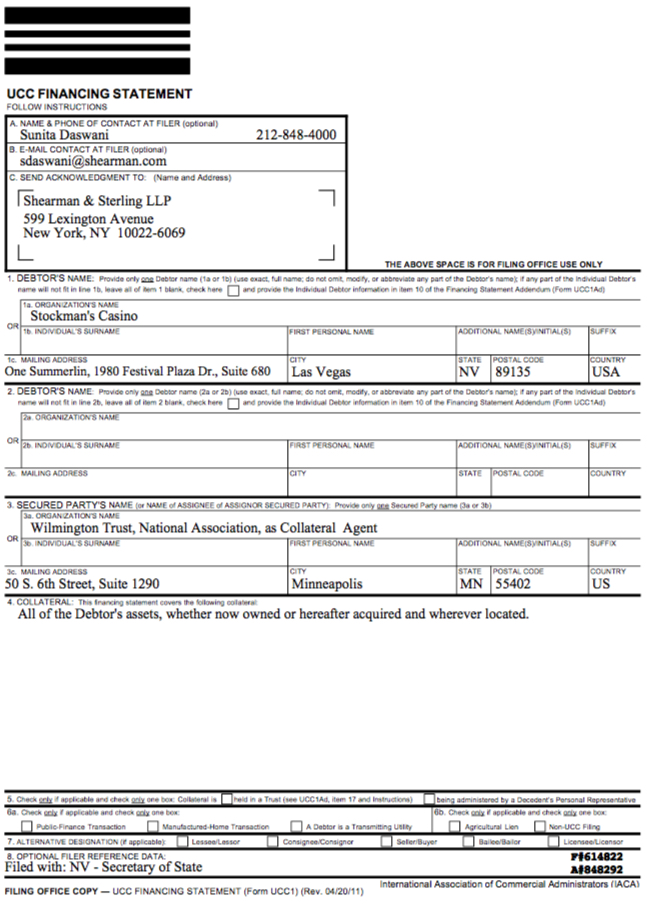

D | Financing Statements | |

E | Accounts, Pledged Equity Interests, Instruments, Commercial Tort Claims & Letters of Credit | |

F | Form of Security Agreement Supplement | |

SECURITY AGREEMENT

This SECURITY AGREEMENT (this "Agreement") is made as of February 2, 2018, by FULL HOUSE RESORTS, INC., a Delaware corporation (the "Company"), FULL HOUSE SUBSIDIARY, INC., a Nevada corporation ("Full House Sub"), FULL HOUSE SUBSIDIARY II, INC., a Nevada corporation ("Full House Sub II"), STOCKMAN’S CASINO, a Nevada corporation ("Stockman’s"), GAMING ENTERTAINMENT (INDIANA) LLC, a Nevada limited liability company ("Gaming Indiana"), GAMING ENTERTAINMENT (NEVADA) LLC, a Nevada limited liability company ("Gaming Nevada"), SILVER SLIPPER CASINO VENTURE LLC, a Delaware limited liability company ("Silver Slipper"), GAMING ENTERTAINMENT (KENTUCKY) LLC, a Kentucky limited liability company ("Gaming Kentucky"), RICHARD & LOUISE JOHNSON, LLC, a Kentucky limited liability company ("Johnson"), FHR-COLORADO LLC, a Nevada limited liability company ("FHR") and any other Subsidiary of the Company party hereto from time to time as an Additional Grantor (as herein defined) (collectively with the Company, Full House Sub, Full House Sub II, Stockman’s, Gaming Indiana, Gaming Nevada, Silver Slipper, Gaming Kentucky, Johnson and FHR, the "Grantors"), in favor of Wilmington Trust, National Association, as collateral agent (together with its successors and assigns in such capacity, the "Collateral Agent"), for the benefit of the Secured Parties.

W I T N E S S E T H:

A. The Company has entered into that certain Indenture, dated as of the date hereof (as it may be amended, restated, supplemented or otherwise modified from time to time, the "Indenture"), by and among the Company, the Guarantors (as named therein), and Wilmington Trust, National Association, as Trustee and Collateral Agent;

B. The Company has entered into and issued $100,000,000 in aggregate principal amount of Senior Secured Notes due 2024 (the "Notes") pursuant to that certain Notes Purchase Agreement, dated as of the date hereof (as it may be amended, restated, supplemented or otherwise modified from time to time, the "Notes Purchase Agreement"), by and among the Company, the Guarantors (as named therein), and the Purchasers (as defined therein);

C. In consideration of the purchase of the Notes and other accommodations of the Trustee and Collateral Agent as set forth in the Bond Documents, each Grantor has agreed to secure such Grantor’s obligations under such agreements as set forth herein; and

D. It is a condition precedent to the issuance of the Notes and other financial accommodations under the Indenture and the Notes Purchase Agreement that each Grantor has agreed to secure such Grantor’s obligations under the Bond Documents as set forth herein.

NOW THEREFORE, in consideration of the premises and the agreements, provisions and covenants herein contained, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, each Grantor and the Collateral Agent hereby agree as follows:

ARTICLE I

DEFINITIONS

1.01 Definitions. When used herein, (a) the terms Account, Certificated Security, Chattel Paper, Commercial Tort Claims, Commodity Account, Document, Equipment, Financial Asset, Fixture, Goods, Instrument, Inventory, Investment Property, Letter of Credit, Letter of Credit Rights, Record, Securities Account, Security, Security Entitlement, Supporting Obligations and Uncertificated Security have the respective meanings assigned thereto in the Uniform Commercial Code (as defined below) and if defined in more than one article of the Uniform Commercial Code shall have the meaning set forth in Article 9 thereof; (b) capitalized terms which are not otherwise defined have the respective meanings assigned thereto in the Indenture; and (c) the following terms have the following meanings (such definitions to be applicable to both the singular and plural forms of such terms):

"Account Debtor" means the party who is obligated on or under any Account Receivable, Chattel Paper, Contract Right or General Intangible.

"Account Receivable" means any Account, including without limitation any right of a Grantor to payment for goods sold or leased or for services rendered, whether or not earned by performance, any Chattel Paper and any Instrument.

"Additional Grantor" shall have the meaning assigned in Section 7.12.

"Agreement" shall have the meaning assigned in the preamble hereto.

"Collateral" shall have the meaning assigned in Section 2.01.

"Collateral Account" shall mean any account established by the Collateral Agent.

"Collateral Agent" shall have the meaning assigned in the preamble hereto.

"Company" shall have the meaning assigned in the preamble hereto.

"Computer Hardware and Software" means all of such Grantor’s rights (including rights as licensee and lessee) with respect to (i) computer and other electronic data processing hardware, including all integrated computer systems, central processing units, memory units, display terminals, printers, computer elements, card readers, tape drives, hard and soft disk drives, cables, electrical supply hardware, generators, power equalizers, accessories, peripheral devices and other related computer hardware; (ii) all software programs designed for use on the computers and electronic data processing hardware described in clause (i) above, including all operating system software, utilities and application programs in whatsoever form (source code and object code in magnetic tape, disk or hard copy format or any other listings whatsoever); (iii) any firmware associated with any of the foregoing; and (iv) any documentation for hardware, software and firmware described in clauses (i), (ii) and (iii) above, including flow charts, logic diagrams, manuals, specifications, training materials, charts and pseudo codes.

"Contract Rights" means all rights of such Grantor (including, without limitation, all rights to payment) under each Contract.

"Contract(s)" means all contracts or other agreements between such Grantor and one or more additional parties, including, without limitation, all of the material contracts described on Exhibit C attached hereto.

