SCHEDULE 14A

Consent Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant [ ]

Filed by a Party other than the Registrant [x]

Check the appropriate box:

[ ] Preliminary Consent Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Consent Statement

[X] Definitive Additional Materials

[ ] Soliciting Material Under Rule 14a-12

Full House Resorts, Inc.

(Name of Registrant as Specified In Its Charter)

Daniel R. Lee

Ellis Landau

Ray Hemmig

W.H. Baird Garrett

Bradley M. Tirpak

Craig W. Thomas

(Name of Person(s) Filing Consent Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act | |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

| 2 |

Concerned Stockholders Respond to Statements made by Full House Resorts, Inc.

Three Concerned Stockholders of Full House Resorts Inc. (NASDAQ: FLL) ("Full House" or the "Company") who own 1,161,482 shares of the Company's common stock (the "Common Stock"), representing approximately 6.2% of the shares outstanding, have sent a Solicitation Statement and WHITE Request Card to stockholders of the Company for the purpose of calling a Special Meeting.

On October 13, 2014, the Company’s management filed a Current Report on Form 8-K with the Securities and Exchange Commission (“SEC”) which contained statements that the Concerned Stockholders believe are false and misleading. We wish to respond to these statements and we have laid out in detail below each of the Company’s claims and countered them with the actual facts.

We believe filing misleading statements at the SEC illustrates the need for improved corporate governance at Full House. The issuance of misleading information not only destroys the credibility of the Company and its management, but it has real financial risk to the Company if investors rely on such information. It is the responsibility of the Board of Directors of the Company (the "Board") to oversee management, but in Full House’s case, management constitutes 40% of the Board and has longstanding professional relationships with the other three so called “independent” members of the Board. Effectively, in our view the Board is not properly positioned to supervise the Company’s management.

The Concerned Stockholders are seeking stockholder support to call a Special Meeting, the purpose of which will be to vote on the composition of the Board. According to the respected search firm of Spencer Stuart, which recruits qualified members for the boards of many companies, the average company in the S&P 500 as of 2013 had 10.7 members, 85% of which are independent. If we succeed in calling that Special Meeting, then we plan to propose an expansion of the Full House Board from its current five seats to a total of ten seats and to nominate five experienced and independent individuals to fill the newly-created seats. Combined with the existing five directors, the election of the five independent individuals would create what we view as an enhanced board, with greater experience, greater share ownership, and substantially greater independence.

A complete discussion of the need for the Special Meeting is included in the proxy materials that were filed with the SEC on October 28, 2014. Such materials are available at www.SEC.gov or from Morrow & Co., LLC at 800-662-5200 or by e-mail at savefullhouse@morrowco.com. The definitive Solicitation Statement and WHITE Request Card are being distributed to stockholders to call the Special Meeting.

PLEASE RETURN THE WHITE REQUEST CARD TODAY

In light of the Company’s recent filing, the Concerned Stockholders have also served demands on the Company and each of its Directors, pursuant to Section 220 of the Delaware General Corporation Law (the “DGCL”), to inspect certain books, records and documents of the Company including, among others, the Company’s calculation of the investment returns claimed by the Company.

| 3 |

Misleading Claim 1

The Company claims it “has created value and significant return on its investments at its properties.”

Reality:

Between September 30, 2013 and September 30, 2014, stockholders have lost 58% of their investment.

Furthermore, over virtually any time frame, the share price of Full House has greatly underperformed the market, which presumably would not have happened if the Company had “created value and significant return on its investments.” For example, the Company’s share price has declined by 62% since December 2006, when the Company last completed an equity offering at $3.25 per share. Over that same period, the Russell 2000 index has risen approximately 42% and the Dow Jones Gambling Index has risen approximately 21%. Today, the Company’s enterprise value is significantly less than the sum it paid for its owned properties.

Misleading Claim 2

The Company claims that since 2010, the salaries paid to the Company’s executives have been at the low-end of executive compensation for equivalent positions for companies of similar size and status.

Reality

As far as we are aware, according to its public disclosure, the Company’s compensation committee has not performed a compensation study for nearly five years and relies on a bonus plan created in 2006, or eight years ago, to award annual bonuses.

