1 1 Presentation Presentation 19 19 th Annual Roth Capital Partners Annual Roth Capital Partners Growth Stock Conference Growth Stock Conference Exhibit 99.2 |

1 1 Presentation Presentation 19 19 th Annual Roth Capital Partners Annual Roth Capital Partners Growth Stock Conference Growth Stock Conference Exhibit 99.2 |

2 2 This presentation is not an offering of securities nor a solicitation

for the sale or purchase of securities which can only be made by

formal prospectus. Full House Resorts, Inc. Full House Resorts, Inc. |

3 3 The following statements are made pursuant to the safe harbor for

forward-looking statements described in the Private

Securities Litigation Reform Act of 1995. In these

presentations, we may make certain statements that are forward-looking, such as statements regarding Full House’s future results and plans and anticipated trends

in the industries and economies in which Full House

operates. These forward-looking statements are the

Company’s current expectations and the Company will make no effort to update these expectations based on subsequent events or knowledge. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions,

including that our revenues may differ from that projected, that

governmental and court approvals may not be forthcoming or may be delayed: · Our growth strategies may not be realized; · Our development and potential acquisition of new facilities may not

occur; · Trends in the gaming industries may be negative; · We may not have access to capital, including the ability to finance future business requirements; · There may be adverse changes in federal, state and local laws and

regulations, including environmental and gaming license

legislation and regulations; and · Other risks detailed in our documents filed with the SEC. Should one or more of these risks or uncertainties materialize, or should

our underlying assumptions prove incorrect, actual results may

differ significantly from results expressed or implied in any forward- looking statements made by the Company in these communications Safe Harbor Statement Safe Harbor Statement |

4 4 Full House Resorts, Inc. is an established gaming company with a two-pronged business model: • FLL develops, manages and operates local casinos for American Indian Tribes and other independent gaming companies • FLL acquires, improves and operates independent local casinos Full House manages and owns independent casinos which target local customers living and working in healthy demographic areas across the United States |

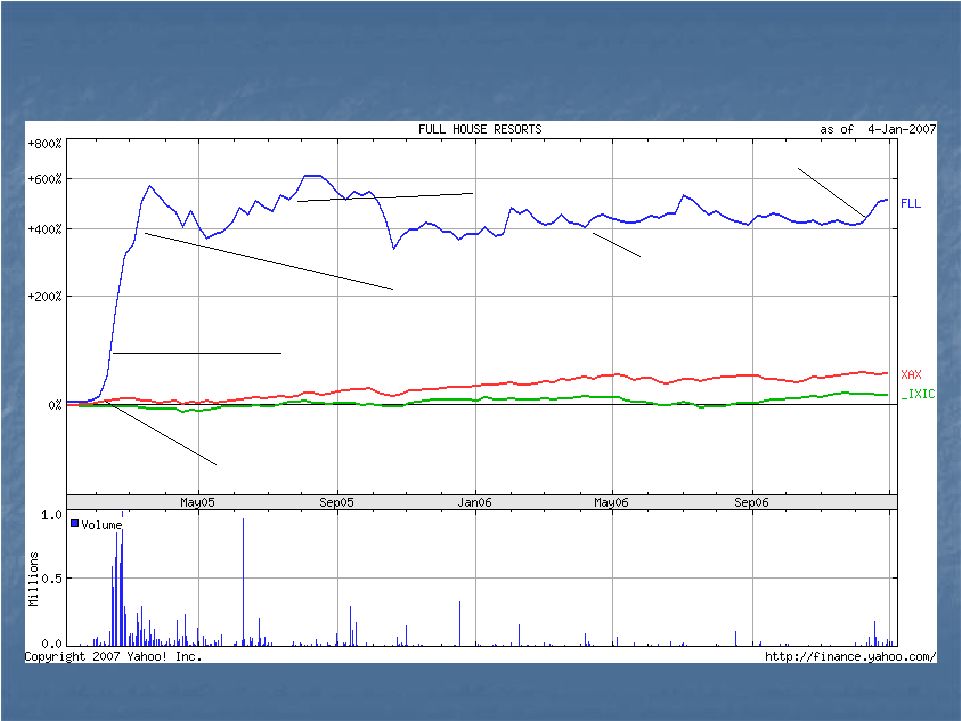

5 5 Historical Stock Appreciation Historical Stock Appreciation FLL = Blue AMEX = Red NASDAQ = Green Midway Expansion Nambe selects FLL as Manager Northern Cheyenne select FLL as Manager FLL begins trading on the AMEX Stockman’s Announcement Public Offering |

6 6 Management Vision Statement Management Vision Statement To provide: To provide: • • superior return to its investors superior return to its investors • • security to its employees security to its employees • • opportunity to its partners and vendors and opportunity to its partners and vendors and • • support to its host communities support to its host communities |

7 7 Strategy Strategy • • Provide superior development and Provide superior development and management services to well-placed and management services to well-placed and successful Native American gaming operations successful Native American gaming operations • • Acquire at reasonable multiples, and operate Acquire at reasonable multiples, and operate well-managed and successful local casinos well-managed and successful local casinos • • Look for greenfield opportunities in the local Look for greenfield opportunities in the local casino arena casino arena |