"Copyright Licenses" means all licenses, contracts or other agreements, whether written or oral, naming such Grantor as licensee or licensor and providing for the grant of any right to use or sell any works covered by any Copyright (including, without limitation, all Copyright Licenses set forth in Exhibit B hereto).

"Copyrights" means all domestic and foreign copyrights, whether registered or unregistered, including, without limitation, all copyright rights throughout the universe (whether now or hereafter arising) in any and all media (whether now or hereafter developed), in and to all original works of authorship fixed in any tangible medium of expression, acquired or used by such Grantor (including, without limitation, all copyrights in software, mask works, Internet web sites and the contents thereof and the copyrights described in Exhibit B hereto), all applications, registrations and recordings thereof (including, without limitation, applications, registrations and recordings in the United States Copyright Office or in any similar office or agency of the United States or any other country or any political subdivision thereof), all rights of publicity and privacy, all rights therein provided by international treaties and conventions, all moral and common-law rights thereto, and all other rights associated therewith.

"Deposit Account" means all "deposit accounts" as defined in Article 9 of the Uniform Commercial Code and all other accounts maintained with any financial institution (other than Securities Accounts or Commodity Accounts), and shall include, without limitation, all of the accounts listed on Exhibit E hereto under the heading "Deposit Accounts" together, in each case, with all funds held therein and all certificates or instruments representing any of the foregoing.

"Discharge of Secured Obligations" means and shall have occurred upon the earliest to occur of the date on which (i) all Secured Obligations shall have been indefeasibly paid in full in cash and all other obligations under the Bond Documents shall have been performed (other than contingent indemnification obligations), (ii) the Company exercises its Legal Defeasance option or Covenant Defeasance option described in Article 8 of the Indenture, and (iii) the satisfaction and discharge of the Indenture occurs in accordance with Article 12 thereof.

"Excluded Collateral" means (a) any license, permit, or authorization issued by any of the Gaming Authorities or any other Governmental Authority or any other Collateral, but solely to the extent a security interest in such license, permit, authorization, or other Collateral is prohibited under Gaming Laws or other applicable Law, or under the terms of any such license, permit, or authorization, or which would require a finding of suitability or other similar approval or procedure by any of the Gaming Authorities or any other Governmental Authority prior to being pledged, hypothecated, or given as collateral security (in each case, to the extent such finding or approval has not been obtained) (whether the Excluded Collateral is held by the Company, or any Grantor, or any trustee or conservator appointed by state or local officials or any other person or entity, whether it be governmental, judicially appointed or private), provided

that the Proceeds of any such license, permit or authorization shall constitute Collateral except to the extent prohibited under Gaming Laws or other applicable Law, rule or regulation or the terms of any such license, permit or authorization, (b) any other lease, license, contract or agreement that (1) is, pursuant to mandatory provisions of Gaming Laws or other applicable Law, prohibited from being pledged as security (unless such Gaming Laws or other applicable Law would be rendered ineffective with respect to the creation of the security interest hereunder pursuant to Sections 9-406, 9-407, 9-408 or 9-409 of the Uniform Commercial Code (or any successor provision or provisions)); (2) would require consent of any Governmental Authority or any party to such lease, license, contract or agreement other than the Company or any Grantor; provided, that, upon the request of the Collateral Agent (acting at the direction of the Required Noteholders or Trustee) each Grantor will in good faith use reasonable efforts to obtain consent for the creation of a security interest in favor of the Collateral Agent in such Grantor’s rights under such lease, license, contract or agreement; or (3) would be violated or invalidated by the granting of a Lien therein, or the granting of a Lien in which would create a right of termination in favor of any party thereto other than the Company or any Grantor, provided that, with respect to the exclusions in each of subclauses (1) through (3) of this clause, upon the termination of such prohibitions for any reason whatsoever or in the event such prohibitions are or become unenforceable under Gaming Laws or other applicable Law, such foregoing property shall automatically become Collateral hereunder; and provided further that the exclusions in each of subclauses (1) through (3) of this clause shall not include any Proceeds of any such excluded Collateral; (c) any "intent-to-use" application for registration of a Trademark filed pursuant to Section 1(b) of the Lanham Act, 15 U.S.C. ß 1051, prior to the filing of a "Statement of Use" pursuant to Section 1(d) of the Lanham Act or an "Amendment to Allege Use" pursuant to Section 1(c) of the Lanham Act with respect thereto, solely to the extent, if any, that, and solely during the period, if any, in which, the grant of a security interest therein would impair the validity or enforceability of any registration that issues from such intent-to-use application under applicable federal law; or (d) any motor vehicles, rolling stock, Vessels and other assets subject to a certificate of title, in each case having a value less than $250,000.

"Gaming Facilities" means Bronco Billy’s Casino, Grand Lodge Casino, Rising Star Casino Resort, Silver Slipper Casino, Stockman’s Casino and the Rising Star Vessel.

"Gaming Stock" means equity securities the ownership of which subjects the party holding such securities to the jurisdiction of the applicable Gaming Authorities as a licensee, qualifier, key person, affiliate of a licensee, registered company or any other form of registration or regulation under applicable Gaming Laws (or prior to such time in furtherance of the person or entity’s application to become a licensee, qualifier, key person, affiliate of a licensee or registered company under applicable Gaming Laws).

"General Intangibles" means all of such Grantor’s "general intangibles" as defined in the Uniform Commercial Code and, in any event, includes (without limitation) all of such Grantor’s Intellectual Property, customer lists, inventions, designs, software programs, mask works, registrations, licenses, franchises, tax refund claims, guarantee claims, security interests, rights to indemnification, payment intangibles, all contractual rights and obligations or indebtedness owing to such Grantor from whatever source arising, all things in action, rights represented by judgments, claims arising out of tort and other claims relating to the Collateral (including the right to assert and otherwise be the proper party of interest to commence and prosecute actions),

and all rights in respect of any pension plan or similar arrangement maintained for employees of such Grantor.

"Grantors" shall have the meaning assigned in the preamble hereto.

"Guaranteeing Grantor" shall have the meaning assigned in Section 7.03.

"Indenture" shall have the meaning assigned in the recitals hereto.

"Intellectual Property" means all past, present and future: (i) trade secrets and other proprietary information; (ii) Trademarks, service marks, business names, designs, logos, indicia and other source and/or business identifiers, and the goodwill of the business relating thereto and all registrations or applications for registrations which have heretofore been or may hereafter be issued thereon throughout the world; (iii) Copyrights (including copyrights for computer programs) and copyright registrations or applications for registrations which have heretofore been or may hereafter be issued throughout the world and all tangible property embodying the copyrights; (iv) unpatented inventions (whether or not patentable); patent applications and Patents; industrial designs, industrial design applications and registered industrial designs (v); Licenses; license agreements related to any of the foregoing and income therefrom; books, records, writings, computer tapes or disks, flow diagrams, specification sheets, source codes, object codes and other physical manifestations, embodiments or incorporations of any of the foregoing; (vi) the right to sue for all past, present and future infringements, dilutions or other violations of any of the foregoing; (vii) income, fees, royalties, damages, claims and payments for past, present and future infringements, dilutions or other violations of any of the foregoing; and (viii) all common law and other rights throughout the world in and to all of the foregoing.

"Investment Accounts" shall mean the Collateral Account, Securities Accounts, Commodity Accounts and Deposit Accounts.

"Investment Related Property" shall mean: (i) all "investment property" (as such term is defined in Article 9 of the Uniform Commercial Code) and (ii) all of the following (regardless of whether classified as investment property under the Uniform Commercial Code): all Pledged Equity Interests, Pledged Debt, all Investment Accounts and certificates of deposit.