According to the annual proxy statements filed by the Company with the SEC, the total annual compensation of the CEO has risen from $573,668 in 2010 to $933,459 in 2013, an increase of 62.7%. The total annual compensation of the COO has risen from $586,351 in 2010 to $958,880 in 2013, an increase of 63.5%.

Furthermore, the Company does not list peers in its proxy statements and the Concerned Stockholders have been unable to find any comparable casino companies where 100% of its properties are showing revenue declines and/or the stock has declined approximately 60% in a year. We have also been unable to find any comparable casino companies where the compensation of the top two individuals comprises a similarly high proportion of the company’s income.

Misleading Claim 3

The Company claims its “historical investments have generated attractive returns on investment.”

Reality

The Concerned Stockholders believe the Company uses inappropriate, often inaccurate and misleading math in making such a statement.

| 4 |

The Company offers several examples, including:

“Rising Star and Grand Lodge. The Company made an investment in Rising Star of $42.4 million in April 2011. Our performance at Rising Star enhanced our opportunity to lease the Grand Lodge in September 2011 at a price of $0.6 million. The properties collectively generated total EBITDA of $31.1 million from their respective acquisition dates through June 30, 2014, representing an average annualized return on investment of 23.7%.”

The Concerned Stockholders believe this statement is misleading because i) the Company significantly understates the true purchase price of Rising Star and the capital expenses at the Grand Lodge, ii) the Company groups the income of two completely separate properties --a wholly-owned casino and, 2,000 miles away, a leased casino, iii) the remaining term of such lease is three years and it can be cancelled today at any time by the landlord with the payment of a relatively minor sum, iv) revenues and profitability at the Rising Star have fallen significantly, v) the Company provides no separate disclosure of results at the Grand Lodge and, vi) the Company does not include maintenance capital expenditures in its calculations.

Understated Purchase Price of Rising Star

The Company states the investment in the Rising Star was $42.4 million. On page 15 of the Quarterly Report on Form 10-Q filed at the time of the transaction, the Company stated, “The purchase price is $43.0 million, exclusive of estimated cash and net working capital balances of $8.0 million and fees and expenses as of the closing date.” Consistent with this, the Annual Report on Form 10-K filed for the year in which the transaction closed indicated that “On April 1, 2011, we purchased the Grand Victoria Casino and Resort (since renamed Rising Star) located in Rising Sun, Indiana on the Ohio River for approximately $19.0 million in cash and $33.0 million drawn from the Company’s Credit Agreement”. The Quarterly Report on Form 10-Q filed on May 6, 2011 further disclosed that the Company had expensed through March 31, 2011 approximately $700,000 of deal fees and expenses related to the acquisition. Finally, the press release issued by the Company in the third quarter of 2011 disclosed that the Company had expensed $211,849 of “rebranding costs.” Pursuant to the purchase agreement, the Company was required to rebrand the property within 180 days following its acquisition and the cost of such rebranding was clearly part of the cost of the acquisition.

The Concerned Stockholders believe the actual investment to acquire Rising Star, calculated from the Company’s own previous filings, was approximately $52.9 million, not $42.4 million. This fully loaded purchase price also excludes the very high up-front fees of $2.6 million paid to arrange a $38 million credit facility used for the acquisition, which resulted in a higher effective cost of the Company’s debt.

| 5 |

Understated Acquisition Cost of Grand Lodge Lease

The Company states that the “price” of the Grand Lodge lease was only $0.6 million. The original lease was a five-year lease commencing September 1, 2011. The Current Report on Form 8-K filed by the Company at the time of entering into the lease states the Company was "to acquire the operating assets and certain liabilities related to the Casino for approximately $600,000, exclusive of operating cash and working capital.” In other words, the Company also reimbursed the landlord for the operating cash and working capital that existed in the entity at that date. The cost of such reimbursement has not been disclosed, but judging by the numbers disclosed in the Rising Star transaction, such amounts were likely to be material. On April 11, 2013, the parties amended the lease and the Company stated in a press release, “The extension will allow us to invest in a much-needed new casino management system for the Grand Lodge Casino.”

The Concerned Stockholders believe that the actual investment in the Grand Lodge was significantly higher than the $0.6 million stated by the Company. We believe the working capital, transaction fees, and further investments made in the casino management system need to be included in the “price” used in any return calculation.