8 8 Business Model Business Model Two areas of development: Development and Management Services: Indian and Other Gaming • Opportunity: Revenue and Earnings Growth • Challenge: Development Projects have long lead time Acquisition and Operation: Local Casinos • Opportunity: Quickly accretive to earnings Operations benefit from our experience • Challenge: Competition for good properties The mix of limited term management contracts and direct ownership

spreads risk and allows continuing operations to fund

development. |

9 9 Board of Directors Board of Directors LEE A. IACOCCA -DIRECTOR since April, 1998. He founded EV Global Motors and is former CEO and Chairman of Chrysler Corporation. He is Chairman of the Iacocca Foundation

and Chairman of the Committee for Corporate Support of Joslin Diabetes Foundation. Mr. Iacocca is also Chairman Emeritus of the Statue of Liberty Foundation. J. MICHAEL PAULSON- CHAIRMAN has been involved in the real estate development and investment business since 1986, as the Founder, Owner and President of Nevastar Investments

Corp. and Construction Specialist of Nevada, Inc. Mr. Paulson

was a key principal of Gold River Resort and Casino, Inc. and Gold River Operating Corporation. KATHLEEN KATHLEEN M. M. CARACCIOLO, CARACCIOLO, DIRECTOR DIRECTOR - Chairperson of our Audit Committee, is a CPA who since July 2003 has been Vice President, Chief of Finance for Atlantic City Coin & Slot Service Co. Inc. She has served as VP of Finance for the Atlantic City Convention and Visitors Authority, and has held various finance positions with several Atlantic City Casinos, including Atlantic City Showboat, Inc. and Caesars Atlantic City, Inc. DR. CARL G. BRAUNLICH- DIRECTOR is an Associate Professor in the William F. Harrah College of Hotel Administration at UNLV. He has been on the faculties of the hotel management

programs at Cornell and Purdue Universities and held executive

positions or consulted for several casinos including Wynn Las Vegas, Harrah’s Entertainment, Inc., Showboat Hotel, etc. He was on the Board of Directors of the National Council on Problem Gambling. KEN KEN ADAMS, ADAMS, DIRECTOR DIRECTOR - Mr. Adams is a principal in the gaming consulting firm, Ken Adams Ltd., founded in 1990. He is also an editor of the Adams’ Report monthly newsletter, the Adams’ Daily Report and the Adams Review, each focusing on the gaming industry. He is a partner in Johnny Nolon’s Casino in Cripple Creek Colorado. He is also a Director of Vision Gaming & Technology, Inc., and the

Downtown Improvement Agency for Reno, Nevada. ANDRE ANDRE M. M. HILLIOU, HILLIOU, CEO CEO AND AND DIRECTOR. DIRECTOR. With over 25 years experience in the gaming industry, he was tapped to operate the Showboat Atlantic City, where he took the company from $30 million in net revenue to $130 million within two years. Andre was chosen as Showboat's senior manager for its Sydney Harbour Casino project. He has served as President and CEO of other gaming companies.

|

10 10 Strategy to Obtain Tribal Strategy to Obtain Tribal Management Contracts Management Contracts 1) Initial contacts with Tribes are

based on referrals from lenders, contractors, 1) Initial contacts with Tribes are

based on referrals from lenders, contractors, architects and others. architects and others. 2) A Letter of Intent is secured from the Tribe after making a presentation

on the 2) A Letter of Intent is secured from the Tribe after

making a presentation on the qualifications of Full

House. qualifications of Full House. 3) An independent market study is performed to determine the viability of

the project. 3) An independent market study is performed to

determine the viability of the project. 4) Budgets, based on the

market study, 4) Budgets, based on the market study, and architectural renderings are presented to the and architectural renderings are presented to the Tribal authority in a formal presentation to secure approval of Full House

as the Tribal authority in a formal presentation to secure

approval of Full House as the developer and manager. developer and manager. 5) 5) Lee Iacocca's involvement in the process includes the following: Lee Iacocca's involvement in the process includes the following: a) He is featured in the marketing brochures and promotional materials that

are a) He is featured in the marketing brochures and

promotional materials that are given to the Tribe given to the Tribe during the first during the first introductions. introductions. b) Mr. Iacocca b) Mr. Iacocca gives the opening and closing remarks (on video) in our formal gives the opening and closing remarks (on video) in our formal power point presentations. power point presentations. c) He has entertained tribal leaders in his home. c) He has entertained tribal leaders in his home. d) Occasionally he d) Occasionally he writes letters, writes letters, sends autographed copies of his books, and sends autographed copies of his books, and personally meets with tribal officials. personally meets with tribal officials. |

11 11 Acquisition Strategy Acquisition Strategy Accretive to Earnings Strong Pattern of Revenue Growth Strong Management willing to remain Market Leader Strong Operational Base Expansion Opportunities Availability of operations for training Indian Casino Employees

|

12 12 Management Team Management Team Full House Resorts, Inc. Full House Resorts, Inc. Andre Hilliou - over 25 years gaming experience. Turn around experience. Senior positions with public companies. Opened and operated major casino developments in Atlantic City and Sydney Australia. Mark J. Miller - has served in various positions with the Showboat organization including Executive Vice President of Finance and of operations and President of