"Licenses" means, collectively, the Copyright Licenses, the Trademark Licenses and the Patent Licenses.

"Notes Documents" means, collectively, (i) the Bond Documents and (ii) the Notes Purchase Agreement.

"Obligor" means any Person liable (whether directly or indirectly, primarily or secondarily) for the payment or performance of any of the Secured Obligations whether as maker, co-maker, endorser, guarantor, accommodation party, general partner or otherwise.

"Other Obligor" means, with respect to any Grantor, each Obligor other than such Grantor.

"Patent Licenses" means all licenses, contracts or other agreements, whether written or oral, naming such Grantor as licensee or licensor and providing for the grant of any right to manufacture, use or sell any invention covered by any Patent (including, without limitation, all Patent Licenses set forth in Exhibit B hereto).

"Patents" means all domestic and foreign letters patent, design patents, utility patents, industrial designs, inventions, trade secrets, ideas, concepts, methods, techniques, processes, proprietary information, technology, know-how, formulae and other general intangibles of like nature, now existing or hereafter acquired (including, without limitation, all domestic and foreign letters patent, design patents, utility patents, industrial designs, inventions, trade secrets, ideas, concepts, methods, techniques, processes, proprietary information, technology, know-how and formulae described in Exhibit B hereto), all applications, registrations and recordings thereof (including, without limitation, applications, registrations and recordings in the United States Patent and Trademark Office, or in any similar office or agency of the United States or any other country or any political subdivision thereof), all reissues, reexaminations, divisions, continuations, continuations in part and extensions or renewals thereof, and all rights therein provided by international treaties and conventions.

"Permitted Liens" means the Liens permitted by Section 4.10 of the Indenture.

"Pledged Debt" shall mean all indebtedness for borrowed money owed to such Grantor, whether or not evidenced by any Instrument, including, without limitation, all indebtedness described on Exhibit E under the heading "Pledged Debt" (as such exhibit may be amended or supplemented from time to time), issued by the obligors named therein, the instruments, if any, evidencing such any of the foregoing, and all interest, cash, instruments and other property or proceeds from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of the foregoing.

"Pledged Equity Interests" shall mean all Pledged Stock, Pledged LLC Interests, Pledged Partnership Interests and any other participation or interests in any equity or profits of any business entity including, without limitation, any trust and all management rights relating to any entity whose equity interests are included as Pledged Equity Interests.

"Pledged LLC Interests" shall mean all interests in any limited liability company and each series thereof including, without limitation, all limited liability company interests listed on Exhibit E under the heading "Pledged LLC Interests" (as such exhibit may be amended or supplemented from time to time) and the certificates, if any, representing such limited liability company interests and any interest of such Grantor on the books and records of such limited liability company or on the books and records of any securities intermediary pertaining to such interest and all dividends, distributions, cash, warrants, rights, options, instruments, securities and other property or proceeds from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of such limited liability company interests and all rights as a member of the related limited liability company including all of such Grantor’s aggregate rights in any limited liability company and each series thereof howsoever characterized or arising, including, without limitation, (i) the right to a share of the profits and losses of the limited liability company, (ii) the right to receive distributions from the limited liability company, and (iii) the right to vote and participate in the management of the limited liability company.

"Pledged Partnership Interests" shall mean all interests in any general partnership, limited partnership, limited liability partnership or other partnership including, without limitation, all partnership interests listed on Exhibit E under the heading "Pledged Partnership Interests" (as such exhibit may be amended or supplemented from time to time) and the certificates, if any, representing such partnership interests and any interest of such Grantor on the books and records of such partnership or on the books and records of any securities intermediary pertaining to such interest and all dividends, distributions, cash, warrants, rights, options, instruments, securities and other property or proceeds from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of such partnership interests and all rights as a partner of the related partnership, including, without limitation, (i) the right to a share of the profits and losses of the partnership, (ii) the right to receive distributions from the partnership, and (iii) the right to vote and participate in the management of the partnership.

"Pledged Stock" shall mean all shares of capital stock owned by such Grantor, including, without limitation, all shares of capital stock described on Exhibit E under the heading "Pledged Stock" (as such exhibit may be amended or supplemented from time to time), and the certificates, if any, representing such shares and any interest of such Grantor in the entries on the books of the issuer of such shares or on the books of any securities intermediary pertaining to such shares, and all dividends, distributions, cash, warrants, rights, options, instruments, securities and other property or proceeds from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of such shares.

"Proceeds" shall mean: (i) all "proceeds" as defined in Article 9 of the Uniform Commercial Code; and (ii) shall include all dividends, payments or distributions made with respect to any Investment Related Property and whatever is receivable or received when Collateral or proceeds are sold, exchanged, collected or otherwise disposed of, whether such disposition is voluntary or involuntary (in each case, regardless of whether characterized as proceeds under the Uniform Commercial Code).

"Sale Proceeds" means (i) the proceeds from the sale of the Company or one or more of the other Grantors, as a going concern or from the sale of any of the Gaming Facilities as a going concern, (ii) the proceeds from another sale or disposition of any assets of the Grantors that includes any gaming license, permit or approval or benefits from any gaming license, permit or approval or where the assets sold have the benefit of any gaming license, permit or approval or (iii) any other economic value (whether in the form of cash or otherwise) received or distributed that is associated with the gaming licenses, permits or approvals.

"Secured Obligations" means (i) the Obligations, (ii) each guarantee of the Obligations and (iii) whether or not constituting Obligations, the unpaid principal of and interest on (including, without limitation, interest accruing after the filing of any petition in bankruptcy, or the commencement of any insolvency, reorganization or like proceeding relating to the Company or any other Grantor, whether or not a claim for post-filing or post-petition interest is allowed in such proceeding) and all other obligations and liabilities of the Company or any other Grantor to any Secured Party which may arise under or in connection with any Notes Document.

"Securities Act" means the Securities Act of 1933, as amended.

"Security Agreement Supplement" shall have the meaning assigned in Section 7.12.

"Trademark Licenses" means all licenses, contracts or other agreements, whether written or oral, naming such Grantor as licensor or licensee and providing for the grant of any right concerning any Trademark, together with any goodwill connected with and symbolized by any such trademark licenses, contracts or agreements and the right to prepare for sale or lease and sell or lease any and all inventory now or hereafter owned by such Grantor and now or hereafter covered by such licenses (including, without limitation, all Trademark Licenses described in Exhibit B hereto).

"Trademarks" means all domestic and foreign trademarks, service marks, collective marks, certification marks, trade names, business names, d/b/a’s, Internet domain names, trade styles, designs, logos and other source or business identifiers and all general intangibles of like nature, now or hereafter owned, adopted, acquired or used by such Grantor (including, without limitation, all domestic and foreign trademarks, service marks, collective marks, certification marks, trade names, business names, d/b/as, Internet domain names, trade styles, designs, logos and other source or business identifiers described in Exhibit B hereto), all applications, registrations and recordings thereof (including, without limitation, applications, registrations and recordings in the United States Patent and Trademark Office or in any similar office or agency of the United States, any state thereof or any other country or any political subdivision thereof), all reissues, extensions or renewals thereof, together with all goodwill of the business symbolized by such marks and all customer lists, formulae and other Records of such Grantor relating to the distribution of products and services in connection with which any of such marks are used, rights therein provided by international treaties and conventions, and all other rights associated therewith.