Grouping Two Separate Properties

The Company compares the understated acquisition costs to the cumulative collectively-generated total EBITDA of two separate properties. Never before has the Company viewed this grouping as a valid business segment. Rising Star sits alone in the Company’s “Midwest” segment, while the Grand Lodge is grouped with the Stockman’s casino in Fallon, Nevada, as the “Nevada” segment.

The Concerned Stockholders believe it is absurd to calculate average long term returns by grouping a wholly owned property with a casino operating under a limited-term leasehold interest.

Short Term Lease

The Concerned Stockholders note that the term of the Grand Lodge lease could be quite short. The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013, indicates that with respect to this lease “The initial term of the lease expires on August 31, 2018.” The Company indicates that it has an option to extend such lease, but the Concerned Stockholders note that the landlord can deny such extension in its “sole discretion.” Furthermore, the landlord also has the right of early termination of the lease at any time beginning 30 months from the commencement date of September 1, 2011 for the payment of a fee equal to one year’s EBITDA plus the cash and working capital in the entity and the fair market value of the personal property owned by the Company and used in the entity. The fact

| 6 |

that the lease can now be cancelled at any time has not been clear in the Annual Reports on Form 10-K and other financial statements of the Company.

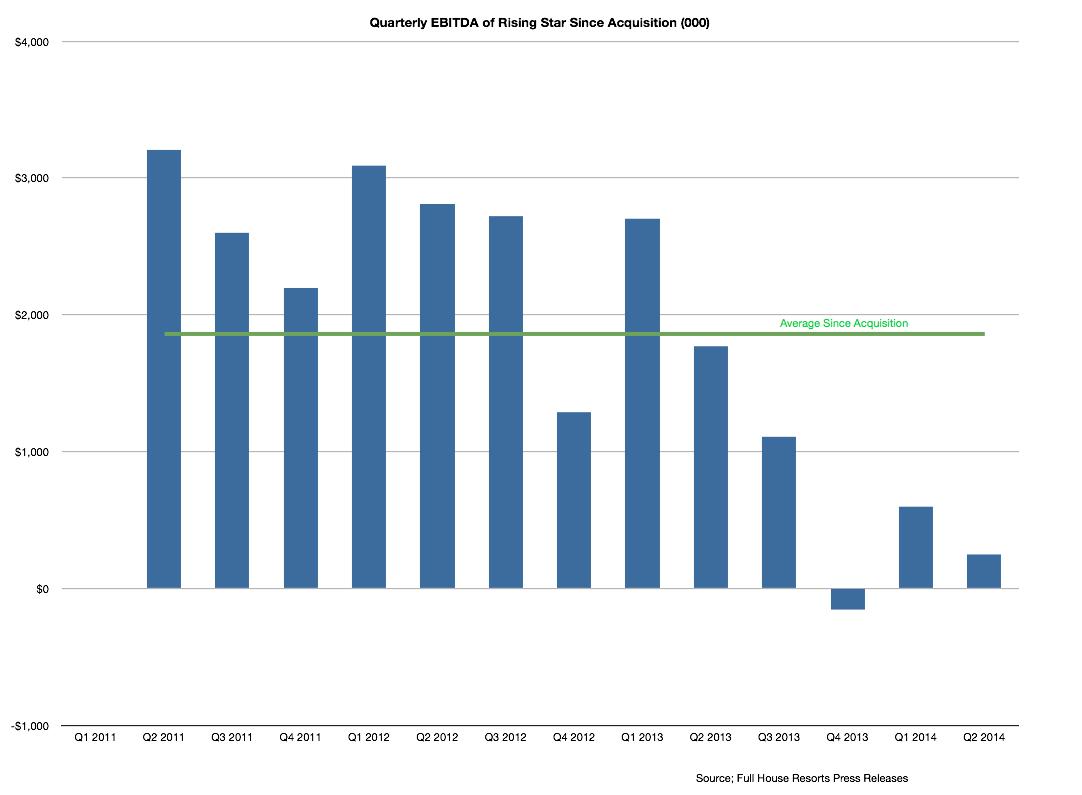

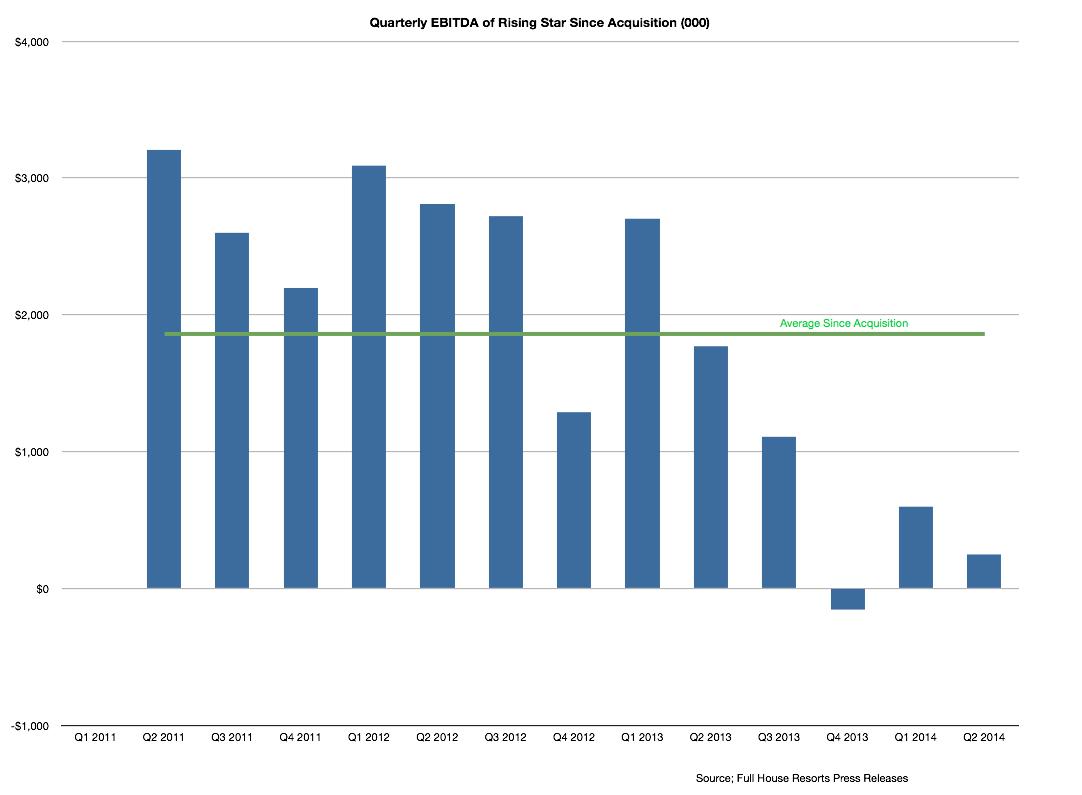

Deteriorating Operations at Rising Star