Atlantic City Showboat Greg Violette - 14 years executive experience in Native American & commercial gaming

development and operations including start-ups and a

turn-around. Wes Elam - 27 years executive experience in every major aspect of casino operations and start-up. Has managed casinos from Atlantic City to Louisiana and

Ontario, Canada and opened the premier facility in Australia, the Star City Casino. Jim Meier - CPA with a Master’s in Hotel Administration. Experienced in both

property and corporate accounting of both public and private

gaming companies. Jim Dacey – serves as the company's liaison to the tribal governments. He has extensive

experience in project and contract management, customer

relationship management, as well as implementation of the business process. Barth Aaron - Over 18 years experience as a gaming regulator and legal officer for public and private major gaming operators and equipment suppliers.

|

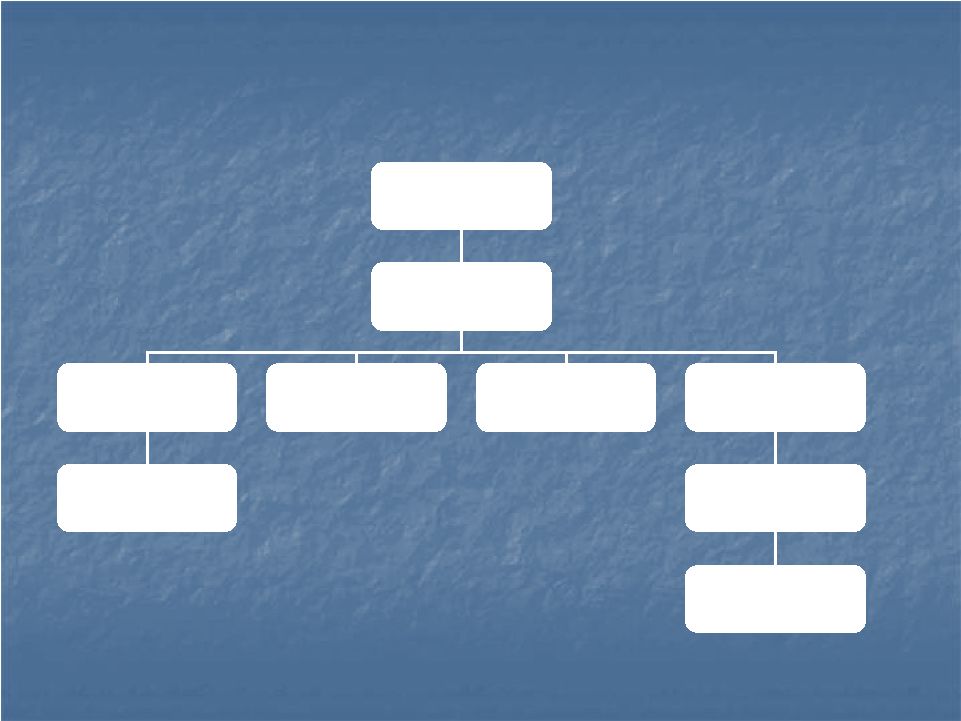

13 13 Management Team Management Team Board of Directors Andre M. Hilliou CEO Greg Violette Exec VP of Development T. Wesley Elam VP of Operations Project Development Barth F. Aaron Secretary General Counsel Mark J. Miller CFO James P. Dacey VP of Indian Development James D. Meier VP of Finance Finance and Accounting Staff |

14 14 Team Accomplishments Team Accomplishments Increased annual earnings growth by improving current operations. Currently three projects in development anticipated to open in 2008. Recovery of $1 million from Torres Martinez tribe on project previously

thought unrecoverable. Company in aggressive growth mode with marketing plan, web site and

associated increase in historical stock price Successfully acquired a commercial casino in Fallon, Nevada at an EBITDA

multiple within our guidelines. Increased stock price from $0.75 to almost $4.00 Obtained listing on American Stock Exchange |