"Vessel" means any vessel owned by such Grantor, whether now owned or acquired or to be delivered to such Grantor in the future, whether or not such Vessel is a vessel within the meaning of 46 U.S.C. (S) 31322(a), and all rights of such Grantor therein, including all equipment, parts and accessories, including, but not limited to, all of its boilers, engines, generators, air compressors, machinery, masts, spars, sails, riggings, boats, anchors, cables, chains, tackle, tools, pumps and pumping equipment, motors, apparel, furniture, computer equipment, electronic equipment used in connection with the operation of the Vessel and belonging to the Vessel, all machinery, equipment, engines, appliances and fixtures for generating or distributing air, water, heat, electricity, light, fuel or refrigeration, or for ventilating or sanitary purposes, fittings and equipment, supplies, spare parts, fuel, and all other appurtenances thereunto appertaining or belonging, whether now owned or hereafter acquired, whether or not on board said Vessel, and all extensions, additions, accessions, improvements, renewals, substitutions, and replacements hereafter made in or to said Vessel or any part thereof, or in or to any said appurtenances.

ARTICLE II

SECURITY INTEREST

2.01 Grant of Security Interest. As security for the prompt and complete payment and performance of the Secured Obligations, each Grantor hereby grants to the Collateral Agent, for

the benefit of the Secured Parties, a security interest in and continuing lien on all of such Grantor’s right, title and interest in, to and under all personal property of such Grantor including, but not limited to, the following, in each case whether now or hereafter existing or in which any Grantor now has or hereafter acquires an interest and wherever the same may be located (collectively, but exclusive of any Excluded Collateral, the "Collateral"):

(i)Accounts Receivable;

(ii)Certificated Securities;

(iii)Chattel Paper;

(iv)Computer Hardware and Software and all rights with respect thereto, including, without limitation, any and all licenses, options, warranties, service contracts, program services, test rights, maintenance rights, support rights, improvement rights, renewal rights and indemnifications, and any substitutions, replacements, additions or model conversions of any of the foregoing;

(v)all Contracts, together with all Contract Rights arising thereunder;

(vi)Documents;

(vii)General Intangibles;

(viii)Goods (including all of its Equipment, Fixtures and Inventory) and all accessions, additions, attachments, improvements, substitutions and replacements thereto and therefor;

(ix)Instruments;

(x)Intellectual Property, including, without limitation, all Copyrights, Patents and Trademarks, and all Licenses;

(xi)Investment Related Property (including, without limitation, Deposit Accounts);

(xii)Letters of Credit and Letter of Credit Rights;

(xiii)money (of every jurisdiction whatsoever);

(xiv)Commercial Tort Claims and the proceeds of any litigation, arbitration or similar proceeding;

(xv)Uncertificated Securities;

(xvi)Vessels;

(xvii)Supporting Obligations;

(xviii)Proceeds;

(xix)Sale Proceeds; and

(xx)to the extent not included in the foregoing, all other personal property of any kind or description, wherever located and whenever acquired;

together with all books, records, writings, data bases, information and other property relating to, used or useful in connection with, or evidencing, embodying, incorporating or referring to any of the foregoing, and all proceeds, products, offspring, rents, issues, profits and returns of and from any of the foregoing.

It is expressly contemplated that additional property may from time to time be pledged, assigned or granted to the Collateral Agent as additional security for the Secured Obligations, and the term "Collateral" as used herein shall be deemed for all purposes hereof to include all such additional property, together with all other property of the types described above related thereto, excepting, in each case, all property that is Excluded Collateral; provided that all Proceeds of the Excluded Collateral shall constitute Collateral hereunder and shall be included within the property and assets over which a security interest is granted under this Section 2.01 except to the extent specifically provided in the definition of Excluded Collateral. Each Grantor agrees that the Collateral Agent is acting as collateral agent for the Secured Parties.

2.02 Certain Limited Exclusions. Notwithstanding anything herein to the contrary, but subject to the last sentence of this Section 2.02, in no event shall the security interest granted under Section 2.01 attach to any Excluded Collateral (whether the Excluded Collateral is held by the Company, or any Grantor, or any trustee or conservator appointed by state or local officials, or any other person or entity, whether it be governmental, judicially appointed or private). Notwithstanding the foregoing, all Proceeds of the Excluded Collateral shall constitute Collateral hereunder and shall be included within the property and assets over which a security interest is granted under Section 2.01 except to the extent specifically provided in the definition of Excluded Collateral.

ARTICLE III

REPRESENTATIONS AND WARRANTIES

In order to induce the Collateral Agent, acting on behalf of the Secured Parties, to accept this Agreement, each Grantor represents and warrants to the Collateral Agent (which representations and warranties will survive the creation and payment of the Secured Obligations) that:

3.01 Ownership of Collateral; Absence of Encumbrances and Restrictions. Such Grantor is, and in the case of property acquired after the date hereof, will be, the sole legal and beneficial owner of the Collateral purported to be owned by it holding good and indefeasible title to the same, free and clear of all Liens except for Permitted Liens and such other defects in title as could not, in respect of such other defects, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, and such Grantor has full right, power and authority to assign and grant a security interest in such Collateral to the Collateral Agent.

3.02 No Required Consent. Except for such authorizations, consents or approvals previously obtained and in effect, no material authorization, consent, approval or other action by, and no notice to or filing with, any governmental authority or regulatory body is required for (i) the due execution, delivery and performance by such Grantor of this Agreement, (ii) the grant by such Grantor of the security interest granted by this Agreement, (iii) the perfection of such security interest (other than the filing of financing statements and the other documents required to perfect or maintain the perfection of the Liens granted hereby) or (iv) the exercise by the Collateral Agent of its rights and remedies under this Agreement, except as may be required by Gaming Laws or by federal or state securities laws or antitrust laws (in connection with the disposition of the Collateral).

3.03 Security Interest. The grant of the security interest in and Lien on the Collateral pursuant to this Agreement creates a valid and continuing security interest in and Lien on the Collateral, enforceable against each Grantor, and, upon the filing of financing statements attached hereto as Exhibit D in the filing office for the locations of the Collateral and the Grantors that are on Exhibit A hereof, the security interests granted hereby which can be perfected by the filing of financing statements will be perfected, prior to all other Liens except Permitted Liens, enforceable against third parties and securing payment of the Secured Obligations. Subject to Gaming Laws, each Grantor has delivered to the Collateral Agent, together with all necessary stock powers, endorsements, assignments and other necessary instruments of transfer, the originals of all stock certificates, instruments, notes, other certificated securities, other Collateral and all certificates, instruments and other writings evidencing the same, in each case relating to Equity Interests and Instruments required to be pledged hereunder.

3.04 No Filings By Third Parties. Other than any financing statement, ship mortgage or other public notice or recording naming the Collateral Agent as secured party therein or financing statements with respect to Permitted Liens, no financing statement or other public notice or recording covering the Collateral is on file in any public office and such Grantor has not signed and will not sign, any document or agreement authorizing the filing of any such financing statement or other public notice or recording so long as any of the Secured Obligations are outstanding.

3.05 Name; No Name Changes. On the date hereof, the name of such Grantor set forth on Exhibit A hereto is the true and correct full legal name of such Grantor, and, except as described on Exhibit A hereto, such Grantor has not, during the preceding five (5) years, entered into any contract, agreement, security instrument or other document using a name other than, or been known by or otherwise used any name other than, the name used by such Grantor herein.