The Company uses the cumulative EBITDA of the properties in its return calculation. The Concerned Stockholders believe the returns should be calculated yearly. Furthermore, the operations at Rising Star have deteriorated sharply since the Company acquired the property, making it inappropriate to use the average return since its acquisition. The following chart illustrates the absurdity of using the average quarterly income of Rising Star when it has shown large, steady declines in income. Even when properly calculated, the implication of the Company’s statement is that the average returns of these two casinos since their purchase would continue into the future for an extended period. Clearly, this is unlikely to be the case. The larger property has a declining trend of income and the smaller property operates under a lease that will soon expire.

| 7 |

Unclear Disclosure of Grand Lodge Results

The Company has not provided the EBITDA of the Grand Lodge leasehold interest on a standalone basis. However, the cumulative EBITDA of Rising Star since its purchase has totaled $24.2 million. If we subtract this from the $31.1 million claimed in the recent Current Report on Form 8-K as the cumulative EBITDA from the two properties, we calculate the cumulative EBITDA of the Grand Lodge leasehold has been approximately $6.9 million over the 12 quarters since its acquisition.

Hence, the Grand Lodge, with its very short-term lease, accounted for 22% of the cumulative income that management used to calculate its return number. We believe it is misleading to portray this as being long-term, ongoing income in the calculation of investment returns.

Capital Expenditures

The Company does not disclose the capital expenditures required to maintain the Rising Star and the Grand Lodge. The Concerned Stockholders believe all capital expenditures should be included in any return calculation.

Misleading Claim 4

The Company has generated an average annualized return of 12.9% from its acquisition of the Silver Slipper.