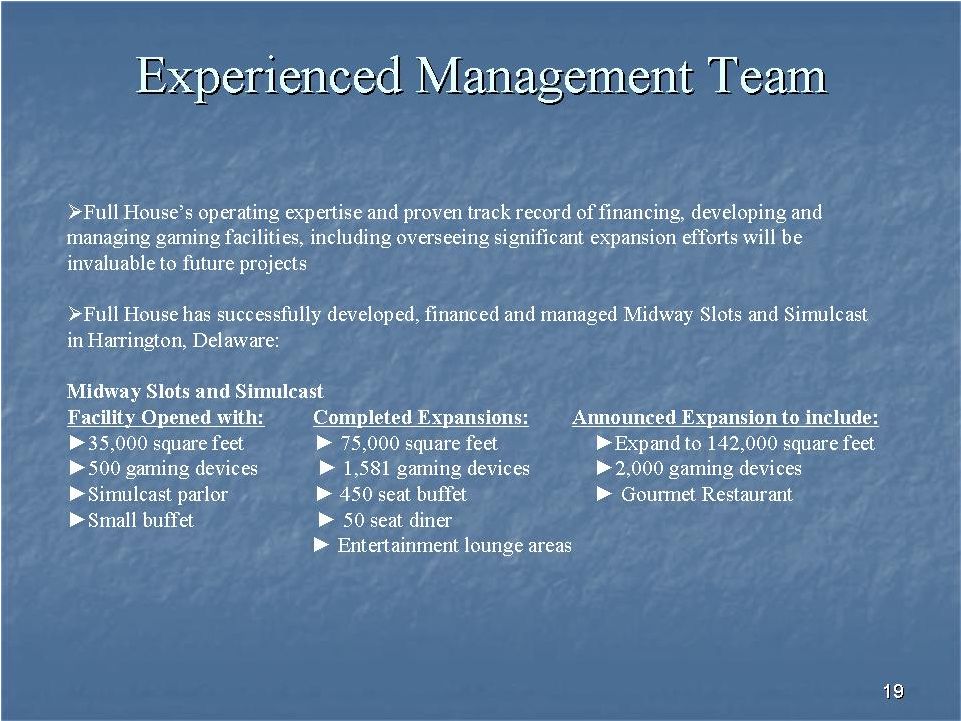

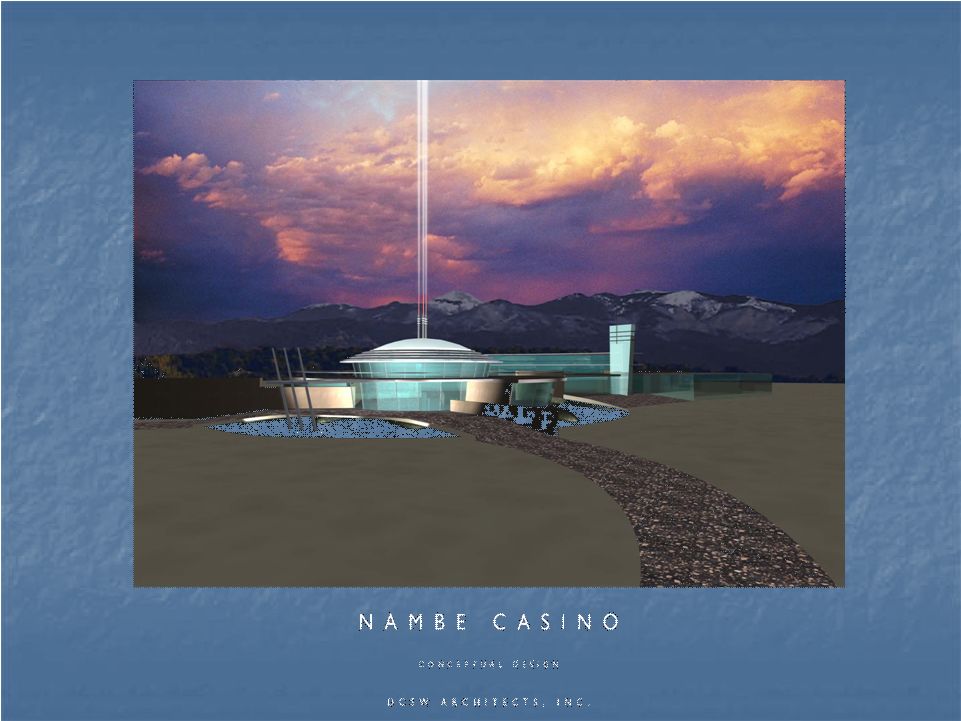

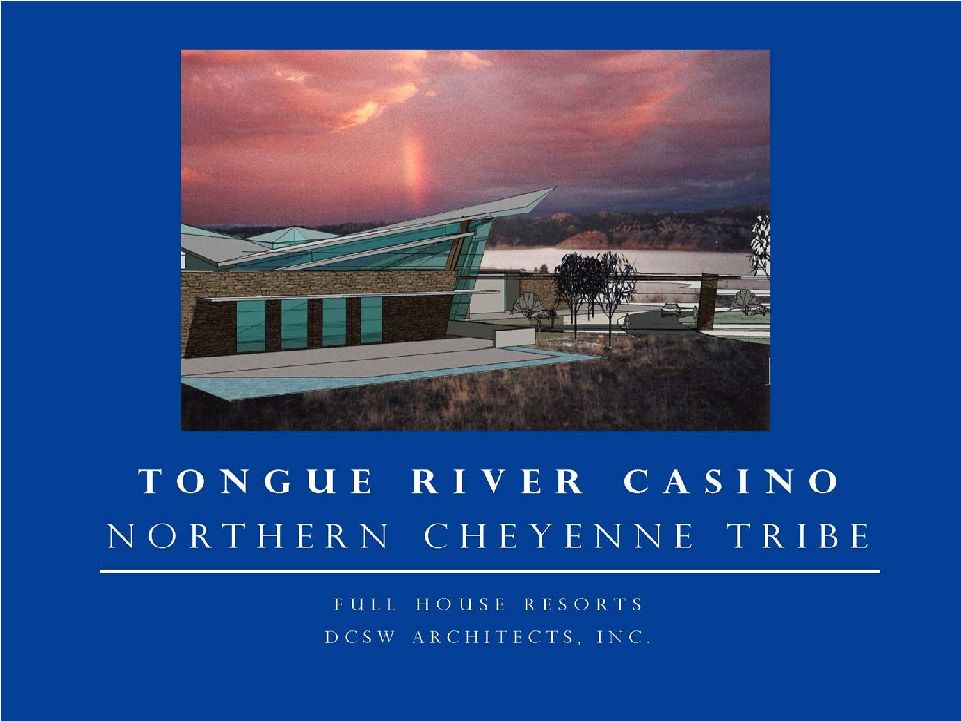

15 15 Gaming Management Projects Developer/Manager Company Owned Gaming Projects Owner/ Operator Harrington Raceway’s Midway Slots, Harrington, DE Firekeepers Casino, Battle Creek, MI Nambe Casino, Santa