3.06 Location of the Grantors and Collateral; Intellectual Property. On the date hereof, such Grantor’s chief executive office, principal place of business and the locations of such Grantor’s records concerning the Collateral are set forth on Exhibit A hereto. Any Collateral not at such location(s) nevertheless remains subject to the Collateral Agent’s security interest. Exhibit B hereto contains a true, correct and complete listing of all of Intellectual Property owned by or licensed to such Grantor which has been registered or for which applications for registration are pending. On the date hereof, such Grantor has delivered to the Collateral Agent complete and correct copies of each material License of such Grantor described in Exhibit B

hereto, including all schedules and exhibits thereto, which represents all of the Licenses of such Grantor existing on the date of this Agreement.

3.07 Intellectual Property

(a)Each Grantor is the exclusive owner of all right, title and interest in and to the Intellectual Property, and is entitled to use all Intellectual Property subject only to the terms of the Licenses and Permitted Liens.

(b)The Intellectual Property is valid, subsisting and enforceable except as would not reasonably be expected to result in a Material Adverse Effect.

(c)The conduct of the businesses of each Grantor as currently conducted or as contemplated to be conducted and the use of the Intellectual Property in connection therewith do not infringe, misappropriate, dilute, misuse or otherwise violate the Intellectual Property rights of any third party in any material respect. No claim, action, suit, investigation, litigation or administrative proceeding has been asserted or is pending or, to the Company’s knowledge, threatened against any Grantor regarding infringement, misappropriation, dilution, misuse or other violation, ownership, validity, registerability or enforceability of the Intellectual Property. No Person is engaging in any activity that infringes, misappropriates, dilutes, misuses or otherwise violates the Intellectual Property or the Grantor’s rights in or use thereof in any material respect.

(d)Each Grantor has taken all commercially reasonable measures necessary to protect the confidentiality of all material trade secrets owned by or licensed to such Grantor.

(e)With respect to each material License: (A) such License is valid and binding and in full force and effect and represents the entire agreement between the respective parties thereto with respect to the subject matter thereof; (B) such License will not cease to be valid and binding and in full force and effect on terms identical to those currently in effect as a result of the rights and interest granted herein, nor will the grant of such rights and interest constitute a breach or default under such License or otherwise give any party thereto a right to terminate such License; (C) such Grantor has not received any notice of termination or cancellation under such License; (D) such Grantor has not received any notice of a breach or default under such License, which breach or default has not been cured; (E) such Grantor has not granted to any other third party any rights, adverse or otherwise, under such License, except in the ordinary course of business; and (F) neither such Grantor nor any other party to such License is in breach or default thereof in any material respect, and no event has occurred that, with notice or lapse of time or both, would constitute such a breach or default or permit termination, modification or acceleration under such License.

(f)Each Grantor has made or performed all filings, recordings and other acts and has paid all required fees and taxes (i) to maintain and protect its interest in each and every item of its Intellectual Property that is registered, issued or applied for as of the date hereof in full force and effect, and (ii) to otherwise protect and maintain its interest in each and every item of its other Intellectual Property in full force and effect to the extent and in such jurisdictions as are deemed advantageous by such Grantor in its reasonable business judgment.

3.08 Accounts, Instruments, Equity Interests, Claims and Letter of Credit Rights. Exhibit E hereto sets forth, as of the date hereof, under the appropriate headings all of such Grantor’s: (a) Deposit Accounts, (b) Securities Accounts, (c) Pledged Equity Interests, (d) Instruments, (e) Commercial Tort Claims and (f) Letter of Credit Rights, in each case having value, independently or in the aggregate in excess of $25,000, for letters of credit.

3.09 Collateral. No report, certificate or other written information furnished by or on behalf of such Grantor in connection with the transactions contemplated hereby or delivered hereunder or under any other Notes Document to the Collateral Agent describing or with respect to the Collateral, when taken as a whole, contains any untrue statement of a material fact; provided that, with respect to projected financial information, the Company represents only that such information was prepared in good faith based upon assumptions believed to be reasonable at the time.

3.10 Taxpayer and Organizational Identification Number. The federal taxpayer identification number, and state of formation or incorporation and organizational identification number, if any, of each Grantor are set forth on Exhibit A hereto.

3.11 Pledged Equity Interests.

(a) Such Grantor is the record and beneficial owner of the Pledged Equity Interests free of all Liens, rights or claims of other Persons (except for the Liens in favor of the Collateral Agent under the Notes Documents) and there are no outstanding warrants, options or other rights to purchase, or shareholder, voting trust or similar agreements outstanding with respect to, or property that is convertible into, or that requires the issuance or sale of, any Pledged Equity Interests; and

(b) Subject to Section 7.07 hereof, no material approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority or any other Person is necessary or required in connection with (i) the grant by such Grantor of the Liens granted by it pursuant to the Collateral Documents, (ii) the perfection or maintenance of the Liens created under the Collateral Documents (including the first priority nature thereof) or (iii) the exercise by the Collateral Agent of its rights under the Collateral Documents or the remedies in respect of the Collateral pursuant to the Collateral Documents, except for the authorizations, approvals, actions, notices and filings, all of which have been duly obtained, taken, given or made and are in full force and effect, except for receipt by the Grantors of: (x) the approval of the Nevada Gaming Commission to the pledge of the Equity Interests in Stockman’s Casino and Gaming Entertainment (Nevada) LLC pursuant to the Collateral Documents; provided that, the Company has made application to the Nevada Gaming Commission for approval of the same and will provide all other information requested by the appropriate authorities in a timely manner; and (y) ratification by the Indiana Gaming Commission of that certain interim approval and waiver issued to Company on January 29, 2018 by the Indiana Gaming Commission’s executive director. Without in any way limiting the Company’s obligations under Section 4.20 of the Indenture, (A) each of the parties hereto acknowledge that the pledge of Equity Interests in Stockman’s Casino and Gaming Entertainment (Nevada) LLC are not effective unless and until approved by the Nevada Gaming Commission and (B) each of the parties hereto acknowledge that any certificates evidencing

ownership of Stockman’s Casino and Gaming Entertainment (Nevada) LLC must be kept in the State of Nevada once approval of the pledge of Equity Interests has been obtained from the Nevada Gaming Commission.

3.12 Actions, Filings, Etc. All actions, filings, notices, registrations and recordings within the United States and all material consents, in each case as are necessary for the exercise by the Collateral Agent of the voting or other rights provided for in this Agreement or the exercise of remedies, in accordance with the terms of the Notes Documents, in respect of the Collateral have been taken, made or obtained.

3.13 Accuracy of Information. All information supplied by any Grantor with respect to any of the Collateral (in each case taken as a whole with respect to any particular Collateral) is accurate and complete in all material respects.

ARTICLE IV

COVENANTS AND AGREEMENTS

Each Grantor will at all times comply with the covenants and agreements contained in this Article IV, from the date hereof and for so long as any part of the Secured Obligations are outstanding:

4.01 Change in Location of Grantor. Such Grantor will not change the location of such Grantor’s chief executive office or principal place of business unless such Grantor gives the Collateral Agent prompt written notice thereof and shall have delivered to the Collateral Agent such new recorded financing statements or other documentation as may be reasonably necessary (or as may be requested by the Collateral Agent) to ensure the continued perfection and priority of its security interest in the Collateral.

4.02 Change in Grantor’s Name or Corporate Structure. Without limiting any prohibition or restrictions set forth in the Indenture or other Notes Documents, such Grantor will not change its name, identity, state of organization, organizational identification number, tax identification number or corporate structure (including, without limitation, any merger, consolidation or sale of substantially all of its assets) unless such Grantor shall have given the Collateral Agent at least ten (10) days prior written notice thereof and shall have delivered to the Collateral Agent such new recorded financing statements or other documentation as may be reasonably necessary (or as may be requested by the Collateral Agent) to ensure the continued perfection and priority of its security interest in the Collateral.

