| 12 12 Strategy to Obtain Tribal Strategy to Obtain Tribal Management Contracts Management Contracts 1) Initial contacts with Tribes are

based on referrals from lenders, contractors, 1) Initial contacts with Tribes are

based on referrals from lenders, contractors, architects and others. architects and others. 2) A Letter of Intent is secured from the Tribe after making a presentation

on the 2) A Letter of Intent is secured from the Tribe after

making a presentation on the qualifications of Full

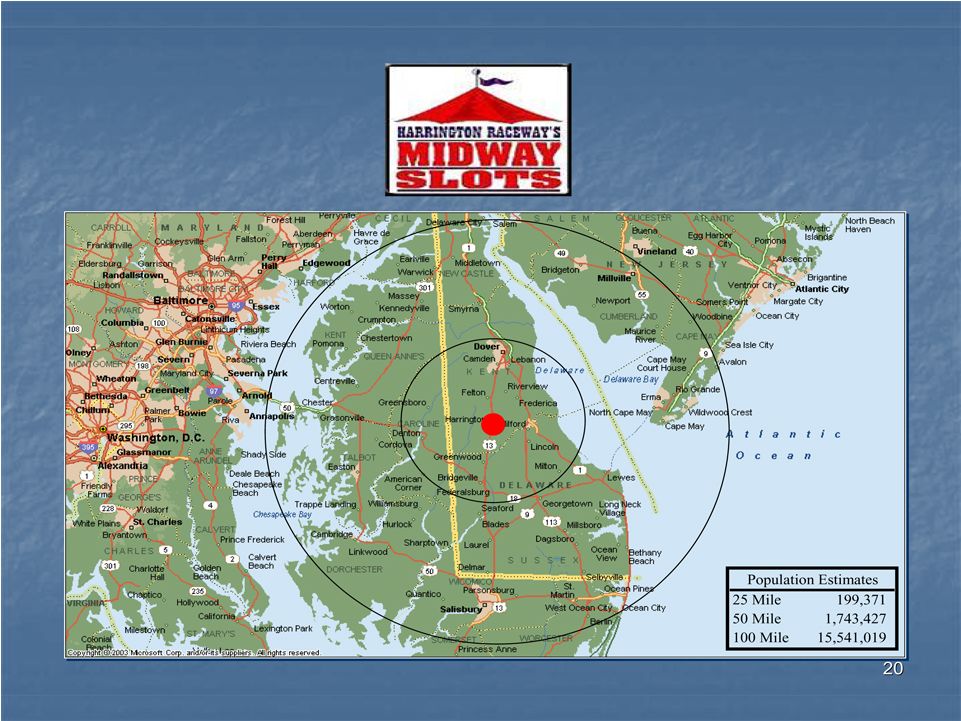

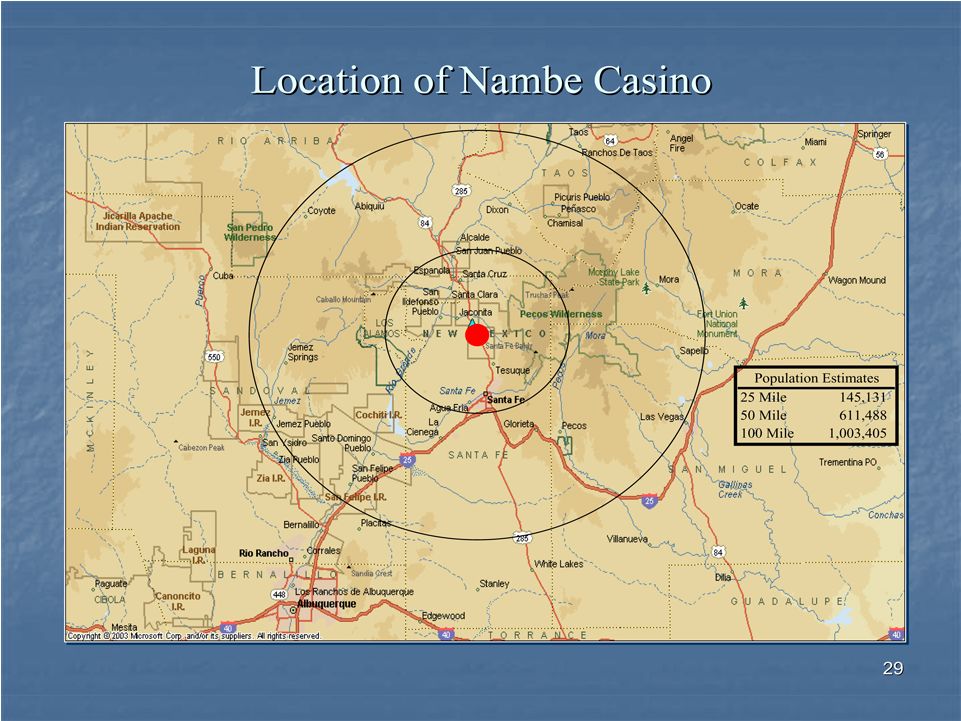

House. qualifications of Full House. 3) An independent market study is performed to determine the viability of

the project. 3) An independent market study is performed to

determine the viability of the project. 4) Budgets, based on the

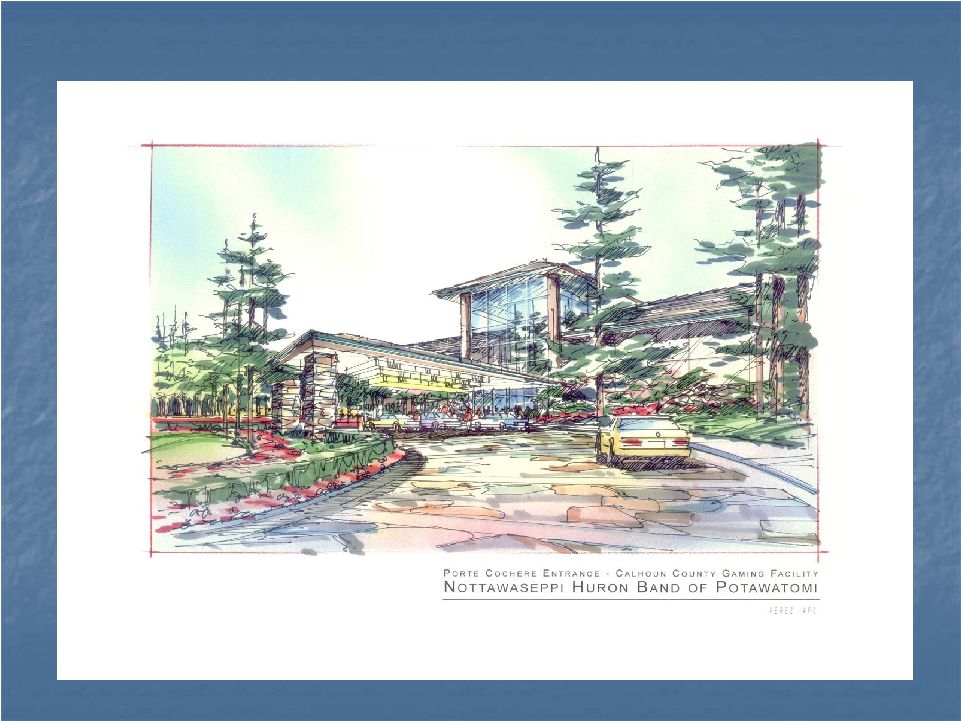

market study, 4) Budgets, based on the market study, and architectural renderings are presented to the and architectural renderings are presented to the Tribal authority in a formal presentation to secure approval of Full House

as the Tribal authority in a formal presentation to secure

approval of Full House as the developer and manager. developer and manager. 5) 5) Lee Iacocca's involvement in the process includes the following: Lee Iacocca's involvement in the process includes the following: a) He is featured in the marketing brochures and promotional materials that

are a) He is featured in the marketing brochures and

promotional materials that are given to the Tribe given to the Tribe during the first during the first introductions. introductions. b) Mr. Iacocca b) Mr. Iacocca gives the opening and closing remarks (on video) in our formal gives the opening and closing remarks (on video) in our formal power point presentations. power point presentations. c) He has entertained tribal leaders in his home. c) He has entertained tribal leaders in his home. d) Occasionally he d) Occasionally he writes letters, writes letters, sends autographed copies of his books, and sends autographed copies of his books, and personally meets with tribal officials. personally meets with tribal officials. |