Fe, NM Tongue River Casino, Decker, MT Stockman’s Casino, Fallon, NV Full House Resorts, Inc. AMEX:FLL Organizational Structure Organizational Structure |

16 16 Project Locations Project Locations |

|

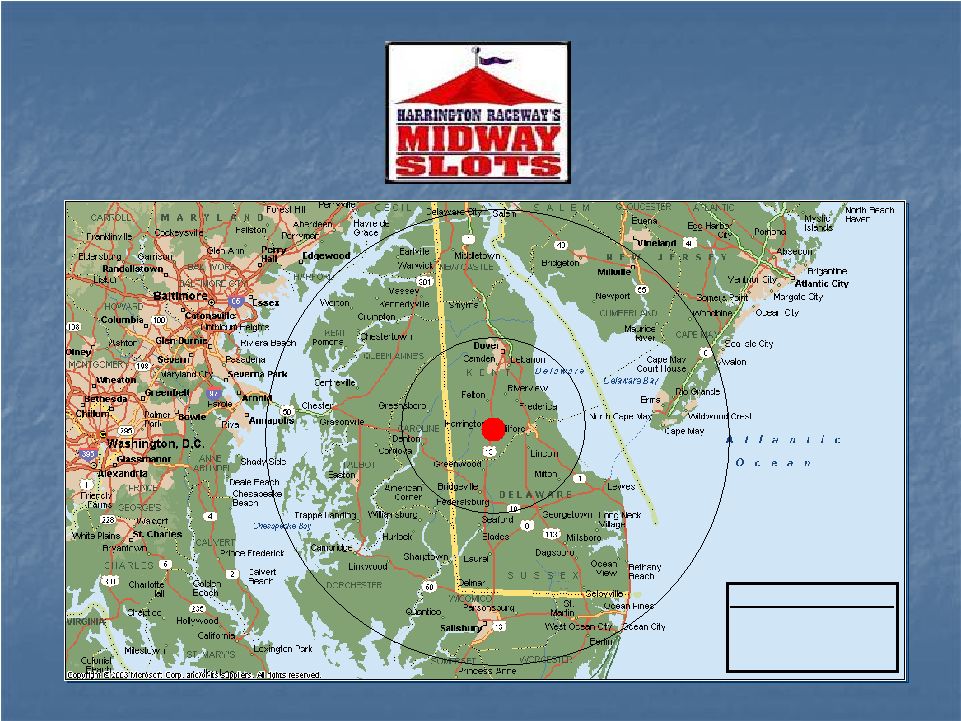

18 18 Population Estimates 25 Mile 199,371 50 Mile 1,743,427 100 Mile 15,541,019 |