4.03 Collateral in Possession of Third Parties. If any Collateral with an aggregate fair market value in excess of $1,000,000 is at any time in the possession or control of any warehouseman, bailee, agent or independent contractor, such Grantor shall notify such Person of the Collateral Agent’s security interest in such Collateral. Upon the Collateral Agent’s request, such Grantor shall instruct any such Person to hold all such Collateral for the Collateral Agent’s account subject to such Grantor’s instructions, or, if an Event of Default shall have occurred and be continuing, subject to the Collateral Agent’s instructions.

4.04 Delivery of Collateral. Such Grantor will deliver (a) each letter of credit having a face amount in excess of $25,000 individually, if any, included in the Collateral to the Collateral Agent, in each case forthwith upon receipt by or for the account of such Grantor and shall cause the issuer of such letter of credit to consent to the assignment of proceeds of such letter of credit to the Collateral Agent and (b) all certificates or Instruments representing or evidencing any Collateral (or, in respect of Promissory Notes and Chattel Paper, all Promissory Notes and Chattel Paper having a face amount in excess of $250,000 individually), whether now existing or hereafter acquired, in suitable form for transfer by delivery or, as applicable, accompanied by such Grantor’s endorsement, where necessary, or duly executed instruments of transfer or assignment in blank, all in form and substance reasonably satisfactory to the Required Noteholders and in form acceptable to the Collateral Agent and subject to Gaming Laws. After the occurrence and during the continuance of an Event of Default and upon the request of the Collateral Agent, if any Collateral becomes evidenced by a promissory note, trade acceptance, tangible Chattel Paper or any other instrument for the payment of money (other than checks or drafts in payment of Collateral collected by such Grantor in the ordinary course of business prior to notification by the Collateral Agent under Section 6.02(g)), such Grantor will immediately deliver such instrument or Chattel Paper to the Collateral Agent appropriately endorsed without reservation and, regardless of the form of presentment, demand, notice of dishonor, protest and notice of protest with respect thereto, such Grantor will remain liable thereon as an endorser until such instrument is paid in full. In addition, such Grantor shall contemporaneously herewith (or, with respect to after acquired property, promptly after acquisition thereof) deliver to the Collateral Agent all instruments (or, in respect of Promissory Notes and Chattel Paper, all Promissory Notes and Chattel Paper having a face amount in excess of $250,000 individually) and all certificated securities in each case duly endorsed in blank or accompanied by transfer powers duly endorsed in blank.

4.05 Maintenance of Security Interest. Each Grantor shall maintain the security interest of the Collateral Agent hereunder in all of such Grantor’s Collateral as a valid, perfected, first priority Lien (subject in priority only to Permitted Liens), except, with respect to perfection only, (a) cash not constituting proceeds of Collateral, (b) Excluded Bank Accounts, and (c) letter of credit rights not constituting supporting obligations.

4.06 Records and Inspection Rights. Each Grantor shall keep accurate and complete records of the Collateral (including proceeds thereof). Each Grantor shall mark its books and records pertaining to the Collateral to evidence this Agreement and the security interests granted hereby. Subject to any applicable Gaming Laws restricting such actions, each Grantor shall permit the representatives and independent contractors of the Collateral Agent to visit and inspect any of its properties and the Collateral, to examine such records, and make copies thereof or abstracts therefrom, all at the expense of the Grantors and at such reasonable times during normal business hours and as often as may be reasonably desired, upon reasonable advance notice to the Grantors; provided that, so long as no Event of Default exists, the Grantors shall only be required to pay for one such inspection per year; provided, however, that when an Event of Default exists the Collateral Agent (or any of its representatives or independent contractors) may do any of the foregoing at the expense of the Company at any time during normal business hours upon reasonable advance notice to the Company.

4.07 Reimbursement of Expenses. Each Grantor hereby assumes all liability for the Collateral, the security interests created hereunder and any use, possession, maintenance, management, enforcement or collection of any or all of the Collateral. Each Grantor agrees to indemnify and hold the Collateral Agent, Trustee and each other Secured Party harmless from and against and covenants to defend the Collateral Agent, Trustee and each other Secured Party against any and all losses, damages, claims, costs, penalties, liabilities and reasonable expenses, including, without limitation, court costs and reasonable attorneys’ fees, incurred because of, incident to, or with respect to the Collateral (including, without limitation, any use, possession, maintenance or management thereof, or any injuries to or deaths of Persons or damage to property, except to the extent caused by the gross negligence or willful misconduct of the Collateral Agent and including those incurred with respect to enforcement of its right to indemnity hereunder). All amounts for which any Grantor is liable pursuant to this Section 4.07 shall be due and payable by such Grantor to the applicable Secured Party not later than ten (10) business days after such amounts have been invoiced to the Grantor. If such Grantor fails to make such payment as required by this Section 4.07 (or if demand is not made due to an injunction or stay arising from bankruptcy or other proceedings) and the applicable Secured Party pays such amount, the same shall be due and payable by such Grantor to applicable Secured Party, plus interest thereon from the date of applicable Secured Party’s demand (or from the date of applicable Secured Party’s payment if demand is not made due to such proceedings) at a rate equal to 2.00% per annum in excess of the then applicable interest rate on the Notes.

4.08 Further Assurances. Each Grantor shall, (a) correct any material defect or error that may be discovered in any Collateral Document or in the execution, acknowledgment, filing or recordation thereof, and (b) do, execute, acknowledge, deliver, record, re-record, file, re-file, register and re-register any and all such further acts, deeds, financing statements, continuation statements, certificates, assurances and other instruments, as necessary (or as the Collateral Agent may reasonably request) from time to time in order to (i) carry out more effectively the purposes of the Collateral Documents, (ii) to the fullest extent permitted by Gaming Laws and other applicable Law, subject any Grantor’s or any of its Subsidiaries’ properties, assets, rights or interests to the Liens now or hereafter intended to be covered by any of the Collateral Documents, (iii) perfect and maintain the validity, effectiveness and priority of any of the Collateral Documents and any of the Liens intended to be created thereunder and (iv) assure, convey, grant, assign, transfer, preserve, protect and confirm more effectively unto the Secured Parties the rights granted or now or hereafter intended to be granted to the Secured Parties under any Collateral Document or under any other instrument executed in connection with any Collateral Document to which any Grantor or any of its Subsidiaries is or is to be a party, and cause each of its Subsidiaries to do so, in each case except with respect to Excluded Collateral, Immaterial Real Property, and Vessels in existence on the date hereof. Each Grantor hereby authorizes the Collateral Agent to file a Record or Records, including, without limitation, financing or continuation statements, Intellectual Property Security Agreements and amendments and supplements to any of the foregoing, in any jurisdictions and with any filing offices as the Collateral Agent may determine, in its sole discretion, are necessary or advisable to perfect or otherwise protect the security interest granted to the Collateral Agent herein, regardless of whether any particular asset described in such financing statement falls within the scope of the UCC or the granting clause of this Agreement. Such financing statements may describe the Collateral in the same manner as described herein or may contain an indication or description of collateral that describes such property in any other manner that is necessary, advisable or prudent

to ensure the perfection of the security interest in the Collateral granted to the Collateral Agent herein, including, without limitation, describing such property as "all assets, whether now owned or hereafter acquired, developed or created" or words of similar effect. A photocopy or other reproduction of this Agreement shall be sufficient as a financing statement where permitted by law. Each Grantor shall furnish to the Collateral Agent from time to time statements, exhibits and schedules further identifying and describing the Collateral and such other reports in connection with the Collateral as necessary (or as the Collateral Agent may reasonably request), all in reasonable detail. Each Grantor ratifies any such financing statement, continuation statements or amendments filed prior to the date hereof. The Collateral Agent shall have no obligation to file, record any financing statements or any other Collateral Documents.