Reality

Like in the Rising Star example above, The Concerned Stockholders believe that the Company i) understates the purchase price ii) fails to include the banking fees and cost of financing the acquisition iii) fails to disclose that the property’s income has been declining and iv) does not include maintenance capital expenditures in its return calculation.

Misleading Claim 5

The Company has cut costs. It claims it has reduced operating costs at Rising Star by 38%.

Reality

The Concerned Stockholders believe that costs cannot be viewed alone and note that while management may have decreased operating costs by 38%, casino revenues declined by 48% over the same time period. Furthermore, much of the decline in operating costs was a direct result of lower revenues, as expenses such as gaming taxes are directly tied to revenues.

| 8 |

Misleading Claim 6

The Company claims that it declined to pursue the Fitz Tunica opportunity “as a result of unexpected changes to the fundamental economics of the transaction.”

Reality

The Concerned Stockholders believe the Company could not find financing and lost over $2 million dollars on the failed transaction. It entered into a purchase agreement that required significant external financing and posted a large deposit, which was lost, we believe, when such financing proved to be unavailable. The Company was in imminent default of the covenants on its debt and in our view management should have realized that there was significant uncertainty whether financing could be arranged. Furthermore, in our view, the Company should have had the financing underwritten by an investment bank or otherwise arranged prior to putting a significant deposit at risk. If it was unable to do so, then it shouldn’t have entered into the purchase agreement.

Misleading Claim 7

The Company claims that the Concerned Stockholders’ nominees “are not qualified to deliver value to the Company’s shareholders.”

Reality

Management has announced a process to potentially sell the Company. However, it appears that no member of the existing Board has ever been involved in the sale of an entire casino company. Furthermore, we can find no examples of any of the “independent” members of the Board ever being involved the sale of any company. We have proposed new board members who have extensive experience in the purchase and sale of companies, including casinos and gaming companies.

All of our proposed nominees are independent and experienced. Two of our nominees have extensive experience in the casino industry and have previously been licensed in each of the jurisdictions in which the Company operates. We believe this expanded ten-member board would have greater experience, knowledge and independence than the incumbent five-member board.

The Concerned Stockholders comprise of one of the Company’s largest stockholders. We have purchased our 1,161,482 shares in the open market. The current “independent” board members own only 58,900 shares combined. Due to our significant ownership in the Company, we believe that our interests are closely aligned with the interests of all stockholders.

Misleading Claim 8

The Company claims the hotel at the Silver Slipper has “fully committed funding.”

| 9 |

Reality

The Company’s first quarter Quarterly Report on Form 10-Q says, “At March 31, 2014 we exceeded the allowable total leverage ratio and the first lien leverage ratios for both of our credit agreements. We received waivers for compliance with these ratios at March 31, 2014 from our Creditors. If we are not in compliance with our covenants at June 30, 2014, and we are not able to renegotiate the terms of our First Lien and Second Lien Credit Agreements, we may be prevented from drawing against the $10.0 million term loan. There can be no assurances that we will be in compliance with our covenants at June 30, 2014 or periods subsequent. The term loan is needed to complete construction of the $17.7 million six-story, 142-guest room Silver Slipper Casino Hotel being built between the south side of the casino and the waterfront, with rooms featuring views of the bay.”

The Company was again out of compliance as of June 30, 2014. It was subsequently again able to negotiate waivers to its credit agreements by paying fees and agreeing to higher interest rates.

As the Company had previously indicated in the first quarter Quarterly Report on Form 10-Q, given that the funding under the credit agreement requires that the Company operate within these ratios, the “fully-committed funding” may not actually be available if the Company continues to breach its credit agreements.

Conclusion

We believe the pattern of behavior evidenced by this litany of misleading statements is illustrative of why stockholders need a more independent and qualified Board. Among other obligations, we believe it is the responsibility of the Board to oversee management, to ensure the veracity of the Company’s statements and to prevent management from providing misleading and inaccurate information.

As noted, we are seeking to call a Special Meeting of stockholders to discuss and potentially improve the Company’s governance to protect stockholders’ investment and have filed a Solicitation Statement with the SEC for this purpose.

PLEASE RETURN THE WHITE REQUEST CARD TODAY

If, for some reason, you have not received such card, please contact

MORROW &

CO., LLC

470 West Avenue, Stamford, CT 06902

(203)-658-9400

or Call toll free at 1-(800)-662-5200

savefullhouse@morrowco.co

| 10 |