|

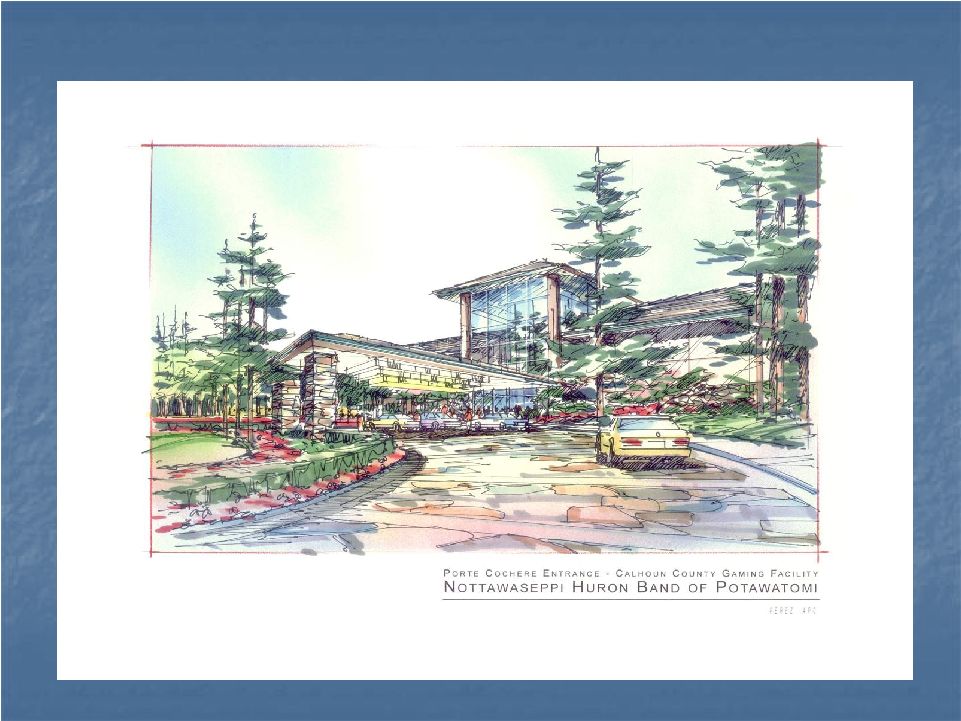

20 20 Firekeepers’ Firekeepers’ Casino, Michigan Casino, Michigan |

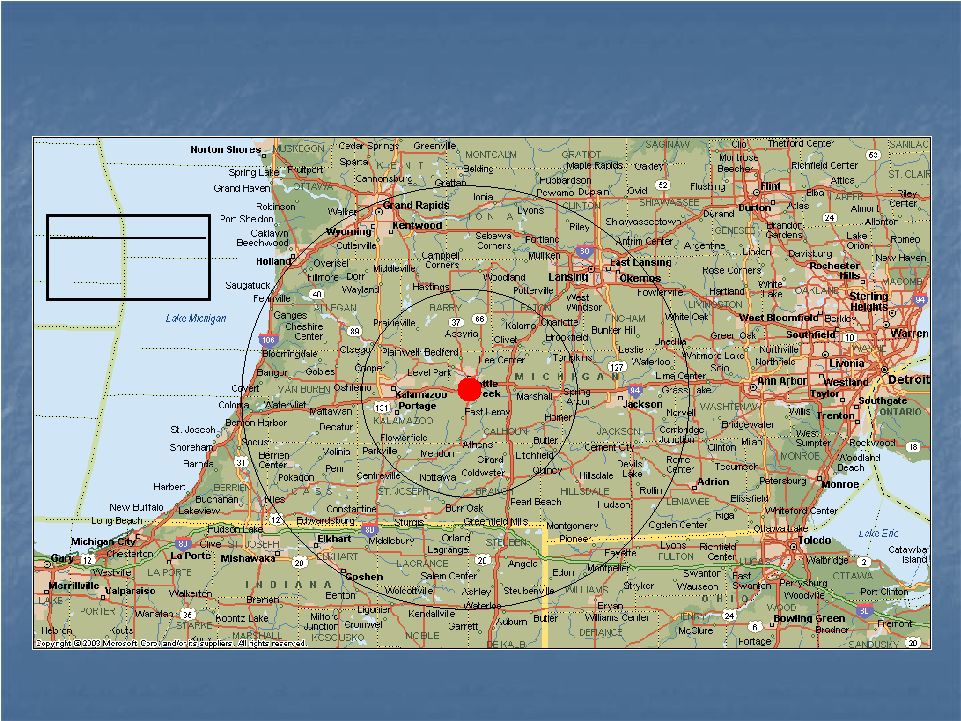

21 21 Location of Firekeepers’ Location of Firekeepers’ Casino: Michigan Casino: Michigan Population Estimates 25 Mile 317,384 50 Mile 1,508,858 100 Mile 8,463,572 |

22 22 Marketing the Firekeepers’ Marketing the Firekeepers’ Casino Financing Casino Financing Battle Creek, Michigan Battle Creek, Michigan City Center Population (1) Median Household Income (2) 1 Ann Arbor (Washtenaw County) 341,847 $51,990 2 Battle Creek (Calhoun County) 139,191 $38,918 3 Birmingham (Oakland County) 1,214,361 $61,907 4 Brighton (Livingston County) 181,517 $67,400 5 Grand Haven (Ottawa County) 255,406 $52,347 6 Grand Rapids (Kent County) 596,666 $45,980 7 Kalamazoo (Kalamazoo County) 240,536 $42,022 8 Lansing (Ingham County) 278,592 $40,774 9 Fort Wayne, IN (Allen County) 344,006 $42,671 (1)Source:U.S.Census Bureau, 2005 Estimates (2)Source:U.S.Census Bureau, 2000 |

23 23 Situation Overview Situation Overview Close Proximity to Chicago and Detroit in addition to other major Michigan

metropolitan markets • • Closest casino for over a million Michigan Residents Closest casino for over a million Michigan Residents • • Diverse and strong local economy Diverse and strong local economy • • Numerous attractions and strong visitation trends Numerous attractions and strong visitation trends Proposed site is irreplaceable, and provides the Tribe with a competitive advantage vis-à-vis existing operators and possible new entrants • • Assembling Assembling a a comparable comparable site site in in such such a a location location likely likely to to be be extraordinarily extraordinarily challenging challenging & time & time consuming consuming • • Size Size of of site site provides provides Tribe Tribe with with significant significant development/growth pipeline development/growth pipeline • Excellent road access to all major highways, especially I-94 and I-69 The Tribe’s casino will be a major competitor to the existing Native American casino operators • • Most Most other other Native Native American American casinos casinos are are located located in in the the Northern Northern part part of of the state the state • • Generally Generally dated dated facilities facilities offering offering less less than than 2,000 2,000 gaming positions gaming positions Given the superior location of the Project, the developmental potential of the site and the superior relative position of the Project, we believe the Company can develop a world class property. |

24 24 Project Status Project Status CONTRUCTION BEGIN: 2Q-3Q/07 GRAND OPENING: 2008 STATUS: 3Q 2007 2Q 2007 MICHIGAN PROJECT FIREKEEPERS CASINO Compact Signed Land In Trust Financing Complete NIGC Approval Environmental Assessment Management Agreement Yes 4Q 2006 Yes Yes Expected Expected |

25 25 Industry Comparables Industry Comparables Greektown Motor City MGM Grand Detroit Blue Chip Casino Owner Sault Ste. Marie Tribe of Chippewa Indians Marian Bayoff Ilitch MGM Boyd Gaming Corporation Slots 2,422 2,463 2,840 2,171 Tables 80 88 72 54 Positions 2,902 2,991 3,272 2,495 Win Per Position Per Day, net $317 $395 $385 $322 Net Revenue($mm) $335.6 $432.2 $460.7 $293.4 Source: Michigan and Indiana Gaming Boards and www.casinocity.com Note: Michigan Calander Year 2005 Revenue; Indiana Fiscal Year 2006 Revenue

|

26 26 |

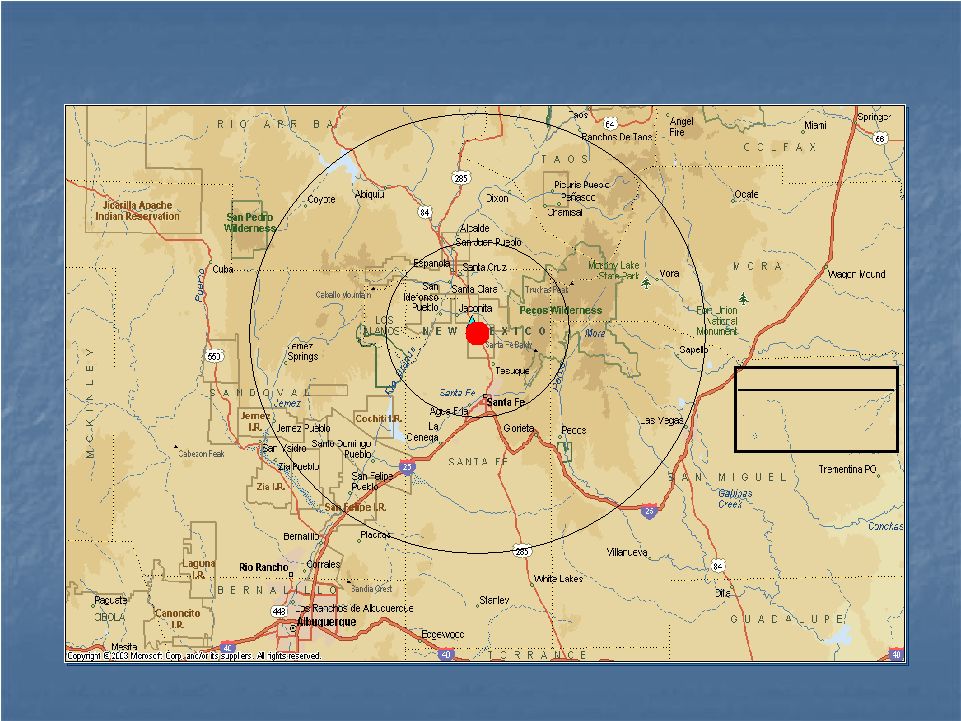

27 27 Location of Nambe Casino Location of Nambe Casino Population Estimates 25 Mile 145,131 50 Mile 611,488 100 Mile 1,003,405 |

28 28 Project Status Project Status CONTRUCTION BEGIN: 3Q/2007 GRAND OPENING 2008 STATUS: Yes Yes Expected Yes Expected Expected 2Q 2007 2Q-3Q 2007 2Q 2007 Environmental Assessment NAMBE PROJECT SANTA FE, NEW MEXICO Compact Signed Land In Trust Management Agreement Financing Complete NIGC Approval |

29 29 Industry Comparables Industry Comparables Casino Tribe/Pueblo Slots Tables Positions Win (1) Win per Day Cities of Gold (1) Pojoaque 717 12 801 18,248,007 $ 84.38 $

OhKay Casino Resort

San Juan 690 5 725 26,993,695 $ 102.01 $

Big Rock Casino Santa Clara 350 7 399 18,739,488 $ 128.67 $

Camel Rock Casino Tesuque 674 7 723 30,526,799 $ 115.68 $

Source: New Mexico Gaming Control and

www.casinocity.com (1) 3Q05 - 2Q06, except Pojoaque

4Q05-2Q06 Note: Pojoaque operate two facilities and report on

a combined basis |

|

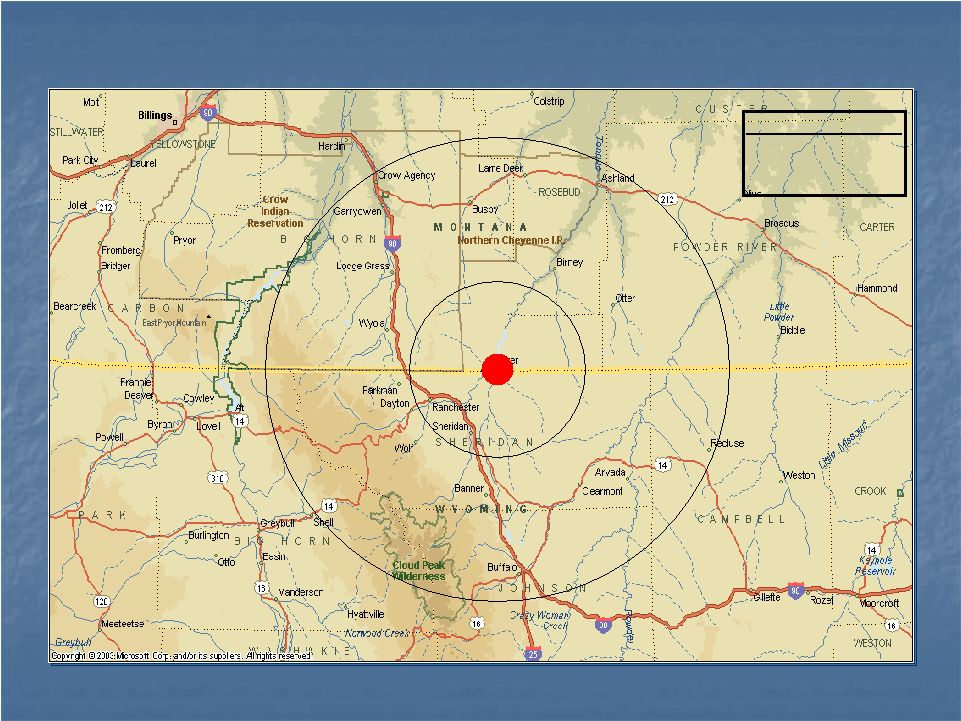

31 31 Location of Tongue River Casino Location of Tongue River Casino Population Estimates 25 Mile 9,320 50 Mile 42,118 100 Mile 238,314 |

32 32 Project Status Project Status CONTRUCTION BEGIN: 3Q/2007 GRAND OPENING 2008 STATUS: Yes Yes Expected Yes Expected Expected 3Q 2007 3Q 2007 3Q 2007 NORTHERN CHEYENNE PROJECT DECKER, MONTANA TONGUE RIVER CASINO Land In Trust Environmental Assessment Management Agreement Financing Complete NIGC Approval Compact Signed |

33 33 Industry Comparables Industry Comparables County Jurisdiction Establishments Positions 2004 Gaming Tax Renenues Annual Gaming Revenue Annual Revenue/ Machine Win/Machine Big Horn County 3 20 $33,725 $224,833 $11,242 $31 Hardin 10 126 $466,138 $3,107,587 $24,663 $68 Yellowstone County 28 266 $713,298 $4,755,320 $17,877 $49 Billings 133 1955 $8,295,356 $55,302,373 $28,288 $78 Broadview 2 3 $1,695 $11,300 $3,767 $10 Laurel 10 150 $486,032 $3,240,213 $21,601 $59 Source: Montana Department of Justice, Gaming Control Division

|

34 34 |

35 35 Stockman’s Casino Stockman’s Casino On January 31, 2007, FLL acquired Stockman’s Casino and Holiday Inn

Express in Fallon, Nevada. Nevada Gaming approvals were obtained in January 2007 on schedule.

Stockman’s Casino consists of Approximately 8,400 square feet of gaming space 274 slot machines 4 blackjack tables Keno game Only casino in town with a player’s club and rating system. Fine dining restaurant, 24-hour coffee shop and a bar. The Holiday Inn Express 98 guest rooms Indoor and outdoor swimming pools, sauna, fitness club Meeting room and business center. Of 7 non-restricted gaming licensees in Fallon, Stockman’s

maintains 26% of the slot market and 35% of the total market

revenue. (1) (1) Source: Nevada Gaming Control Board Monthly Reports

|

36 36 Stockman’s Casino Stockman’s Casino |

37 37 |

38 38 Stockman’s Financial Summary Stockman’s Financial Summary UNAUDITED Audited Audited 2006 2005 2004 Revenues 11,676,684 $ 11,256,964 $ 10,578,839 $ EBITDA - adjusted 4,651,620 $

4,418,377 $ 4,223,892 $ EBITDA - adj. % 40% 39% 40% Note: Financial EBITDA is adjusted as outlined in purchase agreement. Reconciliation of Net Income to EBITDA: Net Income $ 2,399,509

$ 2,251,823

$ 2,041,493

Plus: Depreciation and amortization expense 540,267 493,881 473,562 Owner's compensation payments 160,000 160,000 160,000 Related party rent expense 1,629,114 1,598,161 1,559,523 Loss on sale of assets 58,087 39,994 43,833 Less: Interest Income on excess cash (131,241) (110,826) (41,261) Dividend Income (1,410) (14,656) (13,258) Life insurance surrender (2,706) - -

EBITDA -

adjusted 4,651,620 $

4,418,377 $ 4,223,892 $

|

39 39 FLL Acquisition Strategy FLL Acquisition Strategy Accretive to Earnings Strong Pattern of Revenue Growth Strong Management willing to remain Market Leader Strong Operational Base Expansion Opportunities |

40 40 |