4.09 Maintenance of Collateral. Each Grantor shall in all material respects maintain, preserve and protect all of the Collateral reasonably necessary in the operation of its business in good working order and condition, ordinary wear and tear excepted, and make all reasonably necessary repairs thereto and renewals and replacements thereof that are necessary or desirable to such maintenance, preservation and protection; provided that each Grantor shall, at minimum, use the standard of care typical in the industry in the operation and maintenance of the Collateral.

4.10 Use, Possession and Control of Collateral. Such Grantor will not use any Collateral in violation in any material respect of any Law, or suffer it to be so used, except in such instances in which (a) such requirement of Law or order, writ, injunction or decree is being contested in good faith by appropriate proceedings diligently conducted or (b) the failure to comply therewith, either individually or in the aggregate, could not reasonably be expected to have a Material Adverse Effect. Such Grantor shall procure and maintain in effect all material Permits, licenses and franchises reasonably necessary to the ownership, use or possession of the Collateral, except to the extent that failure to do so would not reasonably be expected to have a Material Adverse Effect. The Grantor’s Collateral will at all times be and remain in the possession and control of the Grantor or the Collateral Agent, as applicable, other than as permitted under this Agreement.

4.11 Collateral Attached to Other Property. In the event that the Collateral may be considered attached or affixed to any immovable (real) property or may be considered an appurtenance of any Vessel, such Grantor hereby agrees that this Agreement may be filed for record in any appropriate records as a financing statement which is a fixture filing, and, to the extent any Vessel acquired after the date of this Agreement has an aggregate fair market value in excess of $750,000, the interests granted herein may be further perfected by the filing of a mortgage and a ship mortgage (as contemplated by the Notes Documents). In connection therewith, such Grantor will take whatever action is required by Section 4.08. If such Grantor is not the record owner of such immovable (real) property, such Grantor will provide the Collateral Agent with any additional security agreements or financing statements necessary (or as reasonably requested by the Collateral Agent) or required by Gaming Laws or other applicable Law for the perfection of the Collateral Agent’s security interest in the Collateral. If the Collateral is wholly or partly affixed to the immovable (real) property or installed in or affixed to other goods, such Grantor will use its commercially reasonable efforts to furnish the Collateral Agent with landlord’s waivers, signed by all Persons having an interest in the immovable (real) property or other goods to which the Collateral may have become affixed, permitting the Collateral Agent to have access to the Collateral at all reasonable times and granting the

Collateral Agent a reasonable period of time in which to remove the Collateral after the occurrence and during the continuance of an Event of Default. For the avoidance of doubt, the provisions of this Section 4.11 shall be subject to Section 4.18 of the Indenture with respect to any Collateral acquired by the Grantors after the date hereof.

4.12 Intellectual Property. Such Grantor shall exercise promptly and diligently each and every right which it may have under each License (other than any right of termination or transfer) and shall duly perform and observe in all respects all of its obligations under each License and shall take all action necessary to maintain the Licenses in full force and effect, in each case, except where the failure to do so would not reasonably be expected to have a Material Adverse Effect, provided that nothing set forth herein shall be construed to permit a change of business practice or trade dress that otherwise requires consent hereunder or under the Bond Documents. Such Grantor shall not cancel, terminate, amend or otherwise modify in any respect, or waive any provision of, any License, except as would not reasonably be expected to cause a Material Adverse Effect. Such Grantor has duly executed and delivered one or more Intellectual Property Security Agreements covering (i) all Intellectual Property owned by such Grantor and applied for, registered or issued in the United States and (ii) all Licenses to which such Grantor is a party as of the date hereof. Such Grantor (either itself or through licensees) shall, and shall cause each licensee thereof to, take all action necessary to maintain all of the Intellectual Property in full force and effect, including, without limitation, using the proper statutory notices and markings and using the Trademarks on each applicable trademark class of goods in order to so maintain such Trademarks in full force, free from any claim of abandonment for non-use, and such Grantor shall not (nor permit any licensee thereof to) do any act or knowingly omit to do any act whereby any such Intellectual Property may become invalidated in each case, except as would not reasonably be expected to have a Material Adverse Effect, dedicated to the public, canceled, forfeited or otherwise impaired. Such Grantor shall cause to be taken all necessary or advisable steps in any proceeding before the United States Patent and Trademark Office and the United States Copyright Office or any similar office or agency in any other country or political subdivision thereof to maintain each registration of the Intellectual Property, including, without limitation, filing of renewals, affidavits of use, affidavits of incontestability and opposition, interference and cancellation proceedings and payment of maintenance fees, filing fees, taxes or other governmental fees, except where the failure to do so would not reasonably be expected to have a Material Adverse Effect. If any of such Grantor’s Intellectual Property is infringed, misappropriated, diluted or otherwise violated by a third party, such Grantor shall (x) upon obtaining knowledge of such infringement, misappropriation, dilution or other violation, promptly notify the Collateral Agent and (y) to the extent such Grantor shall deem appropriate under the circumstances, promptly sue for infringement, misappropriation, dilution or other violation, seek injunctive relief where appropriate and recover any and all damages for such infringement, misappropriation, dilution or other violation, or take such other actions as such Grantor shall deem appropriate under the circumstances to protect such Intellectual Property, in each case, except as the failure to do so would not reasonably be expected to have a Material Adverse Effect. Such Grantor shall within 30 days after creation or consummation thereof (and in any event promptly after the filing of an application for the registration of any Trademark or Copyright or the issuance of any Patent with the United States Patent and Trademark Office or the United States Copyright Office, as applicable, or in any similar office or agency of the United States or any country or any political subdivision thereof) furnish to the Collateral Agent statements, exhibits, schedules and reports (which shall constitute supplements to the exhibits to

this Agreement) identifying and describing Intellectual Property which has been registered, issued or for which applications for registration are pending and Licenses that are created or entered into after the date of this Agreement that are reasonably necessary for the operation of such Grantor’s business. Following receipt by the Collateral Agent of any such statements, exhibits, schedules or reports, or at any other time upon request of the Collateral Agent, the applicable Grantor shall execute, authenticate and deliver any and all assignments, agreements (including applicable Intellectual Property Security Agreements), instruments, documents and papers as necessary (or the Collateral Agent may reasonably request) to evidence the Collateral Agent’s security interest hereunder in such Intellectual Property and the General Intangibles of such Grantor relating thereto or represented thereby, and such Grantor hereby appoints the Collateral Agent its attorney-in-fact to execute and/or authenticate and file all such writings for the foregoing purposes, all acts of such attorney being hereby ratified and confirmed, and such power (being coupled with an interest) shall be irrevocable until the repayment of all of the Secured Obligations in full in cash.

4.13 Deposit Accounts, Securities Accounts and Commodity Accounts.

(a) On or prior to the date that is 30 days after the date hereof (with such reasonable extension as may be consented to by the Required Noteholders, provided that an extension up to 15 days shall be permitted if such extension is as a result of the application of Section 13.05 of the Indenture), such Grantor shall cause each bank and other financial institution at which such Grantor has a Deposit Account or a Securities Account hereto to execute and deliver to the Collateral Agent a control agreement in form and substance satisfactory to the Required Noteholders and in form satisfactory to the Collateral Agent, duly executed by such Grantor and such bank or financial institution, or enter into other arrangements in form and substance satisfactory to the Required Noteholders and in form satisfactory to the Collateral Agent, pursuant to which such institution shall irrevocably agree, inter alia, that it will comply at any time with the instructions and entitlement orders originated by the Collateral Agent to such bank or financial institution directing the disposition of cash, Securities, Investment Property and other items from time to time credited to such account, without further consent of such Grantor, which instructions the Collateral Agent will not give to such bank or other financial institution in the absence of a continuing Event of Default. Without the prior written consent of the Collateral Agent, such Grantor will not make or maintain any Deposit Account, Commodity Account or Security Account except for the accounts identified to the Collateral Agent in writing. Such Grantor shall maintain any Commodity Account subject to the Collateral Agent’s control within the meaning of 9-106 of the Uniform Commercial Code. The provisions of this paragraph shall not apply to the Excluded Bank Accounts.

(b) On or prior to the date that is 30 days after the date hereof (with such reasonable extension as may be consented to by the Required Noteholders, provided that an extension up to 15 days shall be permitted if such extension is as a result of the application of Section 13.05 of the Indenture), such Grantor shall deposit in an account subject to a control agreement in favor of the Collateral Agent as required by Section 4.13(a) above and, until utilized, maintain on deposit in such an account, all cash and Cash Equivalents in accordance with Section 4.37 of the Indenture.

4.14 Pledged Equity Interests, Investment Related Property.

(a) Except as provided in the next sentence, in the event such Grantor receives any dividends, interest or distributions on any Pledged Equity Interest or other Investment Related Property, including, without limitation, upon the merger, consolidation, liquidation or dissolution of any issuer of any Pledged Equity Interest or Investment Related Property or otherwise, then (a) such dividends, interest or distributions and securities or other property shall be included in the definition of the Collateral without further action and (b) except as expressly provided otherwise in this Agreement, such Grantor shall immediately take all steps, if any, necessary or advisable to ensure the validity, perfection, priority and, if applicable, control of the Collateral Agent over such Investment Related Property (including, without limitation, delivery thereof to the Collateral Agent together with any necessary endorsements) and pending any such action such Grantor shall be deemed to hold such dividends, interest, distributions, securities or other property in trust for the benefit of the Collateral Agent and shall segregate such dividends, distributions, Securities or other property from all other property of such Grantor. Notwithstanding the foregoing, so long as no Event of Default shall have occurred and be continuing, each Grantor shall be entitled to receive and retain any and all dividends, interest and other distributions paid on, or distributed in respect of, the Pledged Equity Interests and other Investment Related Property to the extent such dividends, interest and other distributions are permitted under the Indenture.

(b) Voting.

(i)So long as no Event of Default shall have occurred and be continuing, except as otherwise provided under the covenants and agreements relating to Investment Related Property in this Agreement or elsewhere herein or in the Bond Documents, each Grantor shall be entitled to exercise or refrain from exercising any and all voting and other consensual rights pertaining to the Investment Related Property or any part thereof for any purpose not inconsistent with the terms of this Agreement or the Bond Documents; it being understood that neither the voting by such Grantor of any Pledged Stock for, or such Grantor’s consent to, the election of directors (or similar governing body) at a regularly scheduled annual or other meeting of stockholders or with respect to incidental matters at any such meeting, nor such Grantor’s consent to or approval of any action otherwise permitted under this Agreement and the Bond Documents, shall be deemed inconsistent with the terms of this Agreement or the Bond Documents within the meaning of this Section 4.14(b)(i) and no notice of any such voting or consent need be given to the Collateral Agent; and

(ii)Upon the occurrence and during the continuation of an Event of Default and subject to compliance with all applicable Gaming Laws:

| |

(A) | all rights of each Grantor to exercise or refrain from exercising the voting and other consensual rights which it would otherwise be entitled to exercise pursuant hereto shall cease and all such rights shall thereupon become vested in the Collateral Agent who shall thereupon have the sole right to exercise such voting and other consensual rights; and |

| |

(B) | in order to permit the Collateral Agent to exercise the voting and other consensual rights which it may be entitled to exercise pursuant hereto and to receive all dividends and other distributions which it may be entitled to receive hereunder: (1) each Grantor shall promptly execute and deliver (or cause to be executed and delivered) to the Collateral Agent all necessary (or reasonably requested by the Collateral Agent) proxies, dividend payment orders and other instruments and (2) each Grantor acknowledges that the Collateral Agent may utilize the power of attorney set forth in Section 6.03. |

(c) except as expressly permitted by the Bond Documents, such Grantor shall not vote to enable or take any other action to: (i) amend any partnership agreement, limited liability company agreement, certificate of incorporation, by-laws or other organizational documents in any way that could reasonably be expected to be material and adverse to the Secured Parties, (ii) permit any issuer of any Pledged Equity Interest to issue any additional stock, partnership interests, limited liability company interests or other Equity Interests of such issuer unless such Grantor or such issuer, as applicable, has first taken all reasonable actions to grant and perfect the Collateral Agent’s security interest in such Equity Interests, or (iii) cause any issuer of any Pledged Partnership Interests or Pledged LLC Interests which are not securities (for purposes of the Uniform Commercial Code) on the date hereof to elect or otherwise take any action to cause such Pledged Partnership Interests or Pledged LLC Interests to be treated as securities for purposes of the Uniform Commercial Code unless such Grantor or such issuer, as applicable, has first taken all steps necessary or advisable to establish the Collateral Agent’s "control" thereof.

4.15 Accounts Receivable.

(a) Each Grantor shall keep and maintain at its own cost and expense complete records of each Account Receivable, including records of all payments received, all credits granted thereon, all merchandise returned and all other documentation relating thereto. Each Grantor shall, at such Grantor’s sole cost and expense, upon the Collateral Agent's demand made at any time after the occurrence and during the continuance of any Event of Default, deliver copies of all tangible evidence of Accounts Receivable, including copies of all documents evidencing Accounts Receivable and any books and records relating thereto to the Collateral Agent or to its representatives.

(b) Other than in the ordinary course of business consistent with its past practice, such Grantor will not (i) grant any extension of the time of payment of any Account Receivable having a full amount in excess of $250,000, (ii) compromise or settle any such Account Receivable for less than the full amount thereof, (iii) release, wholly or partially, any Person liable for the payment of any such Account Receivable, (iv) allow any credit or discount whatsoever on any such Account Receivable or (v) amend, supplement or modify any such Account Receivable in any manner that could materially adversely affect the value thereof.

4.16 Limitations on Disposition.

Each Grantor shall keep the Collateral separate and identifiable from other property located on the same premises as the Collateral and no Grantor shall sell, lease, license outside the

ordinary course of its business, transfer or otherwise dispose of any of the Collateral, or attempt or contract to do so, except as permitted by Section 4.12 of the Indenture.

4.17 Notices.

Each Grantor shall advise the Collateral Agent promptly, in reasonable detail, of (a) any material Lien, other than Permitted Liens, attaching to or asserted against any of the Collateral, (b) any material change in the composition of the Collateral and (c) the occurrence of any other event which could reasonably be expected to result in a Material Adverse Effect with respect to the Collateral or on the security interest created hereunder.

4.18 Further Covenants.

Each provision contained in Article 4 of the Indenture that relates to the Collateral granted under this Agreement is incorporated herein by reference, mutatis mutandis.

ARTICLE V

RIGHTS, DUTIES AND POWERS OF COLLATERAL AGENT

In addition to the rights, duties and powers set forth in Section 7.15, the Collateral Agent shall have the following rights, duties and powers: